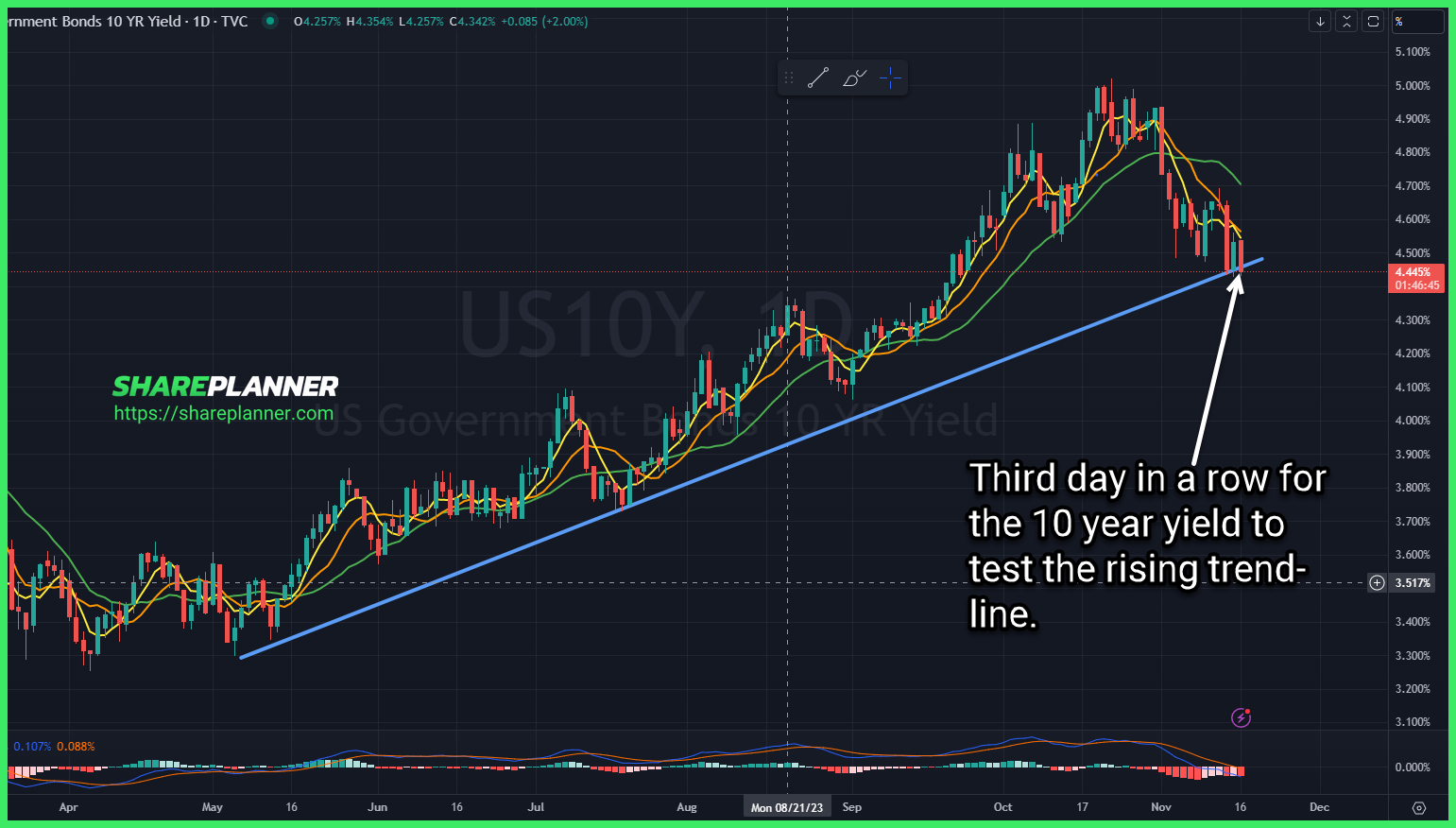

Third day in a row for the 10 year yield (TNX) to test the rising trend-line. Tesla (TSLA) Analysis Alibaba Group (BABA) testing support following a massive earning sell-off. This is a key area to hold going forward. Ugly reversal following yesterday's developing basing pattern.

Episode Overview The use of margin, buying out of the money calls, doubling down on losing trades - what does this all have in common? Blowing your trading account. In this podcast episode, Ryan highlights one trader's journey of blowing up 20 years of life savings on 0DTE calls and TSLA leap calls. 🎧 Listen

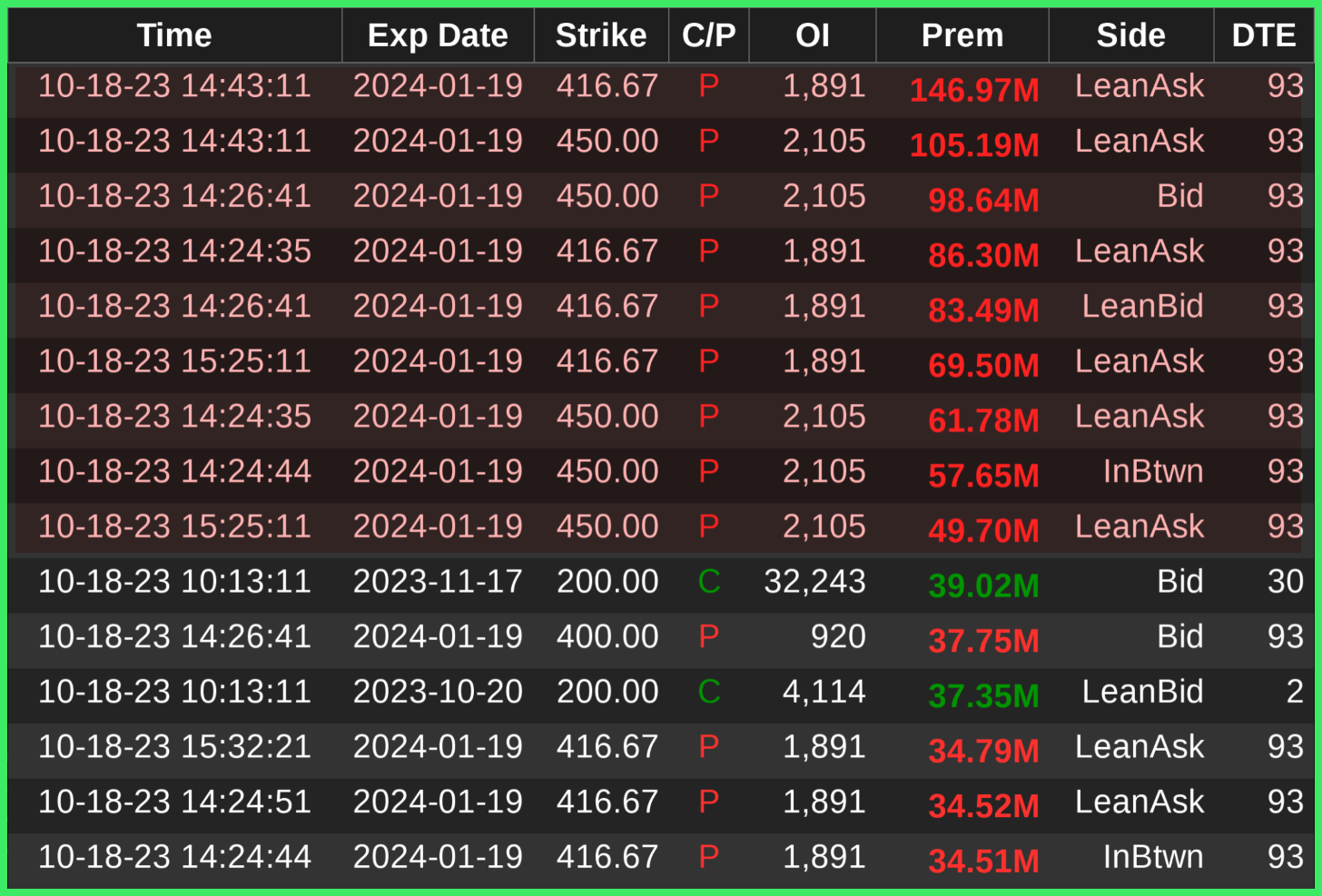

That is a ton of put buying going on with $TSLA today. Still not a reason for me to play earnings though. Rising trend-line on $TSLA beginning to break down ahead of the its earnings report. $CBRL 25 year support level holding up so far and allowing for a bounce to materialize. Key moment for

Double top confirmation with the recall news on $RTX. Possible support at $75. $TSLA broke out of the triangle pattern with a massive gap higher, but be mindful of the heavy resistance lurking overhead, that doesn't make this trade an ideal reward/risk following the massive run higher today. Long-term resistance getting tested on $FNGR following

Watch this consolidation in $TSLA just below the 50-day moving average. A break above the triangle and moving average could jump start the next move higher. T2108 Update Break this key support level and $GME starts to look more like the next $AMC $GPOR with a developing bull flag pattern, but yet to breakout. A

Major support breaking today on Tesla (TSLA). Now the next level of support comes in at the rising trend-line around 207-210 area. SPDR Gold Trust (GLD) inverse cup and handle pattern nearing confirmation. CBOE 10-year Treasury Yield Index (TNX) October highs on tap. Rates continue to rise significantly. Lululemon Athletica (LULU) price action still struggling

Nice bounce off of 3 nearby support levels so far for $NIO, but be mindful of $TSLA earnings today that could have a significant impact on the stock (for better or worse). $SPOT ascending triangle breakout level. Watch the 5-day moving average as type of trailing stop-loss. A close below would be reason for me

$BTC.X remains in the early stages of its breakout. Really nice base breakout that goes back over a year. $XLV (healthcare) struggling to hold Friday's breakout above the declining trend-line. Watch for a break above $133.04 to resume the uptrend. $NIO inverse head and shoulders pattern, with multiple layers of resistance overhead that needs to

$ESMT break of declining resistance today, and push above the 200-day moving average. Keep an eye on major resistance above going back to December '21 $AAL breaking out long-term resistance today, with strong sector/industry leadership. Bull flag watch for $TSLA. A little steeper than I'd prefer, but may work with the 20-day MA holding as