Stock market pullback back lasted for the past two days. Using technical analysis, is now the time to buy the dip, or wait for stocks to sell off even further before considering buying stocks?

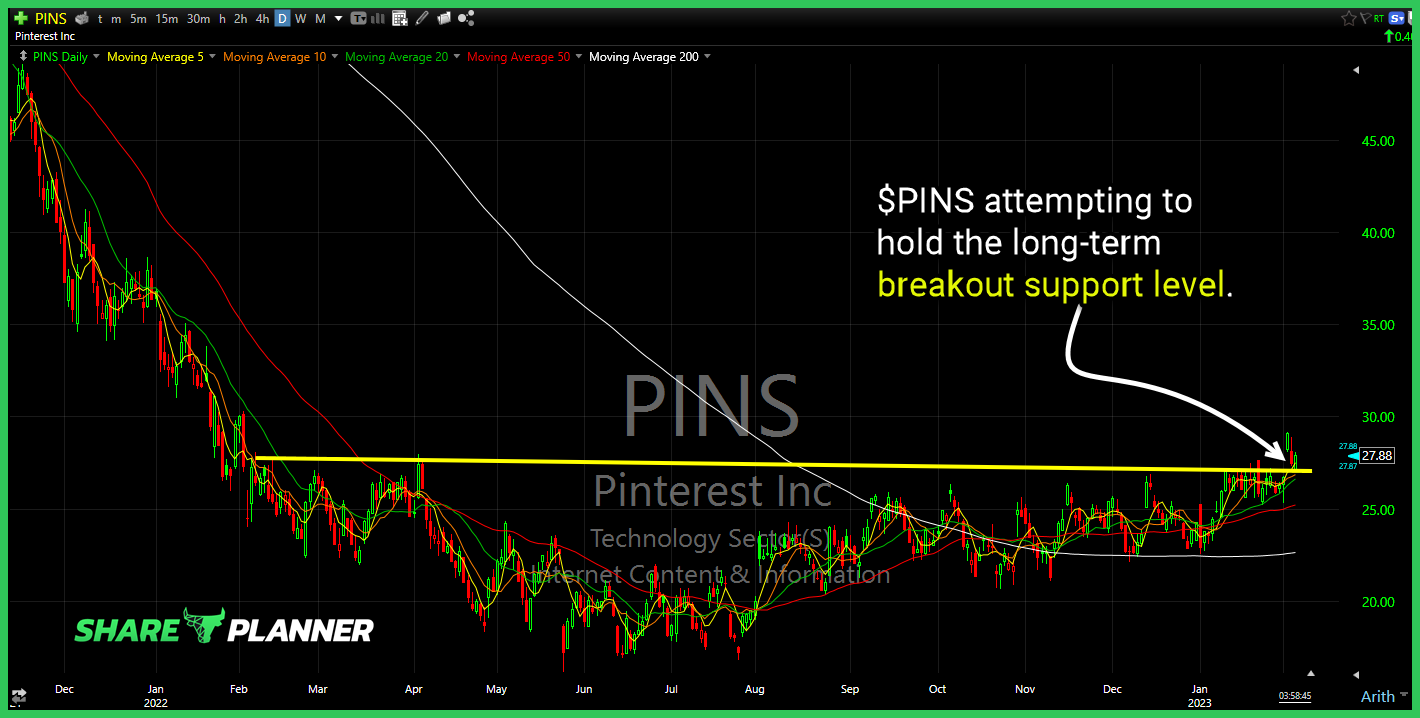

$PINS attempting to hold the long-term breakout support level.

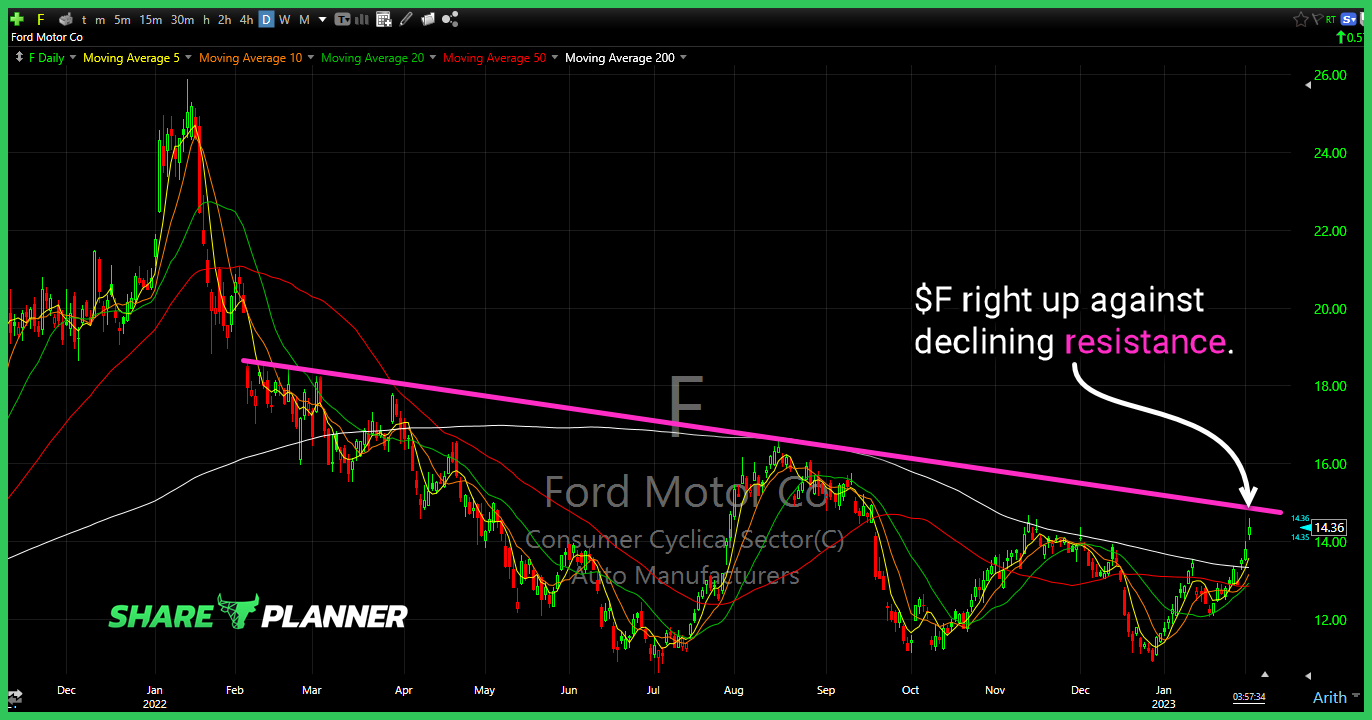

$F right up against declining resistance.

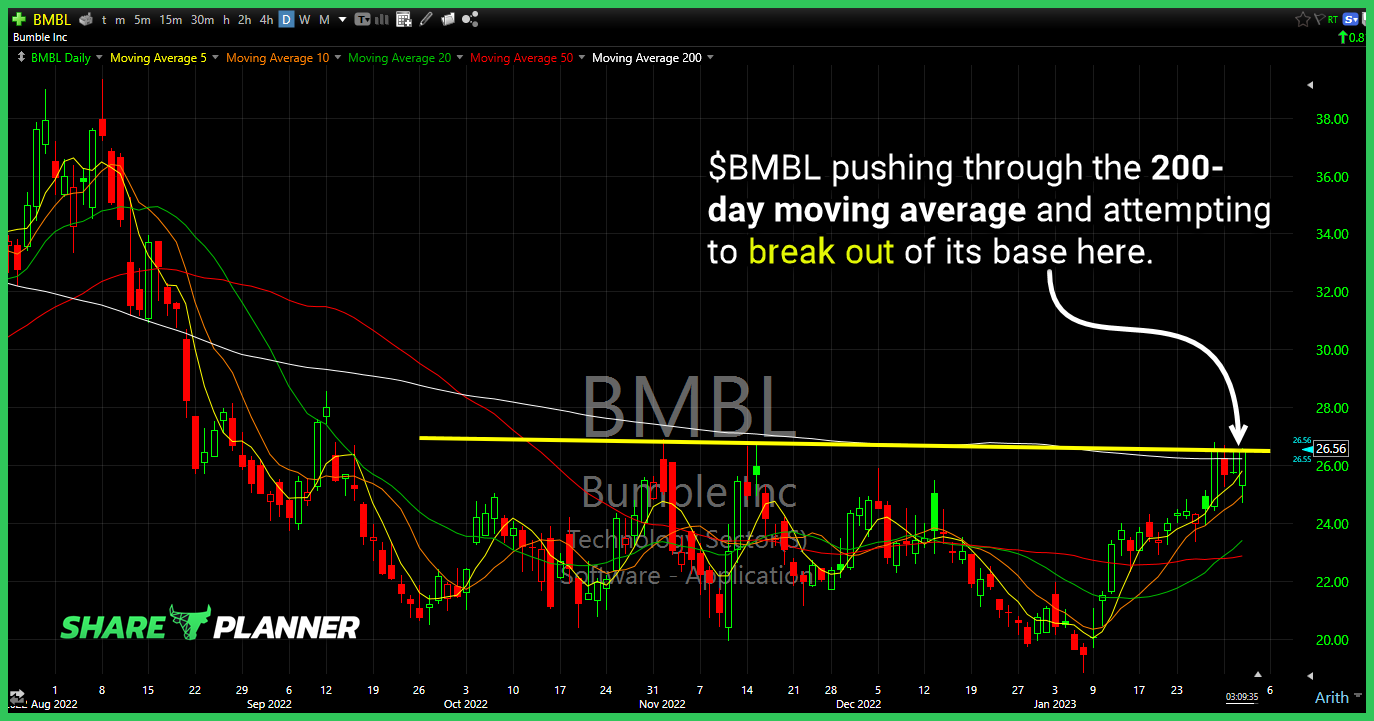

$BMBL pushing through the 200-day moving average and attempting to break out of its base here.

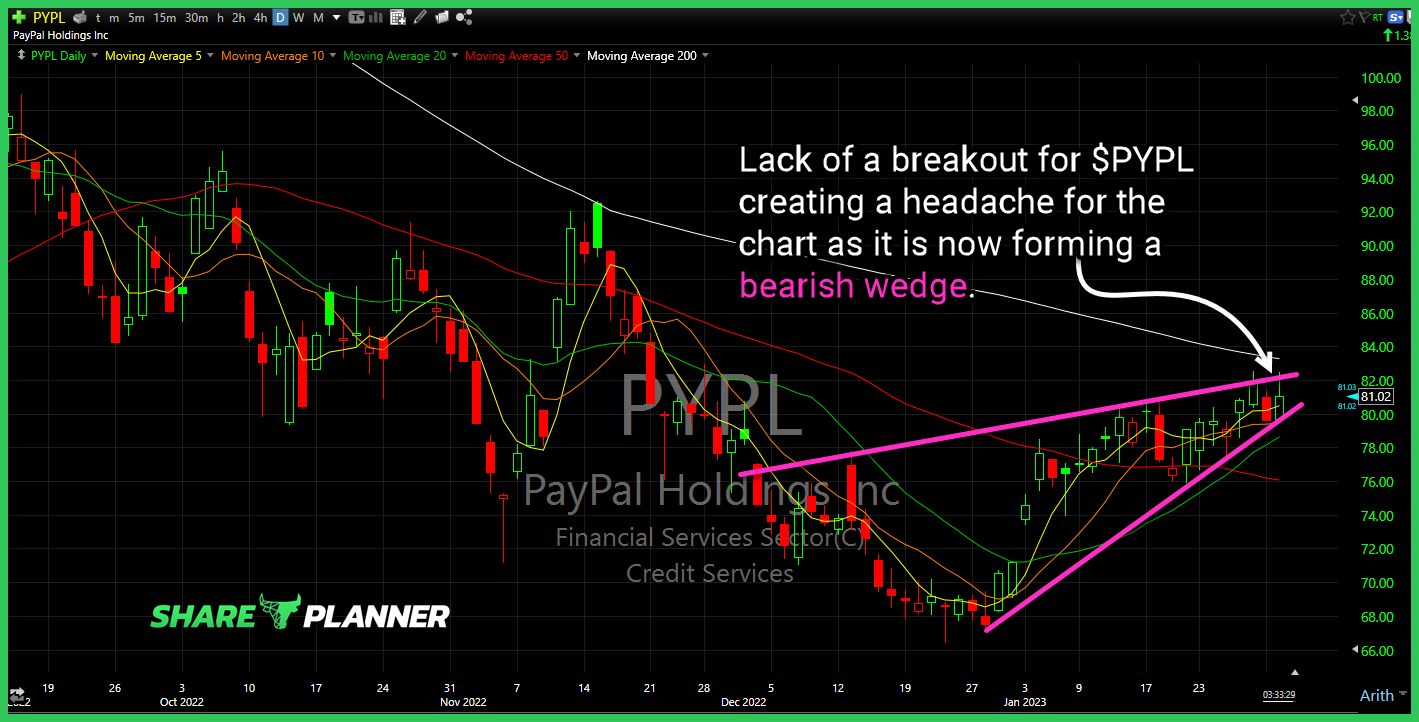

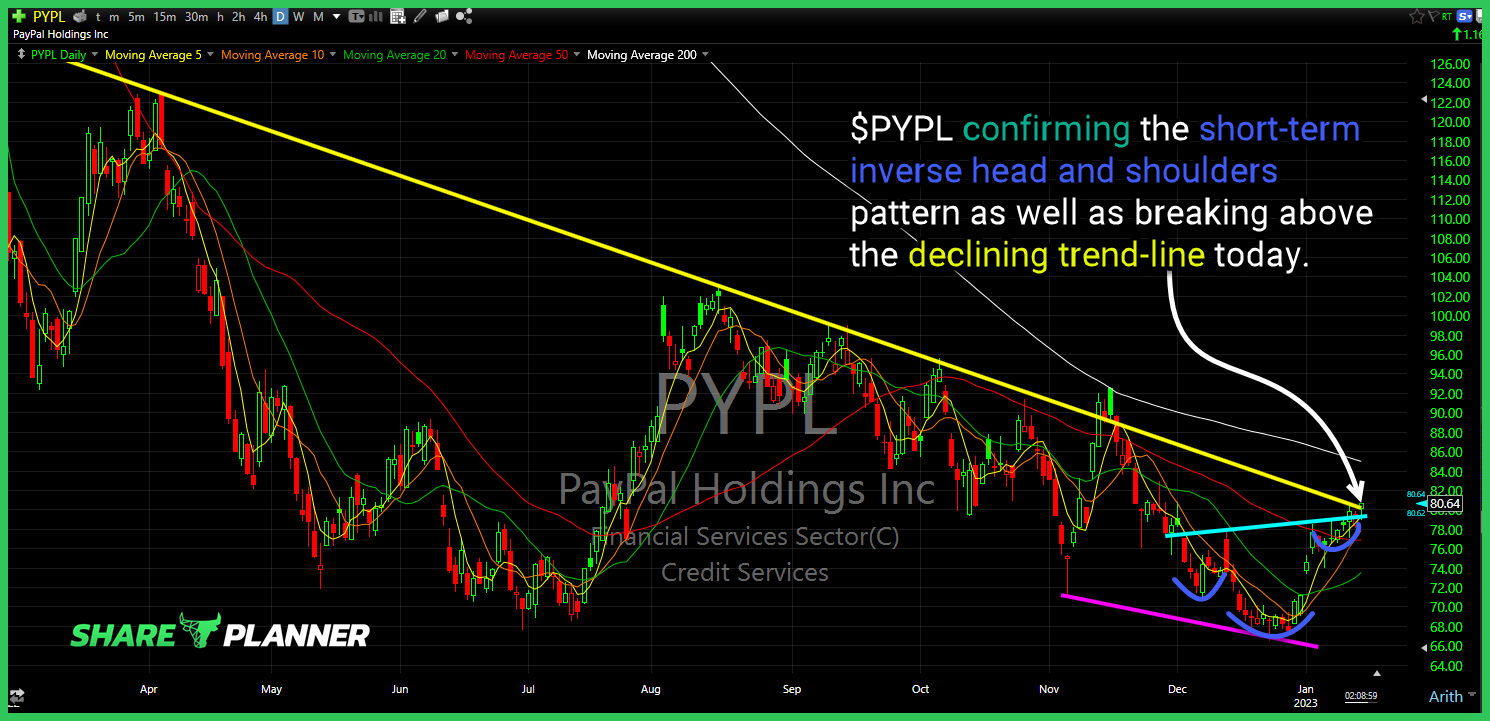

Lack of a breakout for $PYPL creating a headache for the chart as it is now forming a bearish wedge.

$SPY 5 min intraday pullback only a 23.6% retracement from Thursday lows to Monday highs. Needs $395-7 to make it a meaningful one.

Resistance on $VIX continues to kick price back down. The 8th straight successful attempt this year alone and 11th overall.

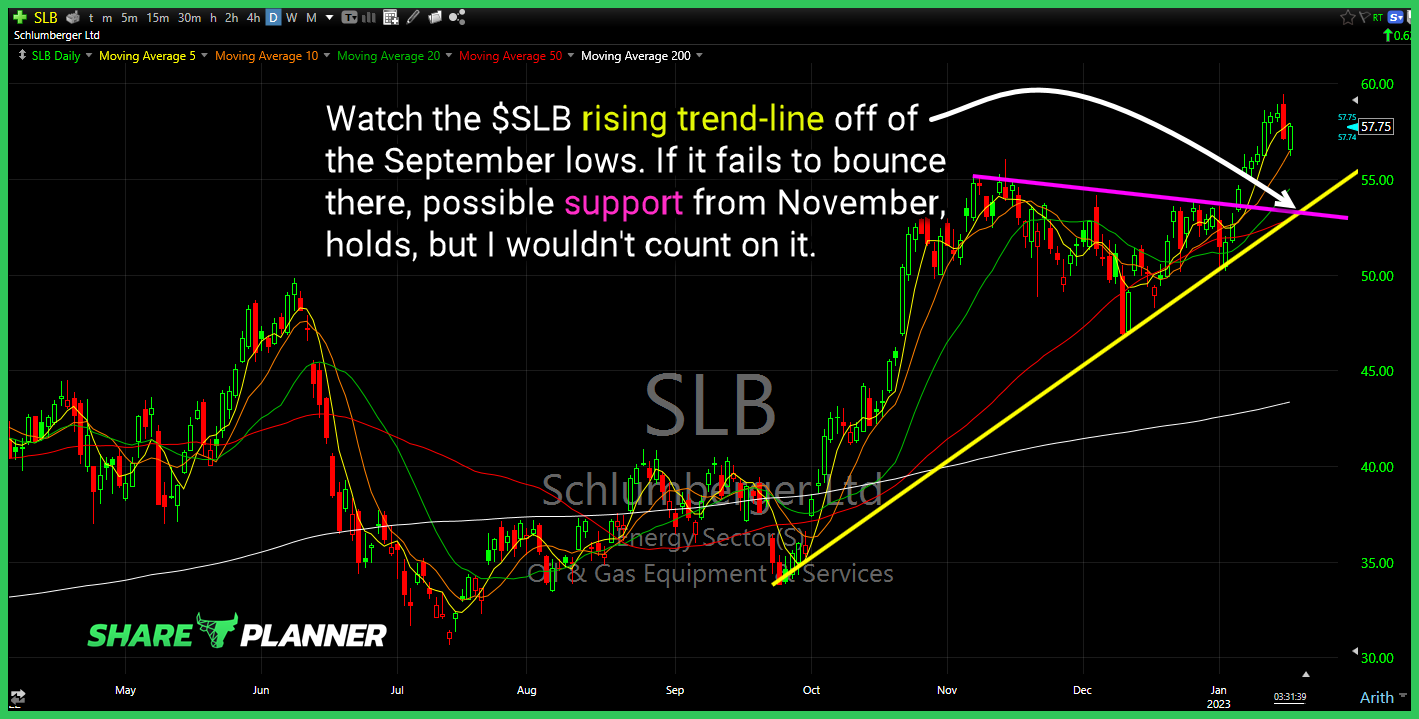

Watch the $SLB rising trend-line off of the September lows. If it fails to bounce there, possible support from November, holds, but I wouldn’t count on it.

$GME so far is simply back testing previous support (now resistance).

$PYPL confirming the short-term inverse head and shoulders pattern as well as breaking above the declining trend-line today.