Big break this week for Amazon (AMZN) weekly chart. Needs to hold this level into the close tomorrow. Netflix (NFLX) support levels to watch. Very little reason for me to want to play this bounce so far. No basing taking place, and support has yet to hold. Carvana (CVNA) inverse head and shoulders going back

Coinbase Global (COIN) finally starting to break out of the declining channel from mid-July. Very little resistance overhead from here to continue to the climb. Imagine getting stopped out on a random 7% drop mid-day for no reason at all on Oracle (ORCL). No news that I can find anywhere. Starbucks (SBUX) breaking

I'm watching to see if Advanced Micro Devices (AMD) pulls back to the rising trend-line from the Nanuary lows. If that Holds it could create a nice bounce opportunity. Netflix (NFLX) attempting to finish off this head and shoulders topping pattern. Watch for SoFi Technologies (SOFI) to retest year long support. If it

Nvidia (NVDA) posting a 99 stochastics reading on a monthly chart is next level crazy. Costco (COST) still confined to a triangle pattern, but nearing a retest of support underneath. Netflix (NFLX) facing stiff push back against long-term resistance. Don't get me wrong - incredible rally today, but be mindful of the challenge above.

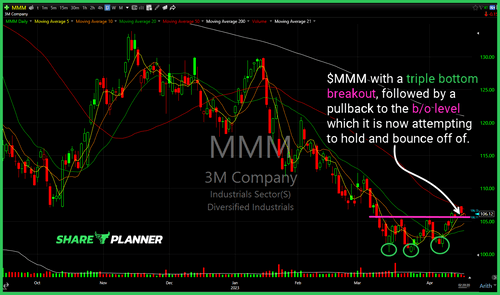

$MMM with a triple bottom breakout, followed by a pullback to the b/o level which it is now attempting to hold and bounce off of.

Heavy sell-off yesterday in $NFLX has price completely reversed and attempting to break out of the bull flag pattern.

$ALB weekly has a broken long-term trend-line that is now acting as resistance. Potential leg lower here.

Into the gap GameStop (GME) goes. Never trust this stock. S&P 500 (SPY) gave up all the day's gains and broke yesterday's lows. Bad omen for this market. Netflix (NFLX) price resistance here worth keeping a close eye on. Pimco Total Return ETF (BOND) nearing resistance from July '22 for a potential breakout.

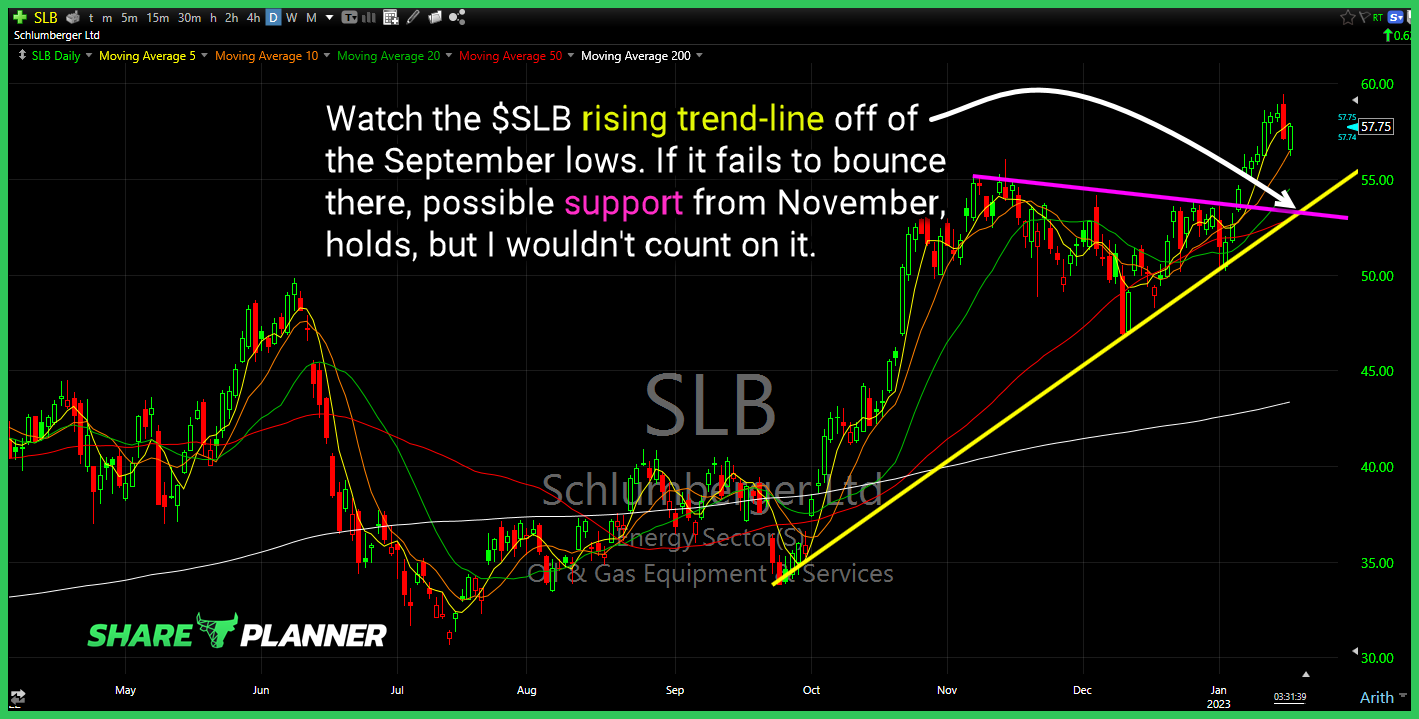

Watch the $SLB rising trend-line off of the September lows. If it fails to bounce there, possible support from November, holds, but I wouldn’t count on it.