My Swing Trading Approach Similar to yesterday, I will take a very cautious approach with this market. Less is more in this market and I do not want to rapidly increase my long exposure with such incredible uncertainty. Only under very bullish circumstances today, will I add additional long exposure to my portfolio. Indicators

My Swing Trading Approach I expect to remain light on my feet today, as the bulls are struggling, and I do not want to add more long exposure in this kind of market. I will be raising the stops on existing positions this morning to help secure profits. Indicators

My Swing Trading Approach I remain cautious here, as the bulls are struggling to rally the market substantially higher. Plenty of choppiness in the market. I don’t see myself adding any more than 1-2 new positions to the portfolio if conditions permit. Indicators

My Swing Trading Approach Caution is warranted here, as the market may give up the gains of the past three days. It is important to make the market prove itself here to you, and not front run any anticipated market bounce. Let the market show you it wants to bounce first. Indicators

My Swing Trading Approach I expect to add some additional long exposure today, as long as the early gains can remain intact in the early going. I may also add some short exposure if the market closes the gap, and continues to establish new lows . Indicators

Today’s rally is strong, and finally pushed price through the 50-day moving average. When I saw the jobs number this morning, and how much it blew out the expectations, I very much expected when I turned my head back towards the monitors to see what the futures were doing in reaction to it, that they

My Swing Trading Approach I’m not opposed to adding a new position in this rally, but stocks are in overbought territory, and may see some profit taking. I’m taking a “wait-and-see” to this market. Indicators

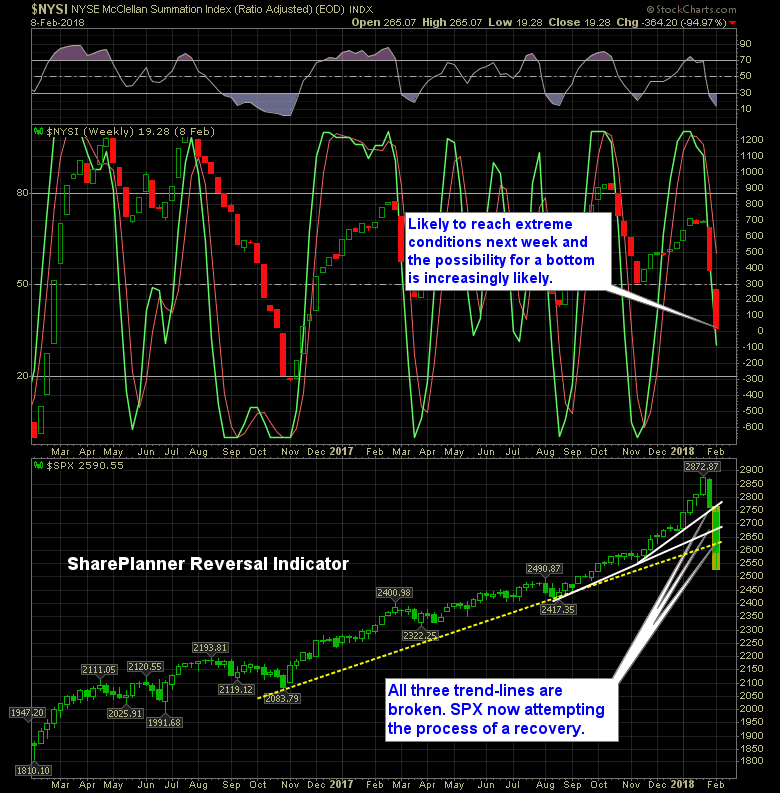

No one really knows if this sell-off is, indeed, over with. The bulls can make a convincing argument that the worst is behind us, with the convincing bounce, last Friday, off of the 200-day moving average.

The market has officially tested the 200-day moving average and so far it is holding. It is the first time it has been tested since June of 2016 and when it did, an amazing bounce, immediately thereafter, unfolded.

My Swing Trading Approach A number of my profitable positions were stopped out yesterday. That’s what the stops are there to do – protect profits! So, if this market can sustain the early morning strength being seen so far, I will look to add 1-2 new positions to the portfolio today. Indicators