As swing traders, we spend a lot of time focused

War headlines can move markets quickly. The bigger question

Advanced Micro Devices (AMD) has seen its fair share

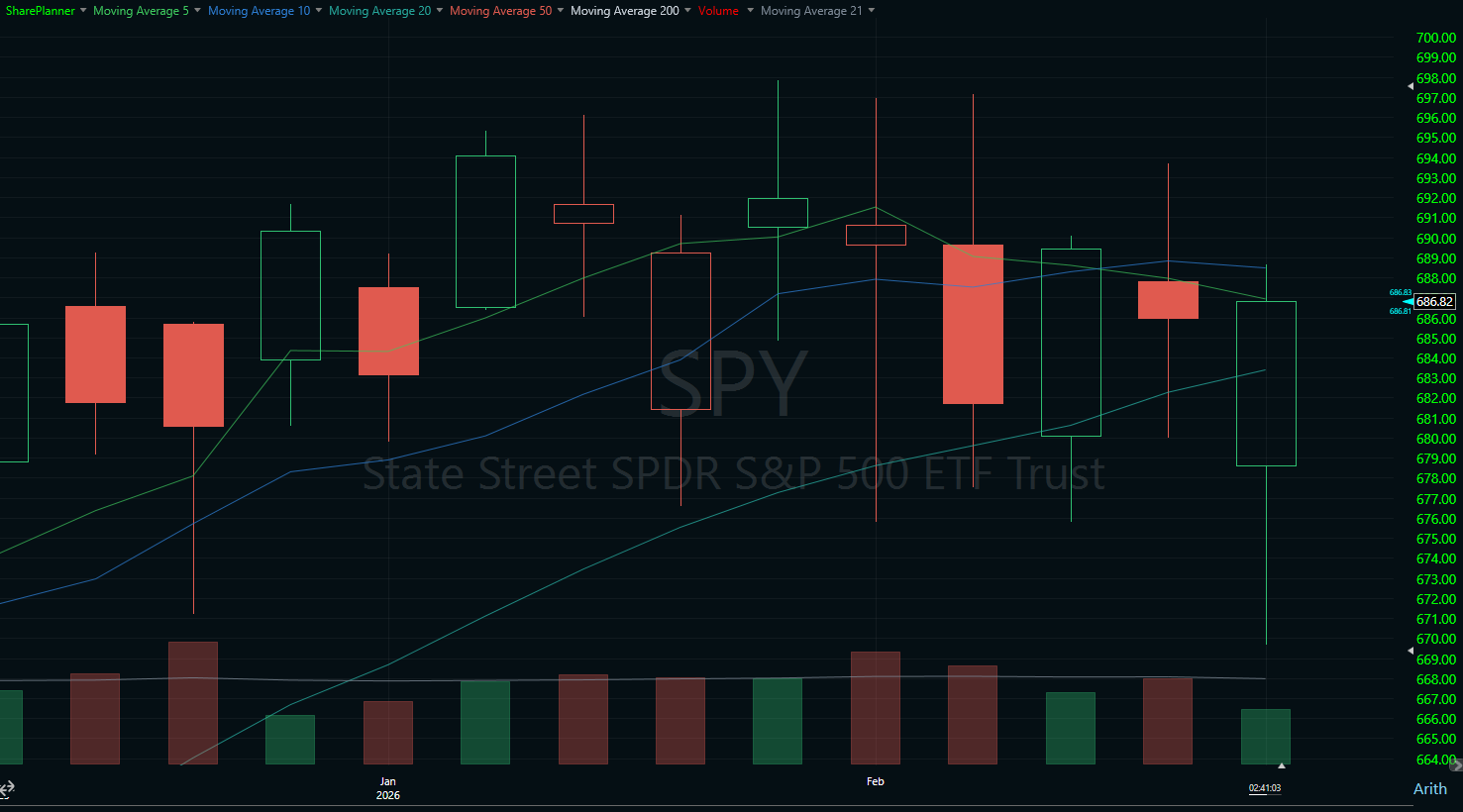

The stock market continues to show mixed signals, with

Livestream Mon-Thurs 9am ET

– Coming Soon! –

Latest Video

My Podcast

More Posts

Netflix (NFLX) – Major Rally After Dropping Warner Bros Bid Netflix shocked the market after abandoning its bid for Warner Bros. Discovery — and traders immediately piled in. The stock exploded higher, breaking through multiple resistance levels in a single session. Now the big question is: how do we trade NFLX from here?

NVIDIA (NVDA) delivered another market-moving earnings report. The stock responded initially with a powerful even before the earnings, and looked to continue that immediately after the earnings release, but then faded later on. So tomorrow is going to be rather interesting as to what we get from it on Thursday. Whether you’re already in NVDA

PayPal (PYPL) is catching attention again as buyout rumors circulate. While nothing is confirmed, PYPL has already started moving on speculation. The question, of course, is whether this is a trade worth taking, or a rumor that traders should avoid. Become part of the Trading Block and get my trades, and learn how

If we were truly honest with ourselves, I think most of us would admit that at some point, we haven’t traded within our means. That doesn’t make you a bad trader or a reckless person. It just means you are human. The stock market has a way of distorting our reality and inflating our expectations

Alphabet (GOOGL) is presenting an interesting technical setup that has me watching closely. There are bullish elements developing on the chart, but several factors still give me pause before committing capital to the long side. The Bullish Case: Support and Pattern Development The stock has found support at previous lows, which is encouraging. When price

Sandisk (SNDK) has been one of the biggest stories of the stock market over the last six months, running over 1,500% higher, seemingly out of nowhere. But now we're seeing the first consolidation out of the stock, since the initial run began and in the process some bullish technical patterns have emerged. But is it worth