It is a new month of trading an you should start it off right by trying out my service by signing up for a Free 7-Day Trial to the SharePlanner Splash Zone and with your membership, you will get each and every trade that I make with real-time text and email alerts (international too) as well as

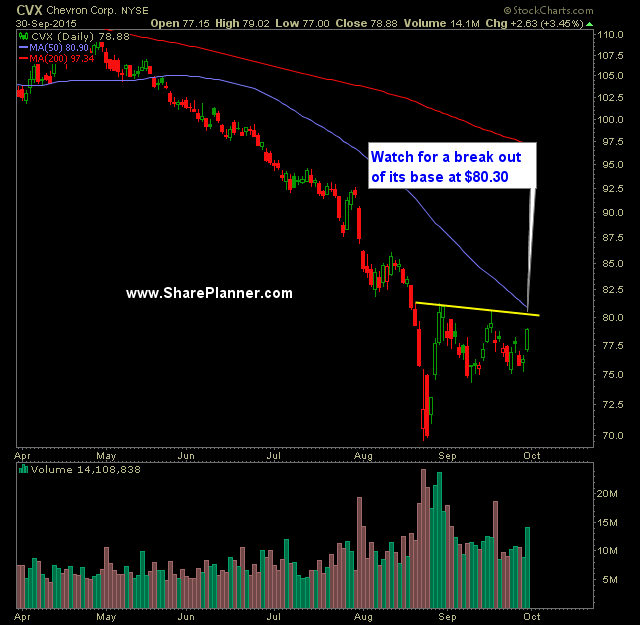

Today’s video covers my current trades in the SharePlanner Splash Zone that includes and how I trade pullbacks and breakouts. The trades that I cover are: Chevron (CVX), Disney (DIS), Facebook (FB), Alphabet (GOOGL), Mastercard (MA) and Starbucks (SBUX). Here’s the video:

Despite another bad month for the market, members of the SharePlanner Splash Zone are still profiting. Sign up for a Free 7-Day Trial and with your membership, you will get each and every trade that I make with real-time text and email alerts (international too) as well as access to my world-class chat-room that I trade in each and

Sign up for a Free 7-Day Trial to the SharePlanner Splash Zone and receive all my Real-Time Trades via text and email alerts as well as access to my trading room. You can sign up by clicking here. Tomorrow’s Swing-Traidng Watch-List: Long Principal Financial Group (PFG)

It is one of the best kept secrets on the web in part due to the fact that I rarely speak of it. Going back to SharePlanner’s origins has been my Investment Newsletter. Starting off in 2003, with a $100,000 in the portfolio it has steadily seen its value rise year after year in value.

Mastercard (MA) retraces for a nice entry (SODA) Stock: Mastercard (MA) Long or Short: Long Entry: $531.40 Stop-Loss: $512.95

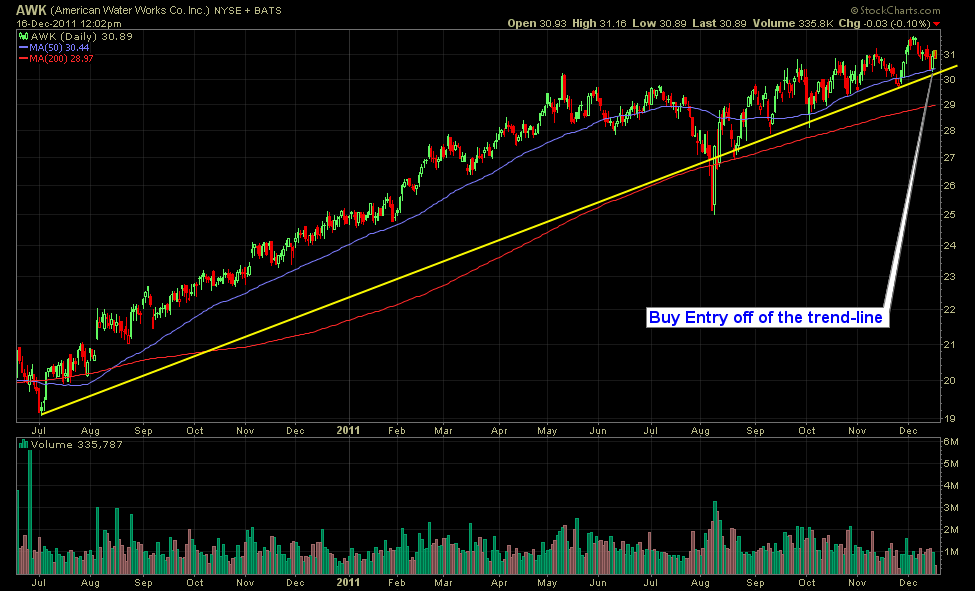

This is a modified version of the “Stocks That Only Go Up” stock screen, and what I’m trying to do here, is outline four stocks that have solid trend-lines that represent beautiful trading opportunities once they decide to pull back. And what you want is a decent pullback in the broader markets, because these stocks

If you are not going to use stops, because either 1) you prefer mental stops 2) the MM’s will “steal” my shares or 3) you’re afraid of it popping back up as soon as you get stopped out, is no excuse to not use stops, in fact, if you don’t do it, you better confine

Recently I have tried to provide readers on the weekend with the most interesting article from the past week. The article below comes from MarketFolly.com. It details the most popular stocks among hedge fund's top-ten holdings. Perhaps you may be able to find a trading idea or two as a result. Given our focus on