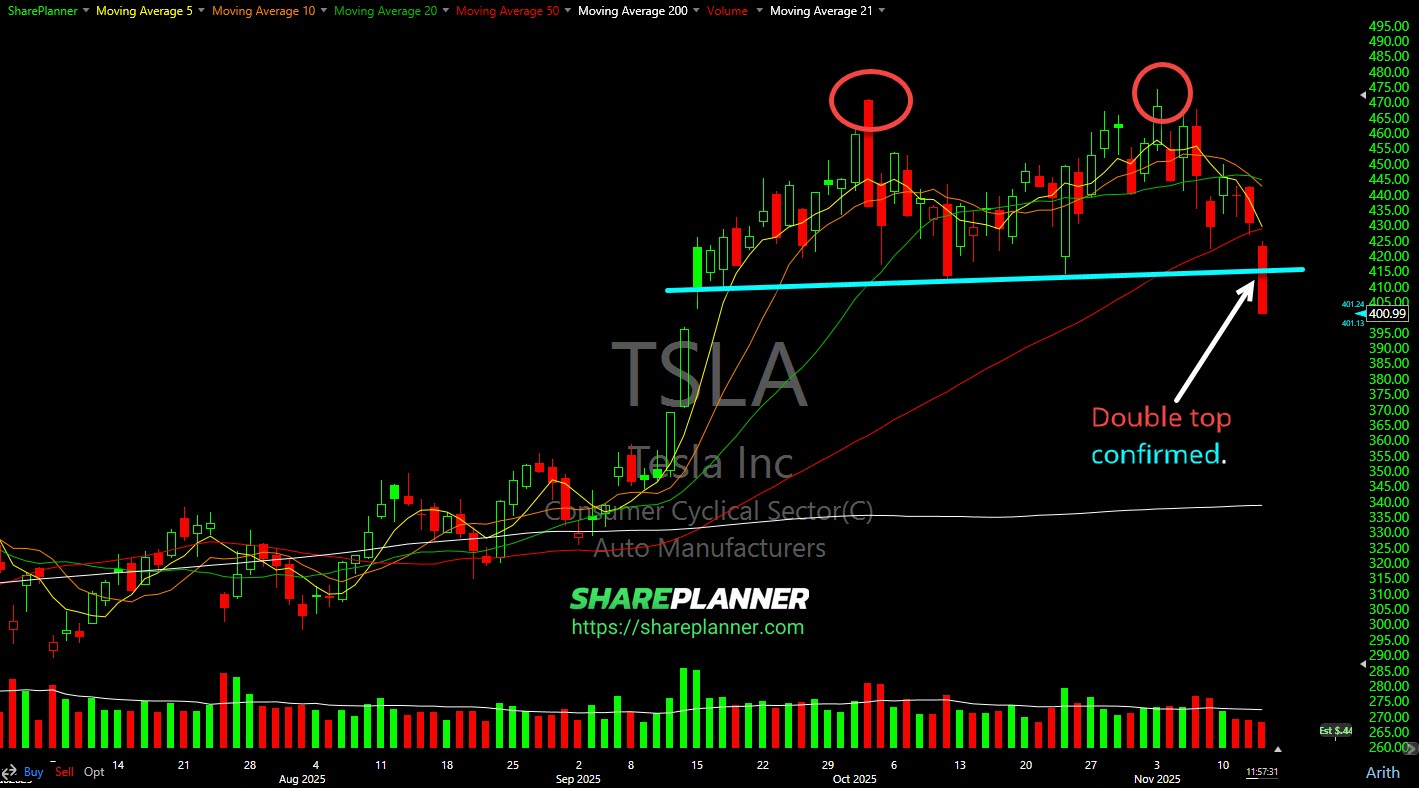

Tesla (TSLA) has been a battleground stock for what feels like forever, but since September, it’s been stuck in a choppy, sideways pattern. For traders like me, this kind of price action is a clear signal to pay close attention for a potential trend reversal as distribution played out over a two-plus month period. During this period, a bearish chart pattern has emerged that all traders should be aware of: the double top.

A Double Top Pattern Confirmed in TSLA

For those unfamiliar, a double top is a bearish reversal pattern that looks like the letter “M”. It happens when a stock hits a high price twice with a moderate decline in between. The pattern is confirmed when the price breaks below the support level, which is the low point between the two peaks.

Looking at the TSLA chart, you can see this pattern has been forming since September. The stock has tested the highs twice, unable to break through, which signals that the buying pressure is weakening. The key support level to watch was around $411.

Over the past week, TSLA found some temporary support at its 50-day moving average, which held off the sellers for a bit. It was a moment of truth for the stock. Would it bounce and invalidate the pattern, or would it break down?

Today, we got our answer.

Key Support is Broken

The stock has officially broken below that critical $411 support level. This breakdown happened on strong volume, which adds conviction to the bearish signal. When you see a key support level break on high volume, it’s like a starting pistol for sellers. It tells you that institutional money is likely heading for the exits, and a further decline is probable.

With the double top pattern now confirmed, my next price target for TSLA is around the $356 level. This is the next significant support area where buyers might step back in and try to stop the bleeding. Until then, the path of least resistance appears to be to the downside.

How I’m Approaching the TSLA Double Top Pattern

For me, trading is about managing risk and playing the probabilities. The confirmation of this double top pattern, combined with the break below a major support level on heavy volume, presents a clear bearish signal.

It’s important to remember that no pattern is a guarantee. The market can always throw a curveball. However, based on my experience and technical analysis, the odds now favor the bears. I will be watching TSLA closely to see if it follows through on this breakdown towards the $356 target.

If you’re looking for more of my real-time analysis and trade ideas, consider becoming part of the Trading Block, where you can get my trades and insights as they happen.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, I talk about tightening the risk on the trades and the benefits of taking a multi-pronged approach in doing so between profit taking and raising the stops. Also, I cover how how aggressive one should be in adding new swing trading positions and how many open positions that one should have at any given time.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.