Pre-market update:

- Asian markets traded 0.1% lower.

- European markets are trading 0.8% higher.

- US futures are trading 0.2% higher ahead of the market open.

Economic reports due out (all times are eastern): Challenger Job-Cut Report (7:30), Jobless Claims (8:30), EIA Natural Gas Report (10:30), Treasury STRIPS (3)

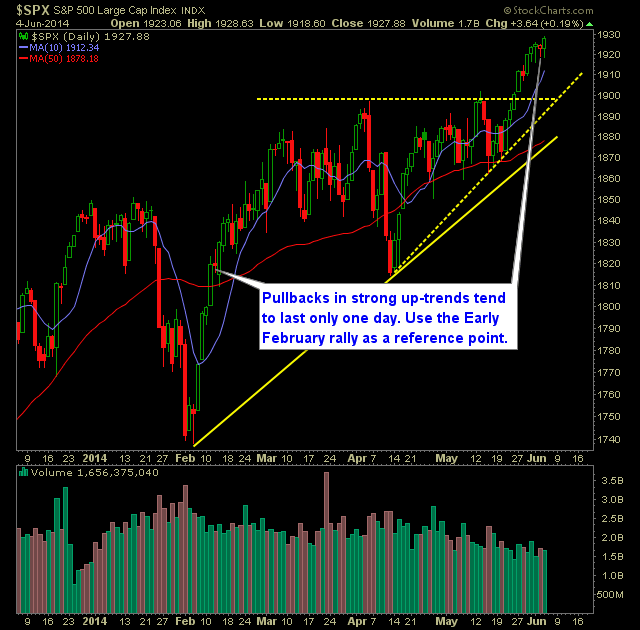

Technical Outlook (SPX):

- Uptrend resumed yesterday and is well below the upper Bollinger Band providing ample room to continue its run.

- Volume returned to its average levels.

- SPX is higher eight out of the last ten times.

- SPX continues to trade heavily in overbought territory.

- The 30-minute SPX chart shows a breakout above previous consolidation.

- Despite the rally yesterday, VIX still managed to rise 1.8% to 12.08.

- The dip buyers continues to reverse intraday weakness rather aggressively.

- As it currently stands, the bears are not showing any true ability to drive this market lower.

- The only moving average that has shown any significant measure of support recently has been the 50-day moving average. That is the only one I would stay focused on at this point.

- A pullback to 1897-1900 is completely fine, but must hold that level.

- There does remain a significant gap up to fill from 5/27 on the SPY chart.

- The short-term support rising off of the 4/28 lows continues to hold up well.

- The market doesn’t care about the economy nor earnings. That is not what is driving it. The market only cares about what the Fed is doing to keep equities propped up.

My Opinions & Trades:

- Closed out AMAT at $21.60 for a 7.8% gain.

- BIDU was previously closed out at 162.92 for a 2.4% loss.

- Added two new long positions yesterday.

- I will look to add 1-2 new long positions today.

- Remain long AKAM at 54.52, BBY at 27.37, HOT at 80.26, HAL at 63.07, WDC at 87.93, STT at 65.75

- 80% Long / 20% Cash

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, I explain whether it is a good idea or not to rapidly increase the size of your portfolio if you come across a sum of cash. A lot of traders will do this without ever recognizing the emotional toll it can have on you as a swing trader and the awful mistakes you can make in doing so.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.