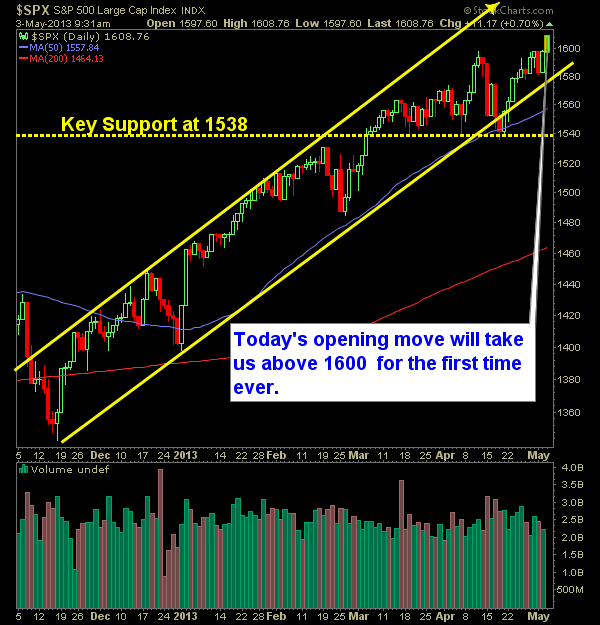

Pre-market update (updated 9am eastern): European markets are trading 1% higher. Asian markets traded flat and mixed. US futures are significantly higher. Economic reports due out (all times are eastern): Employment Situation (8:30am), Factory Orders (10am), ISM Non-Manufacturing Index (10am) Technical Outlook (SPX): Huge beat on the Employment number has the market gapping much higher

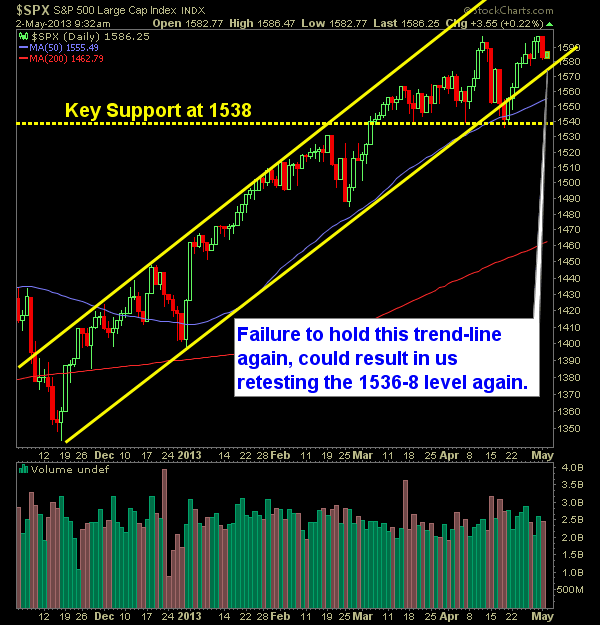

Pre-market update (updated 9am eastern): European markets are trading mixed/flat. Asian markets traded -0.5% lower. US futures are moderately higher. Economic reports due out (all times are eastern): Challenger Job-Cut Report (7:30am), Jobless Claims (8:30am), Productivity and Costs (8:30am), EIA Natural Gas Report (10:30am) Technical Outlook (SPX): First significant sell-off since 4/17 in the markets.

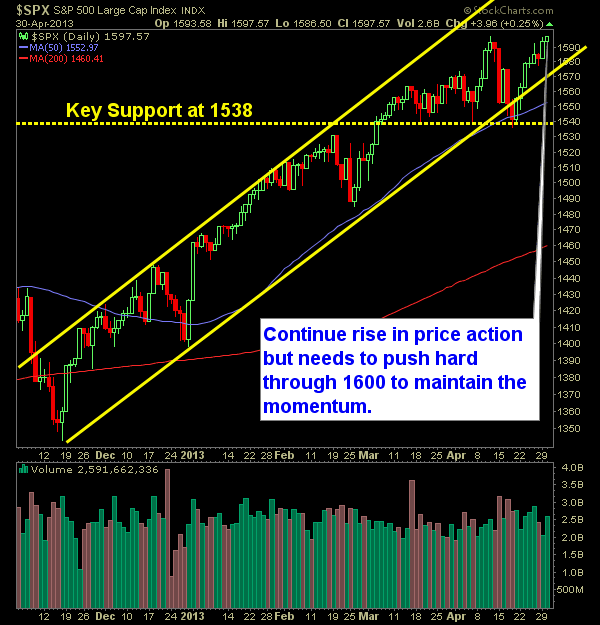

Pre-market update (updated 9am eastern): European markets are trading 0.4% higher. Asian markets traded -0.1% lower. US futures are slightly higher. Economic reports due out (all times are eastern): MBA Purchase Applications, ADP Employment Report, PMI Manufacturing Index (8:58), Treasury Refunding Announcement (9am), ISM Manufacturing Index (10am), Construction Spending (10am), EIA Petroleum Status Report (10:30am), FOMC

After seeing the light volume out of the markets on Friday’s sell-off, I didn’t think it would take too long before we would be testing all time highs again. Right now we are three points below all-time intraday highs, and I suspect we’ll test that level before the day’s end, perhaps we might even see

The S&P is on the cusp of breaking out of that blasted triangle, and once it does, the move down in the market should be somewhat of a self-fulfilling prophesy as everyone and their mom seems to be watching it. Whether we break it (and yes we could bounce here still) is anyone’s guess, but

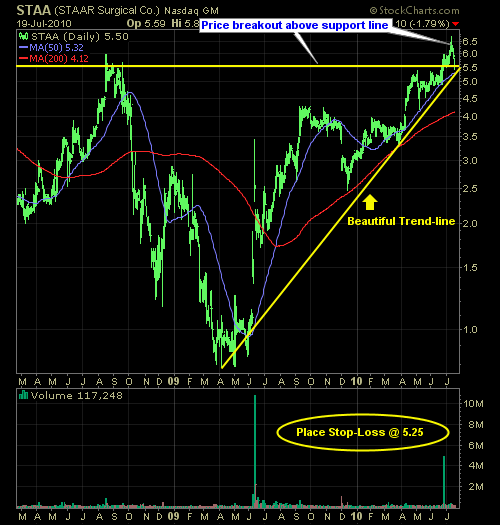

Unlike any of my other screens, this stock screen focuses only on stocks trading under $10/share, and have a market cap of around $1 billion or less (I’ve included a few above that threshold this time around though). As for the variables that I used in the screen, I focused on fundamentals, particularly companies that

I made a quick trade in TZA (Russell 3x Inverse Short) this morning when it became a bit clearer that the market would struggle to make any substantial gains ahead of the Fed Announcement (after which all bets are off). I've also shorted QCOM this morning as well (detailed below), getting in at $53.49 with

Today Mr. Market has been utterly ruthless on the bears. We gap way down on not-so-great earnings from Goldman (GS), IBM (IBM), and Texas Instruments (TXN), and despite those efforts the bulls manage to, once again, go on a buying spree off of the lows. I warned of a possible gap fill from

Since the trading plan was posted, the S&P continues to tinker with about 1% in losses. Goldman Sachs (GS), along with IBM (IBM) and Texas Instruments (TXN) continues to weigh the market down. As I am writing this, I just got stopped out of SCHN on a stinkin’ upgrade from UBS. I could

Current Long Positions (stop-losses in parentheses): None Current Short Positions (stop-losses in parentheses): ESV (42.84), MR (32.34), WTFC (37.71), SLAB (44.80), CERN (82.08), ALB (43.59), HIBB (26.65), WRC (40.95), QQQQ (45.83), SCHN (44.33) BIAS: 106% Short Economic Reports Due Out (Times are EST): ICSC-Goldman Store Sales (7:45am), Housing Starts (8:30am), Redbook (8:55am) My Observations and