My Swing Trading Approach

Once again, yesterday was a day of day-trades for me. I faded the early market intraday bounce yesterday twice, First time, I was quickly stopped out for a small loss, and the second time I profited, allowing me to be profitable overall on the day, despite a market sell-off. Today, I plan to play the bounce to the upside, but may only be as a day-trade.

Indicators

- Volatility Index (VIX) – VIX is only at 22.48 following yesterday’s massive sell-off. I would have suspected a bigger rise than yesterday’s 11.8%. Still lower-highs since October – certainly a bullish divergence there.

- T2108 (% of stocks trading above their 40-day moving average): Bull flag on this indicator finally broke down, with a 20% drop to 23%. Still well off the lows of October. Again a bullish divergence considering yesterday closed below any of the closing levels from October.

- Moving averages (SPX): Currently trading below all the major moving averages here.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Technology changed its tune by not leading to the downside yesterday. In fact it was the fourth strongest sector yesterday. Energy remains in a free-fall – stay away. Staples had been a market leader of late, but is falling apart and looks poised to eventually test its October lows again. Discretionary formed a doji candle and possible bottom – looks like a possible wash-out.

My Market Sentiment

Massive sell-off yesterday, that really didn’t test any major support levels, and is simply left in no-man’s land. Good chance we see a bounce heading into the Thanksgiving holiday, but its sustainability is questionable at best. Still best to probably day-trade this market.

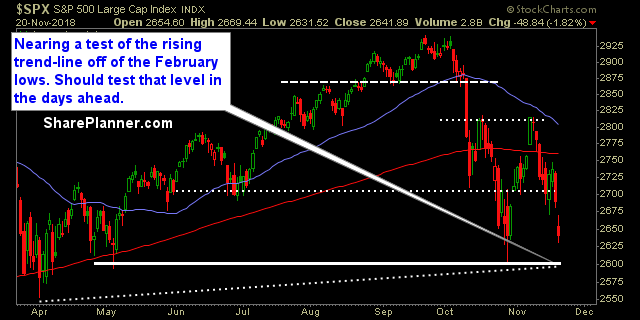

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 100% Cash.