Pre-market update (updated 9am eastern):

- European markets are trading mixed.

- Asian markets traded 0.2% higher.

- US futures are trading moderately higher ahead of the opening bell.

Economic reports due out (all times are eastern): None

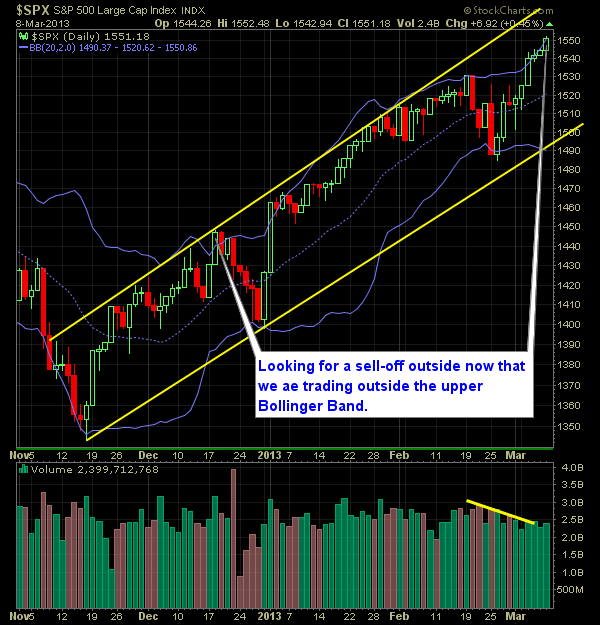

Technical Outlook (SPX):

- SPX rose on Friday for the sixth straight session and eight out of the last nine.

- Rising more than six straight days is a very difficult feat. While this doesn’t happen very often, we actually rose eight straight days earlier this year, though the gains were far less than the gains we saw in this current run.

- Coupled with the fact that we are well outside the upper Bollinger-Band, a pullback here makes sense.

- Compared to what we saw throughout the week, Friday’s session saw a significant jump in volume.

- We are extremely oversold in the short-term.

- A possible reversal doji on the SPY daily.

- While we can still move higher from here, I believe there is far more risk over the next 2-3 days in doing so.

- Significant bearish divergence on the T2108 as the market is putting in recovery highs, the T2108 (% of stocks trading above their 40-day MA) is significantly lower.

- The weekly chart shows a strong breakout in place.

- VIX is back in the 12’s.

- Both channels (July October 2012) and the price channel we are currently in are very similar in nature.

- We haven’t seen a market pullback in excess of 4% since October/November time-frame.

My Opinions & Trades:

- Added ALXN as a short at $91.65

- Remain Long ADBE at $38.88, SLV at $27.97; Short LVS at $51.63, TRI at $29.95.

- Here is my real-time swing-trading portfolio and past-performance

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, I explain whether it is a good idea or not to rapidly increase the size of your portfolio if you come across a sum of cash. A lot of traders will do this without ever recognizing the emotional toll it can have on you as a swing trader and the awful mistakes you can make in doing so.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.