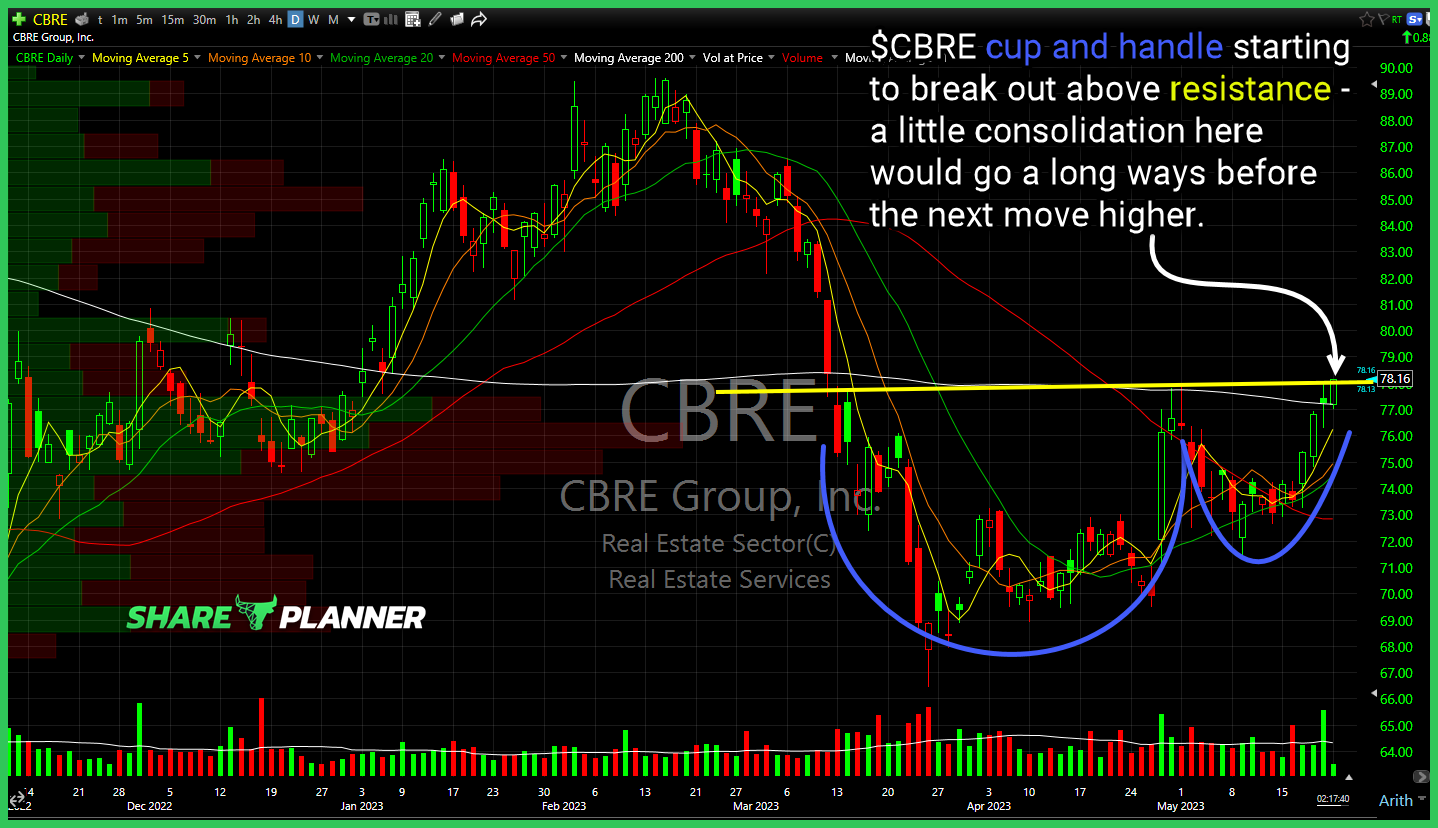

$CBRE cup and handle starting to break out above resistance - a little consolidation here would go a long ways before the next move higher. $GME 200-day moving average has been a headache the previous two attempts to break above, marking temporary highs. Will need to break and close above it to change the narrative.

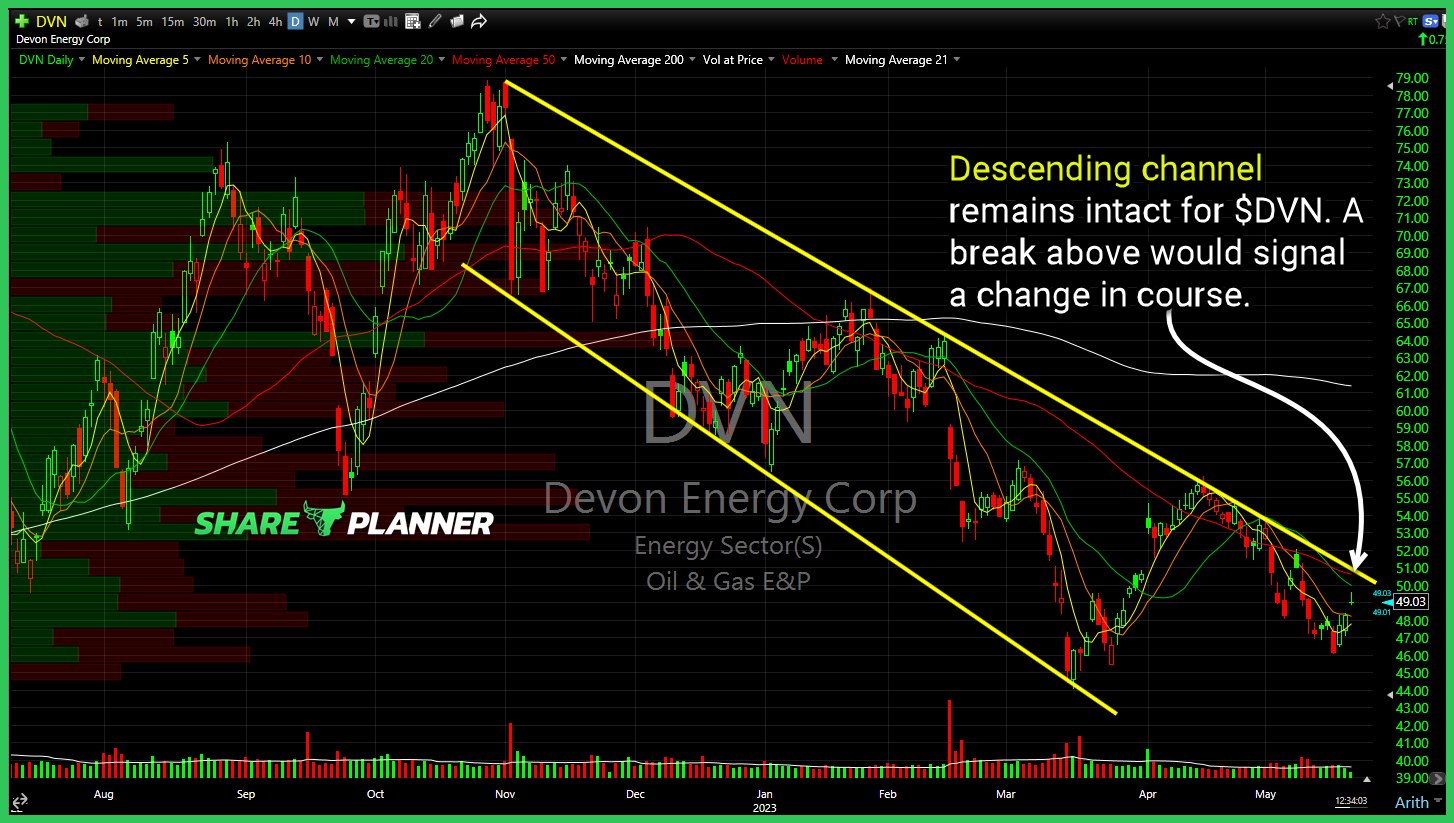

Descending channel remains intact for $DVN. A break above would signal a change in course. $SHLS with a nice push through declining resistance, but needs to breakout of consolidation to get bullish on it. $CRS attempting a bounce here off of short-term rising support. Should the bounce hold be mindful of resistance in the mid-$50's

$NKE attempting here to avoid confirming a double top pattern by trying to bounce off of price level support.

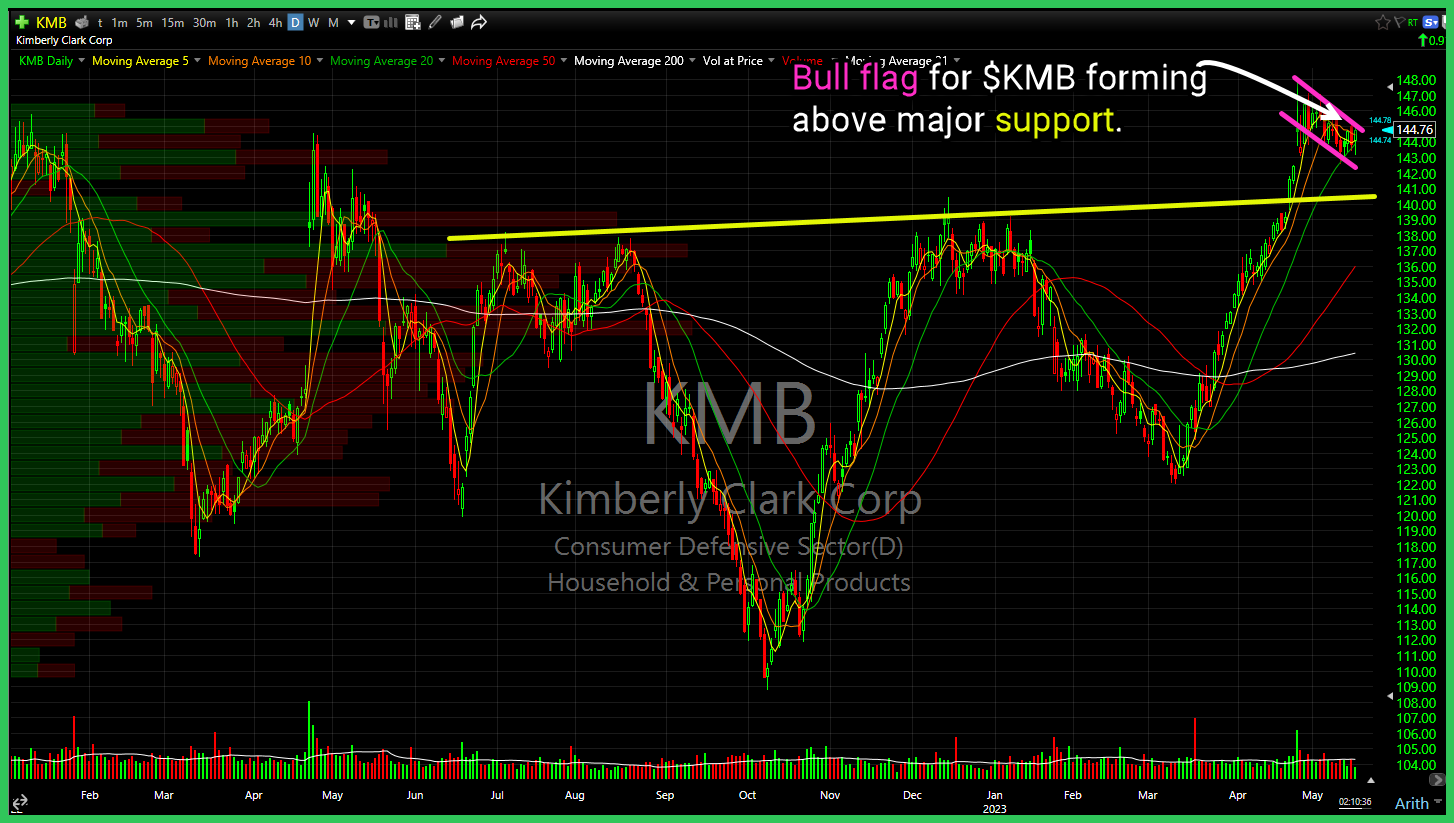

Bull flag for $KMB forming above major support.

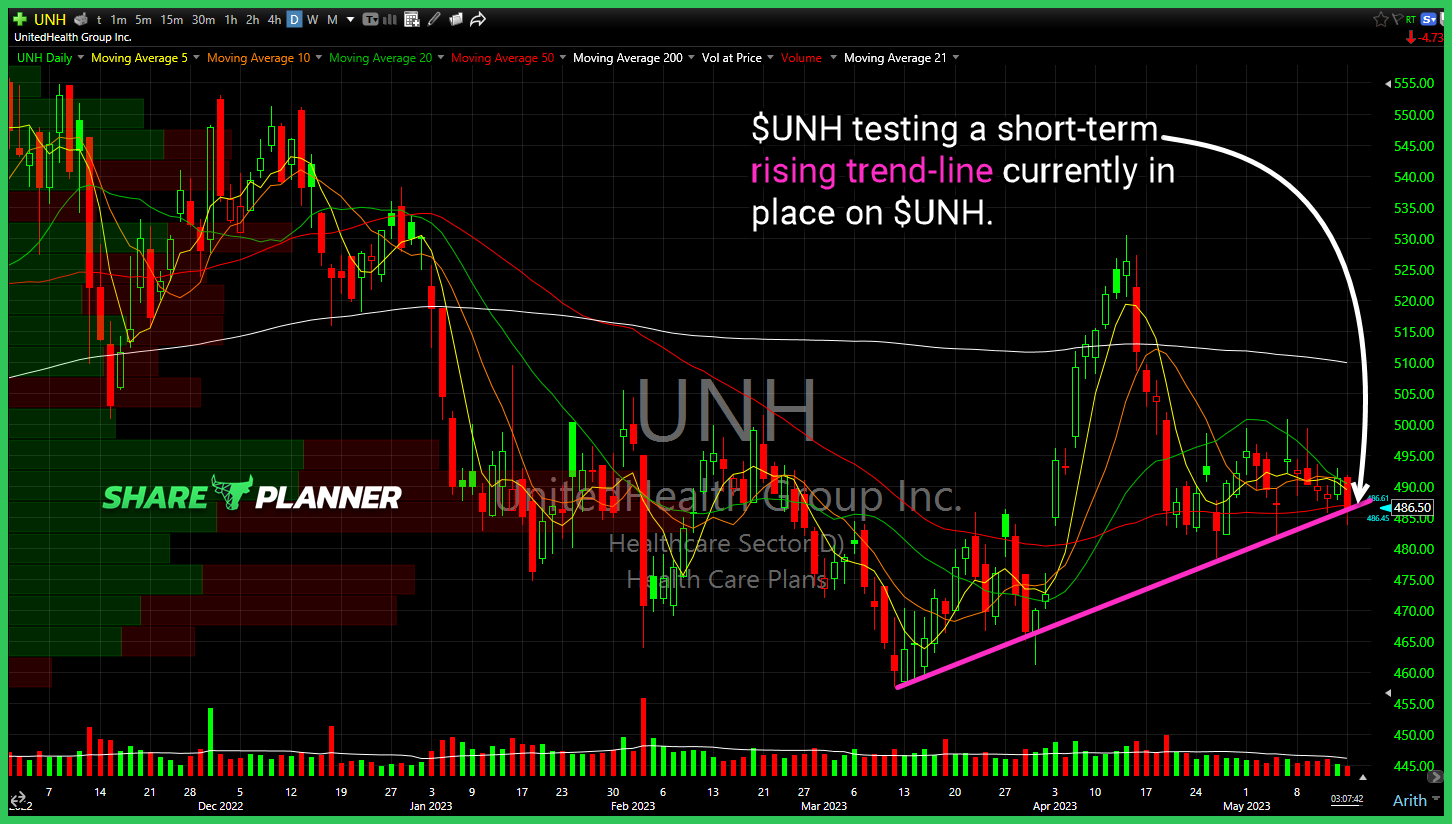

$UNH testing a short-term rising trend-line currently in place on $UNH.

$XLK fighting a major resistance level that goes back for the past year.

$XLK price level resistance and upper channel resistance pushing back on the $XLK move back to last August highs.

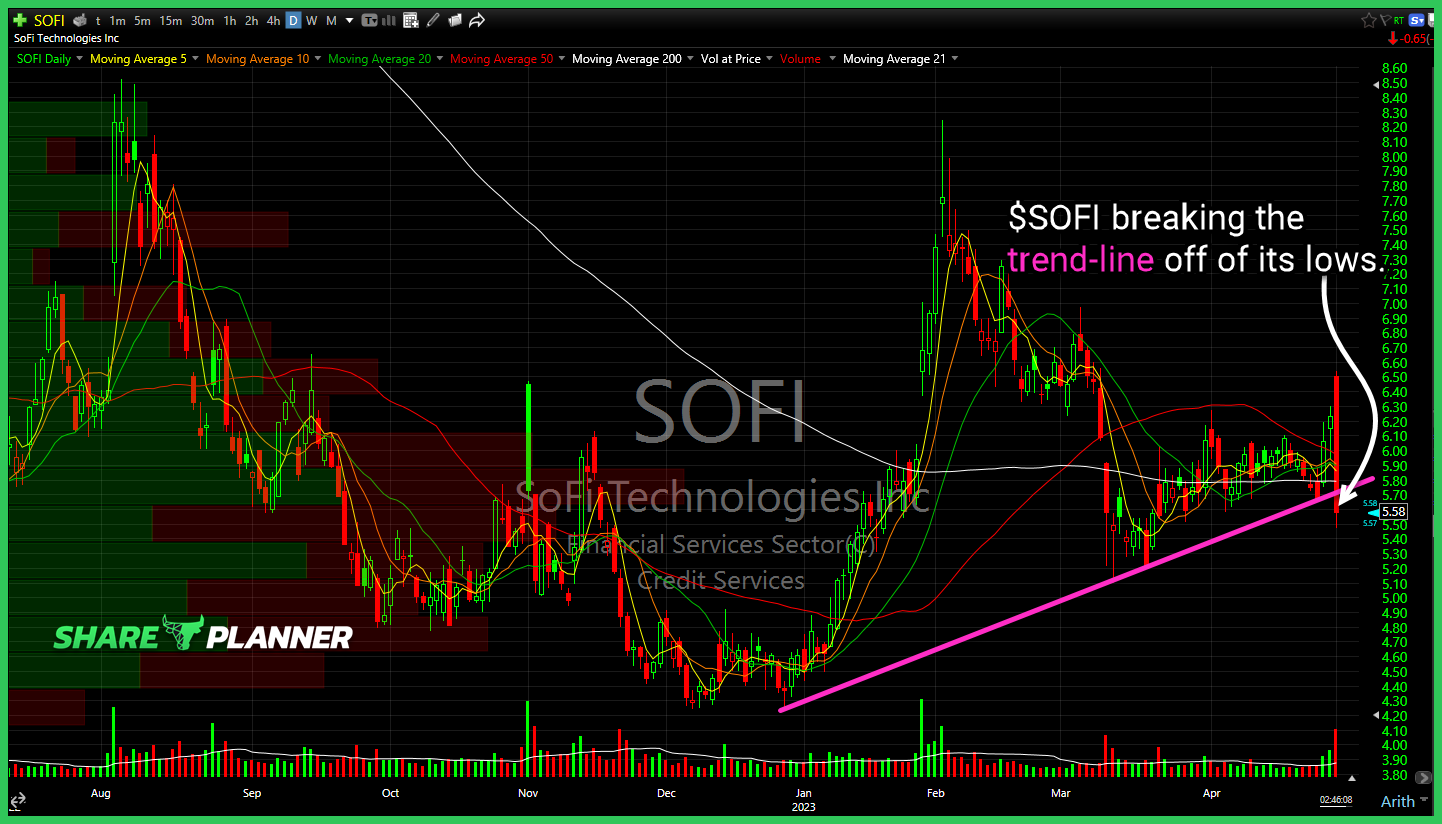

$SOFI breaking the trend-line off of its lows.

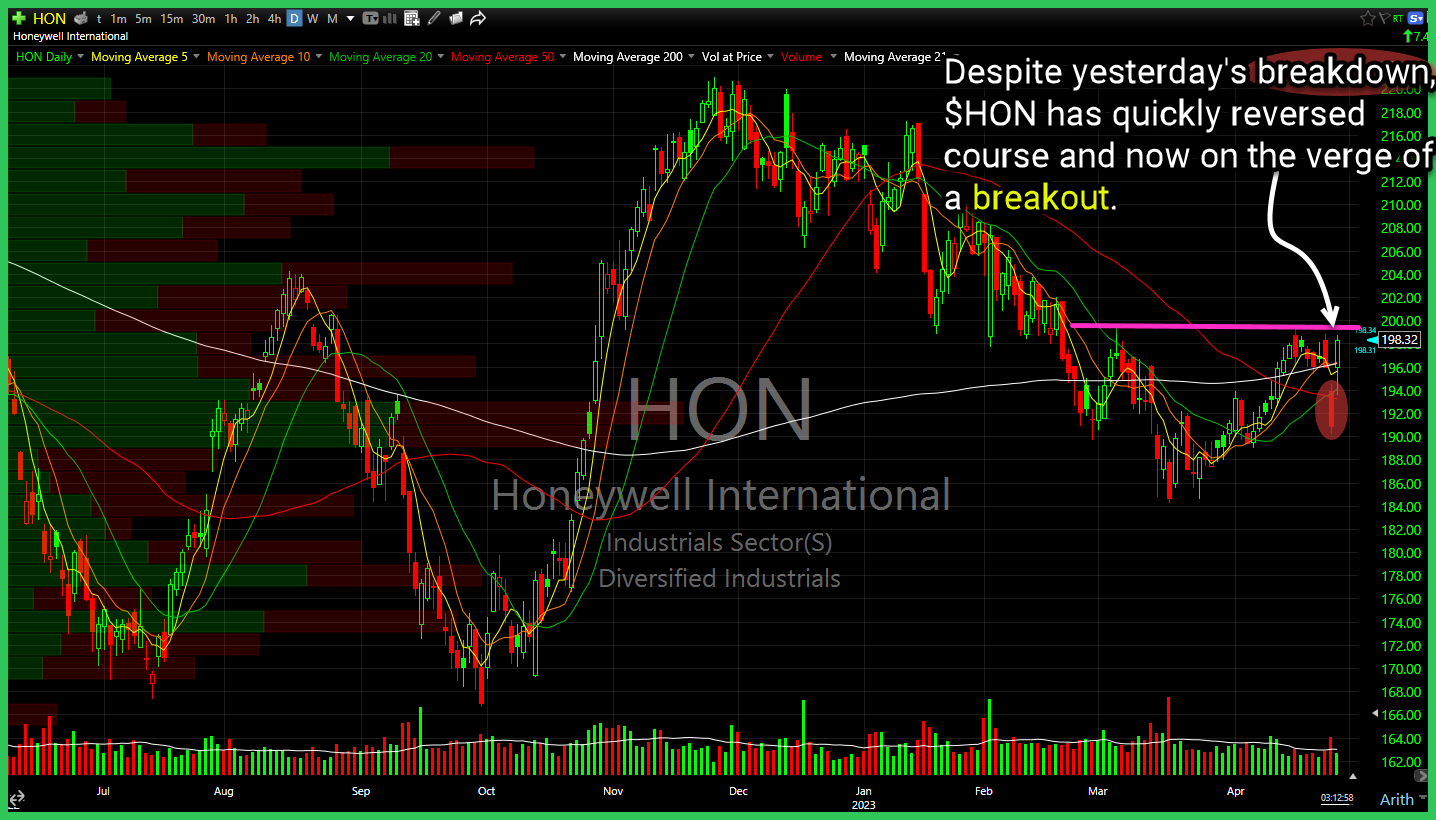

Despite yesterday's breakdown, Honeywell (HON) has quickly reversed course and now on the verge of a breakout. Quite the clown market we are in. Caterpillar (CAT) intraday breakdown of support has now seen a sharp intraday rebound. Watch declining resistance above. Communications Sector (XLC) ripping higher on Meta Platforms (META) earnings, but closing

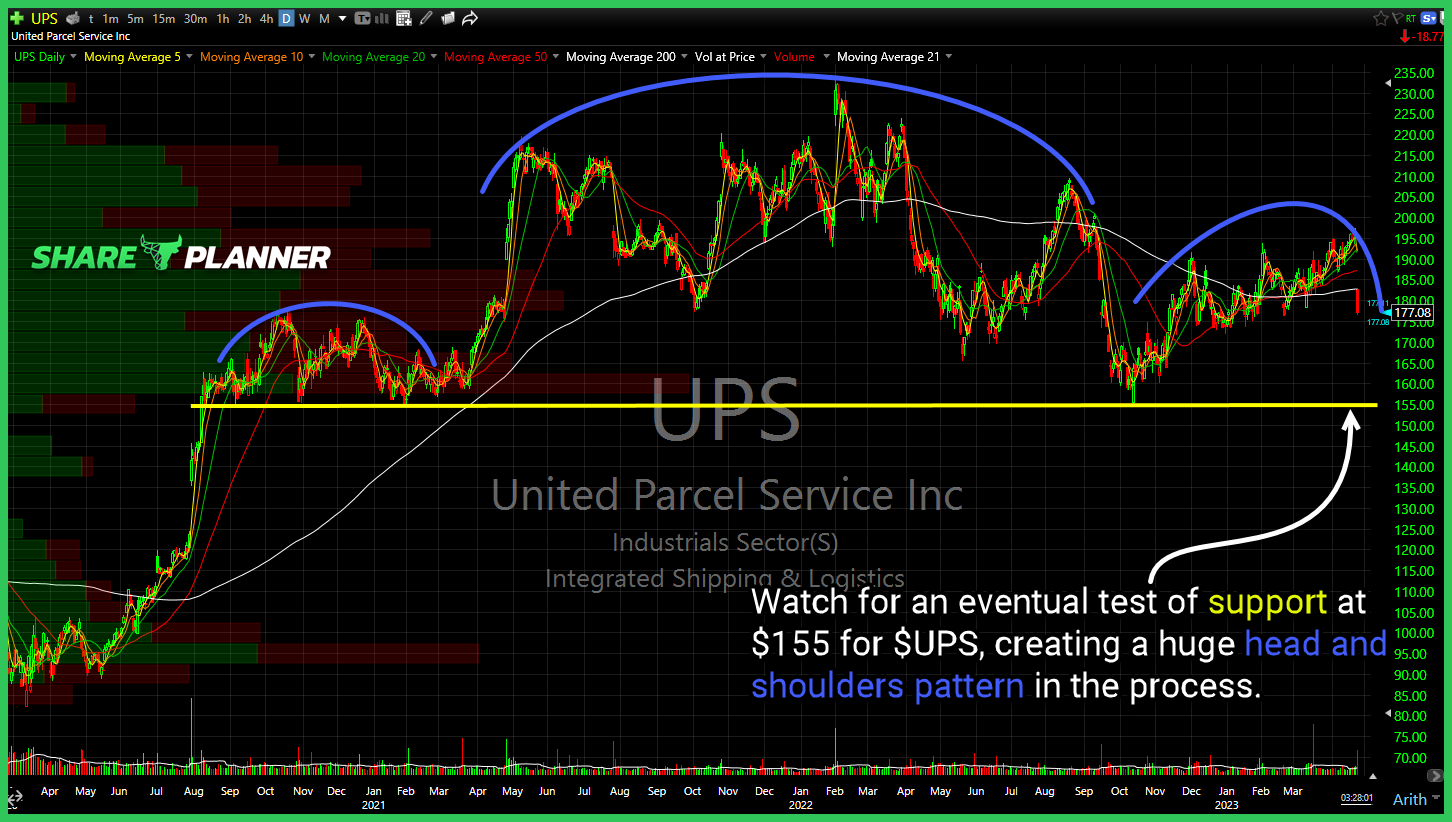

Watch for an eventual test of support at $155 for $UPS, creating a huge head and shoulders pattern in the process.