My Swing Trading Approach

The bulls look to extend Tuesday’s rally, and I will attempt to add 1-2 quality trade setups as well as long as the early morning strength manages to hold.

Indicators

- Volatility Index (VIX) – VIX dropped a resounding 8.1% yesterday, taking it below key support, and possibly targeting a move into the lower 11’s. This is the lowest closing read, since 8/9.

- T2108 (% of stocks trading above their 40-day moving average): Horrible breadth yesterday, in fact breadth was negative and T2108 dropped 5.5%, down to 48%. Not a healthy market.

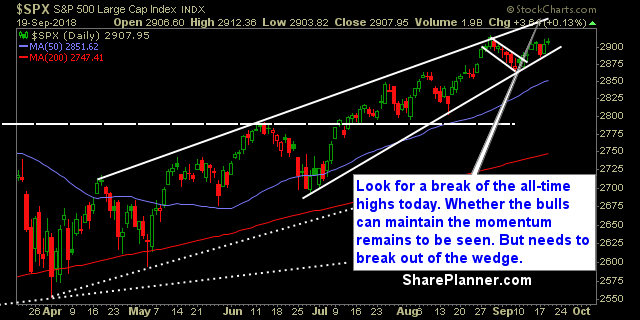

- Moving averages (SPX): Currently trading above all the major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Energy continues to show strength over the last two weeks. May attempt to break the downtrend off of the 5/22 highs today. Until then, it remains in a intermediate-term sideways channel. Financials were the market’s strongest sector, and nearing a significant breakout through resistance on the daily chart. Technology struggled notably for much of the day until the afternoon, when it rallied to near break even.

My Market Sentiment

All-time highs look to be achieved today with SPX, while the Nasdaq is lagging in similar price action and far from achieving the same. With breadth remaining questionable still, my trust in this market isn’t great, but the long side remains the only play at the moment.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 3 Long Positions