Episode Overview The United States, at any moment could find itself in a full scare war with Iran. Whether it happens is anyone's guess, but in this podcast, I am going to detail how stocks react in times of war, whether you should buy, sell, or buy some more. War can can lead to short-term

The market is off to a crazy start with oil and small caps leading the way. I’ve added one new position to the portfolio this morning and going to sit on my hands the rest of the day. I’ve got a long position in Alibaba (BABA) that I came into the week long with

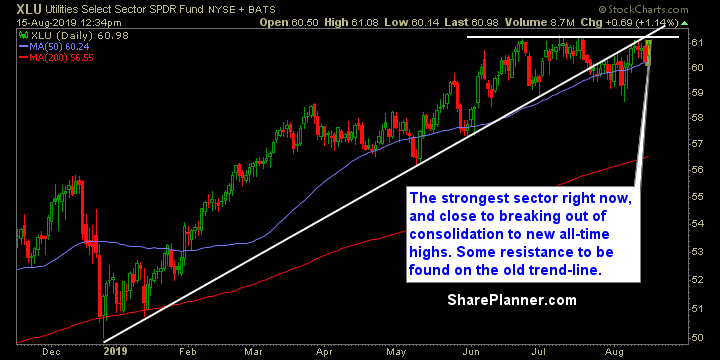

A lot of trend-lines breaks and topping patterns are forming The safe sectors is where big money is putting its capital. Utilities are practically on the brink of new all-time highs. I’d also like to add stocks supporting the military or have big dollars in the Pentagon defense budget are also holding up well and

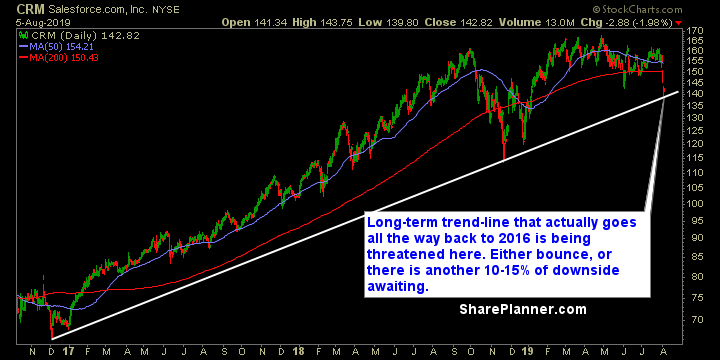

Tueday’s Swing-Trades: $CRM $CG $LMT Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: Salesforce (CRM)

Thursday’s Swing-Trades: $NEE $LMT $OKE Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: NextEra Energy (NEE)

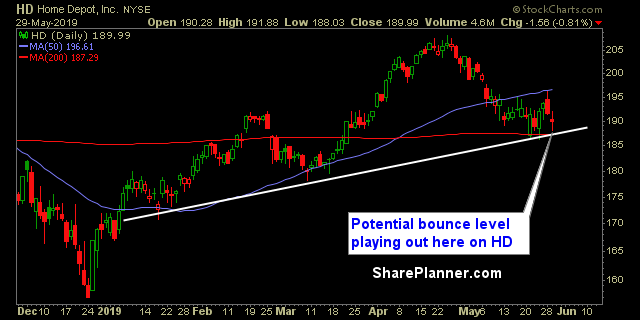

Thursday’s Swing-Trades: $HD $LMT $CWK Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: Home Depot (HD)

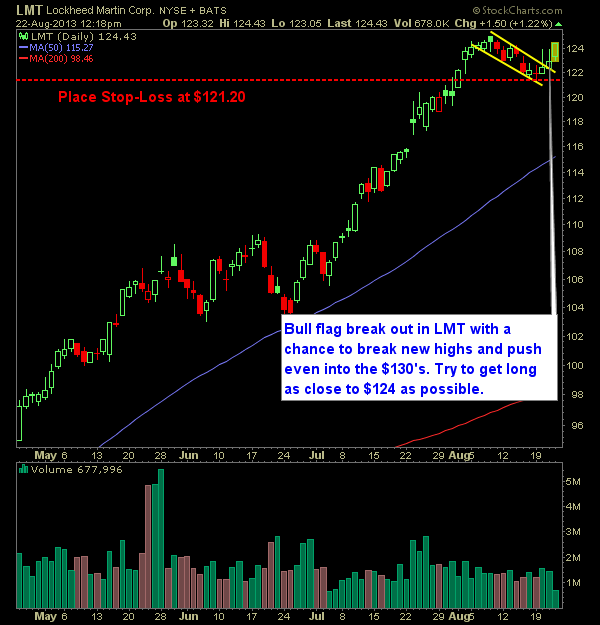

Today’s stock picks It looks to be another profitable month in the Splash Zone. Join me for the last quarter of 2017 by jumping in the Splash Zone and making some profits for yourself! Long Lockheed Martin (LMT)

Technical Outlook: A rare down day for the market – in the case of SPY, only its second in the past seven trading sessions. And as we have seen of late, the sell-offs are quite often mitigated by a huge swell of buying into the close that wipes out all of the day’s losses

I wouldn’t go as far to day that it is a head and shoulders pattern on Boeing (BA) because if it is, that left shoulder is pretty dilapidated, not to mention the right shoulder as well. But there is a clear line of support between $125.00 and $125.80 that if price can push through

Market finally got its bounce today, but it really isn’t that much to get excited about. Getting above the 50-day moving average is critical for this market as it has struggled to do so for the past three trading sessions prior to today. While today might finish in positive territory – what it does from