My Swing Trading Approach I will be looking at adding 1-2 new positions to the portfolio today as long as the early morning strength can hold up. I will look to increase the stop-loss on all my profitable, existing positions. Indicators

My Swing Trading Approach At this point, it is hard to have any bias in this market while the price remains stuck in consolidation. Stay patience, stay ready. Patience defines a trader’s worth. Indicators

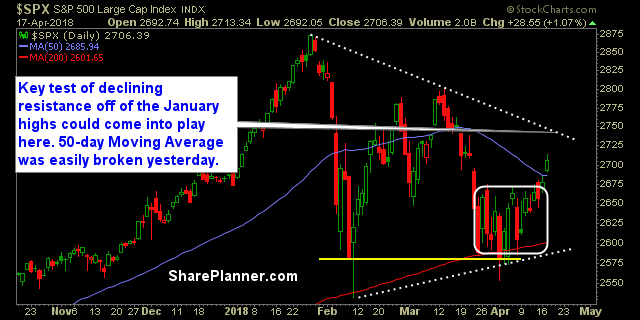

My Swing Trading Approach Huge bullish kicking candle pattern the last two days with the S&P 500 (okay, maybe not a perfect one, but close enough). I am optimistic, the bulls will try to put together a sustainable move here going forward and will add more positions as long as the market is a willing

My Swing Trading Approach I have one short position. I plan to play it cautious here. If the bulls choose to rally, the market today, I will look to add some long exposure, but plan, for now, to keep the short position as long as possible. Some technical damage on the SPX chart warrants

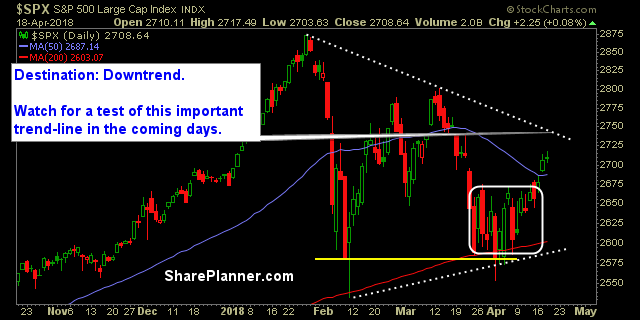

My Swing Trading Approach Considering what the market does with the current consolidation pattern, a breakdown may warrant some short exposure. I may have some opportunity on the dip buy, but overall, a conservative approach to the long side will likely be necessary today. Indicators

My Swing Trading Approach Good chance I will be looking to sit on my hands today, unless the dip buyers step in and aggressively buy up this market. Raise my stops to protect profits, and wait for an opportunity to present itself. Indicators

My Swing Trading Approach I am willing to add a new position to the portfolio today, but I have to be extremely “choosy” with my opportunities here, because the market is overbought, and I have little desire to add more exposure at the tail end, before seeing a normal market pullback. Indicators

Here's my video on swing-trading in the stock market, when price conditions are choppy and unpredictable. Be sure to subscribe to my YouTube channel to get notified whenever I post a new video!

My Swing Trading Approach I am not opposed to adding more trades to the portfolio today, but the market needs to be favorable for it to happen. We could see a pullback, and I don’t want to buy ahead of that, even if it is likely to be just temporary. Indicators

My Swing Trading Approach The bulls are regaining a firm grasp on this market and the bears are being forced to cover in mass. I will look to add 1-2 new positions today. Indicators