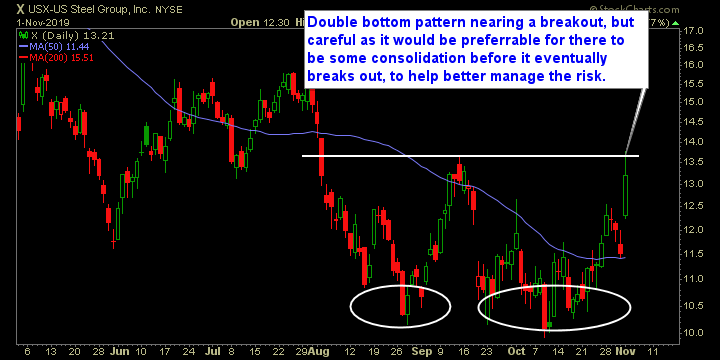

Monday’s Swing-Trades: $X $YETI $CMG Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: US Steel Group (X)

My Swing Trading Strategy I added one short position to the portfolio, not sure if that will be instant regret today or not, with the futures spiking, but it is the only short position in the portfolio, so it isn’t too bad. I’ll look to add possibly one additional long position today considering how the

FAANG Update: $FB $AAPL $AMZN $NFLX $GOOGL I regularly update the charts for Facebook (FB), Apple (AAPL), Amazon (AMZN), Netflix (NFLX) and Alphabet (GOOGL). Check out the updates below. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself!

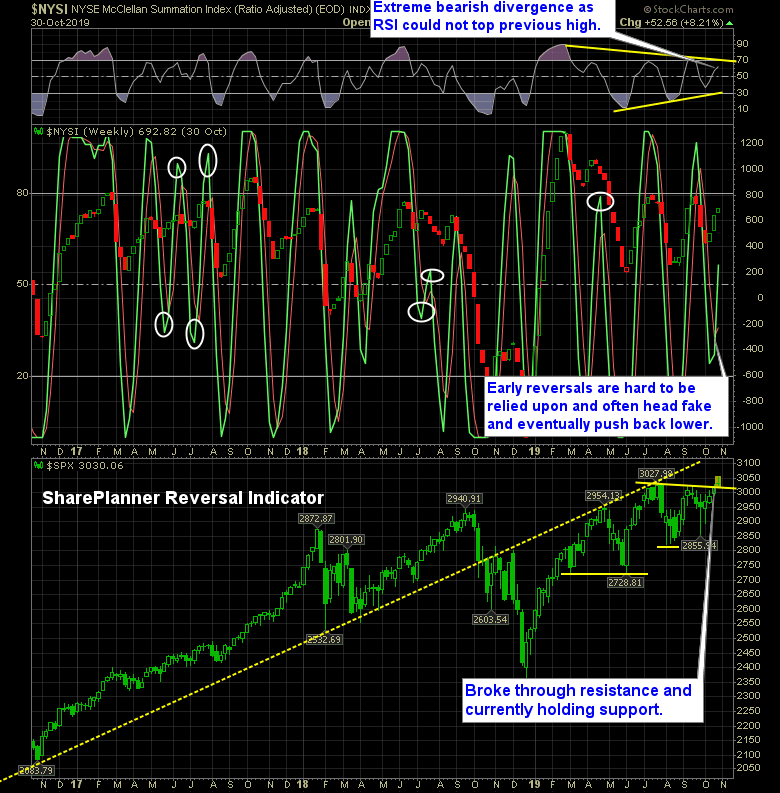

Bullish reversal in place on my market indicator, but can it be trusted? The reversals on the SharePlanner Reversal Indicator are always best served when they happen at extreme levels, because there is enough reflex bounce to get price moving in a substantial way. But this confirmation comes at almost all-time highs, weak volume

My Swing Trading Strategy With FOMC yesterday, I didn’t add any new swing-trades to the portfolio yesterday. I instead sat on my hands and let my current positions increase in profits. There are a few particular stocks that I have my eye on today for possible entries. Indicators Volatility Index (VIX) – The sell-off in

My Swing Trading Strategy One oversold bounce play added to the portfolio. My portfolio is quite conservative considering how much this market is run, and don’t want to be adding a significant amount of new positions at all-time highs here. Indicators Volatility Index (VIX) – Bounced two days in a row, but far from anything special.

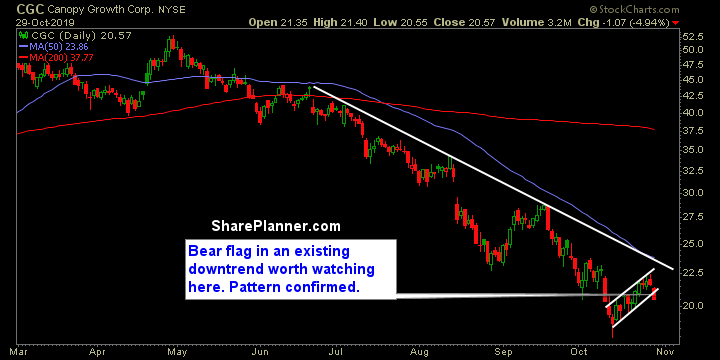

Wednesday’s Swing-Trades: $CGC $EVRG $CTAS Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: Cintas (CTAS)

My Swing Trading Strategy I added one new long position yesterday, but likely to be careful here with too much additional exposure as the market is stretched thing here at all-time highs and likely to see some consolidation at the very least before moving substantially higher again. Indicators Volatility Index (VIX) – Diverged with yesterday’s

FAANG Update: $FB $AAPL $AMZN $NFLX $GOOGL I regularly update the charts for Facebook (FB), Apple (AAPL), Amazon (AMZN), Netflix (NFLX) and Alphabet (GOOGL). Check out the updates below. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself!

My Swing Trading Strategy I don’t have any new positions in my portfolio from Friday. Watching today to see how serious the bulls are about holding on to these new all-time highs. Considering 1-2 new long positions to the portfolio. Indicators Volatility Index (VIX) – VIX dropped 7.8% and likely to drop further, which is creating