Comey and the markets collide Ultimately, I don’t expect much from this testimony. Comey prepared with the special counsel, Robert Mueller. For one, I don’t think he wants Comey’s testimony blowing up his investigation, and much of what could hurt Trump is already out there in the remarks yesterday. Politics aside, the market is only

The ugly sideways price action is likely to persist I think that we are likely to see more of the same price behaviors yet again today. Yesterday’s price action started off typical, open lower, and then spend the rest of the day rallying back towards break even on the day.

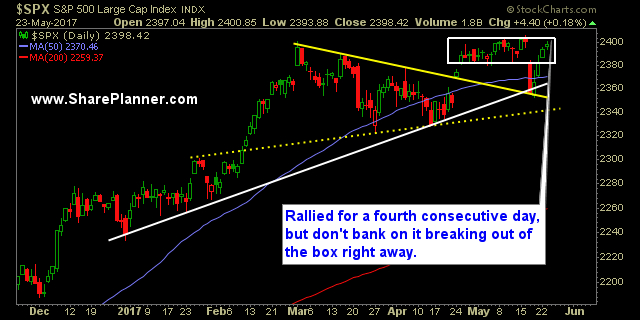

Back to the Dull Market Action Just as I was expecting, we are back to the market conditions that we saw prior to last Wednesday’s sell-off. The market has bounced hard off of those Wednesday’s lows and within four trading sessions, we are back inside of the box that price action has spent practically

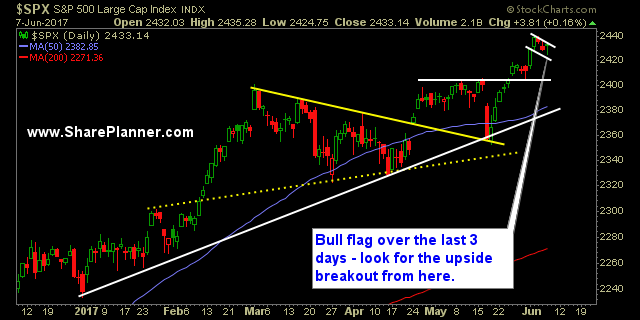

Show some follow through Friday’s move was quite subtle but very strong as well. What started off as a day trading sideways like each of the days of the past eight trading sessions, changed its tune in the afternoon and broke out of the short-term price range and rallied to new all time highs by

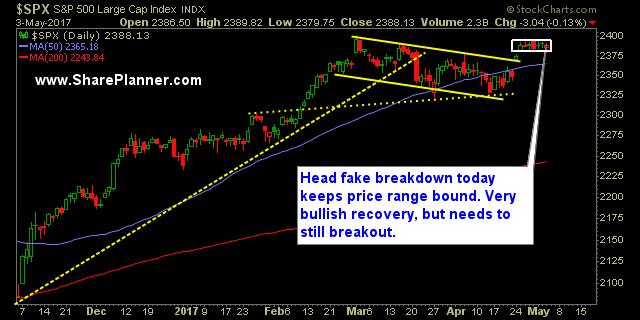

The Fourth is Strong with this Market For a moment there, just a moment, it looked like the market was going to lose its marbles and actually experience a legitimate sell-off yesterday. But nope, it didn’t and now you have “May the Fourth” playing Jedi mind tricks on the Wall Street bears in the pre market

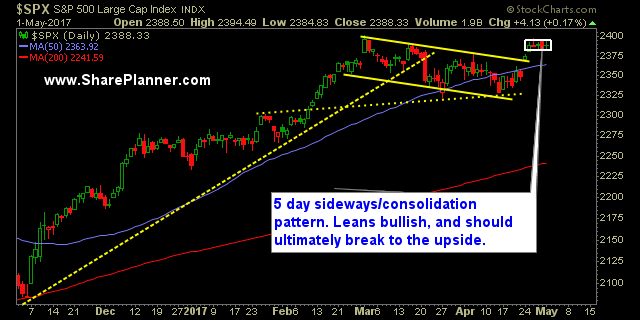

This stock market can’t break out of the range bound price action The price action has become very dull among the indices. In fact, this is the tightest 6-day trading range in the last 23 years. For many of you, that is before you ever started trading. Needless to say, what goes up, must come

Breakout of Consolidation a Must SPX had that opportunity on Friday to really close out the month strong and breakout of that consolidation pattern that is more evident on the intraday charts than it is on the daily chart. Instead the market gave traders a gap and crap the entire day. Very little bounce and

There’s not a lot of reason to be short on this market… well that depends on the day of the week of course, because on Friday of last week and Monday of this week, things were starting to look grim. Since the debate, the market has been extremely bullish. And it is not because it

This shouldn’t be any surprise for traders following the Apple (AAPL) product launch of the iPhone 7 and whatever those wireless earbuds are that has Apple groupies all excited. Since Steve Jobs’ death, every time we have one of these “new product” unveilings, the stock sells off unapologetically. Why? Because they aren’t carving any new