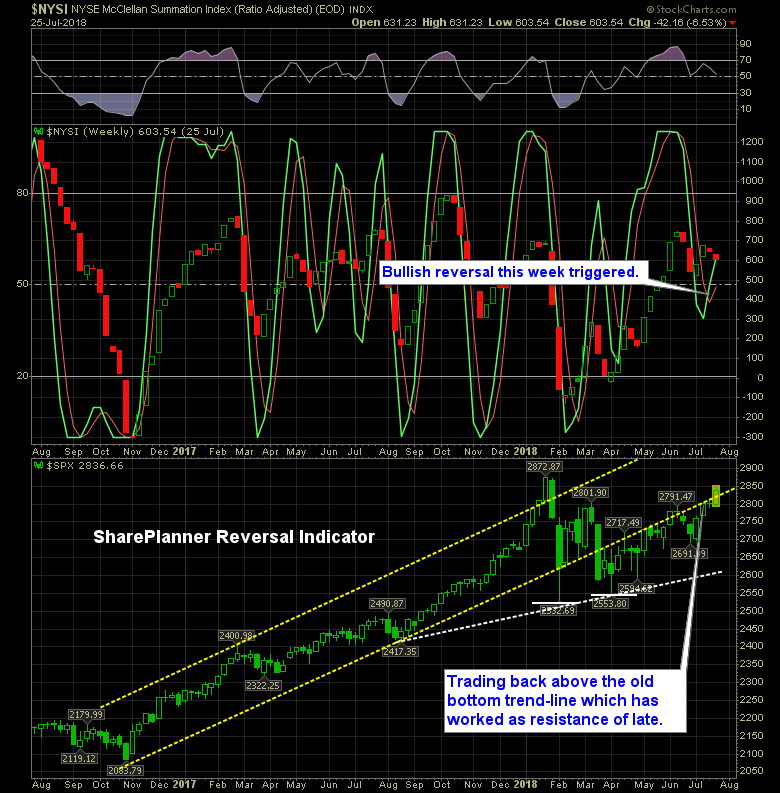

The bearish reversal in June is no more. The bulls have managed to correct the ship and put together a bullish reversal of their own. With strong price action over the last three weeks, market behaviors confirms the reading on the SPRI.

The Bulls are running today, but as has been the case of late, it is rotating sectors each day. Basically whatever sectors are leading the market one day, is what will be lagging the market the following day. Technology is struggling today, after leading the market on Friday. Despite the market trading higher, the breadth

My Swing Trading Approach Playing it cautious yesterday – added one additional play on the dip yesterday, but I am sitting on 80% cash, and if the market cannot rebound today, I will look to keep it that way today. Short plays at this juncture looks like a trap with the market’s low volume and

My Swing Trading Approach Good chance I will be looking to sit on my hands today, unless the dip buyers step in and aggressively buy up this market. Raise my stops to protect profits, and wait for an opportunity to present itself. Indicators

My Swing Trading Approach I am willing to add a new position to the portfolio today, but I have to be extremely “choosy” with my opportunities here, because the market is overbought, and I have little desire to add more exposure at the tail end, before seeing a normal market pullback. Indicators

My Swing Trading Approach I’m not opposed to adding more long exposure, but may wait for some consolidation in price or a light volume pullback first. Indicators

My Swing Trading Approach I am following the downtrend that the bulls are testing at the open today on SPX. Should it break, I will look to steadily increase my long exposure in the market, while protecting my profits in existing positions. Indicators

My Swing Trading Approach Some resistance lingering overhead that I note below, and providing issues for the overall stock market. I will consider adding another position to the portfolio today, but won’t allow myself to stretch too far out. I will look to protect profits on existing positions as my #1 priority. Indicators

My Swing Trading Approach I added and subtracted from my portfolio yesterday. While, I would like to still be in an oil play going forward, I don’t want to be in one ahead of Trump’s Iran announcement. I’ll likely play it cautious ahead of the announcement at 2pm eastern. Indicators

My Swing Trading Approach I’m taking as much from the market as it is willing to give. Meaning, I am not overly committing to the long side, but if there are opportunities to take advantage of, I am going to take them, while raising stops to protect existing profits. With recent market choppiness, I want