My Swing Trading Strategy Last week was an insanely boring week of trading for me. Only one trade overall – that is a rarity. I did close out some positions that weren’t doing much though, including Harris (HRS) for a +0.6% profit. Much of the slowness was due to holiday light volume and recent low volume

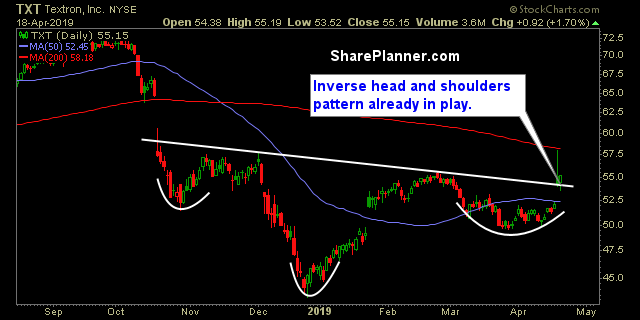

Monday’s Swing-Trades: $TXT $RHI $NVTA Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long Textron (TXT)

Some sectors not looking as healthy as they once were In fact it is one of the first times in quite some time where I am seeing tons of divergences across the different sectors. You have utilities that are topping, and then healthcare that is crashing. Technology is surging, while Energy is simply creeping higher.

My Swing Trading Strategy No trades from me yesterday, and will look to increase stops and book gains in places where it makes sense today. Tomorrow the market is closed and I suspect today, barring any major market news or a bombshell in the Mueller report, that the volume will be low and price action

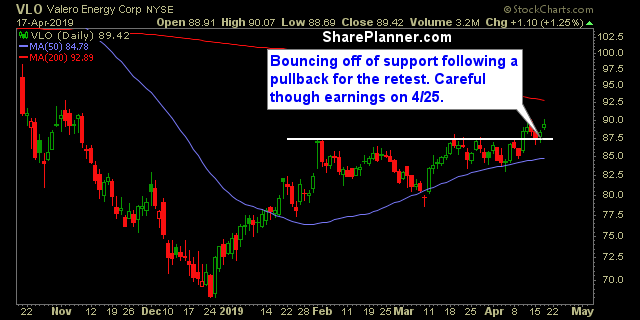

Thursday’s Swing-Trades: $VLO $BC $DTE Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long Valero Energy (VLO)

My Swing Trading Strategy I booked profits in Schlumberger (SLB) for +3.6% yesterday while also adding another position to the portfolio. I’ll look to add more today if this market can hold the morning rally and show a willingness to build upon it. Indicators Volatility Index (VIX) – Finished only 1% lower, but did manage to trade, intraday, below

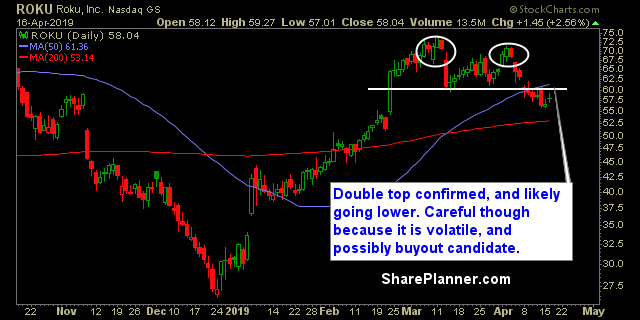

Wednesday’s Swing-Trades: $EXAS $UNM $ROKU Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long Exact Sciences (EXAS)

My Swing Trading Strategy The market provided very little incentive yesterday to add any new trades to the portfolio. I will consider adding another position to the portfolio if the market can hold up its pre-market strength. I also plan to increase my stops in the early going. Indicators Volatility Index (VIX) – Rallied strong earlier

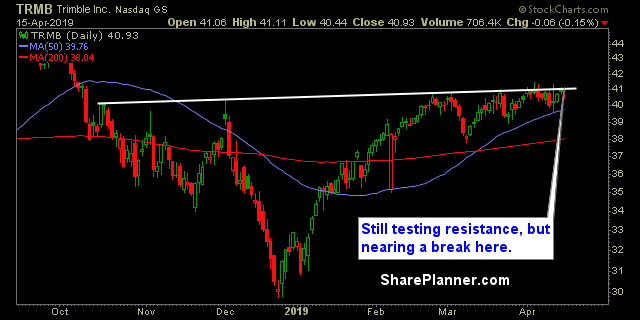

Tuesday’s Swing-Trades: $TRMB $KAR $ACHC Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long Trimble (TRMB)

Easter and Good Friday this week provides us with only a four-day week for swing-trading. I love a good four-day week of trading. And with Good Friday the market gives us an extra day to enjoy the holiday weekend. It is especially needed after the slow start that April has been so far. Sure we