There are some pretty glaring divergences in this market right now (sound familiar?) I thought it would be interesting to show the difference in the charts right now between Apple, (AAPL) which is hitting new all-time highs and breaking out of consolidation today:

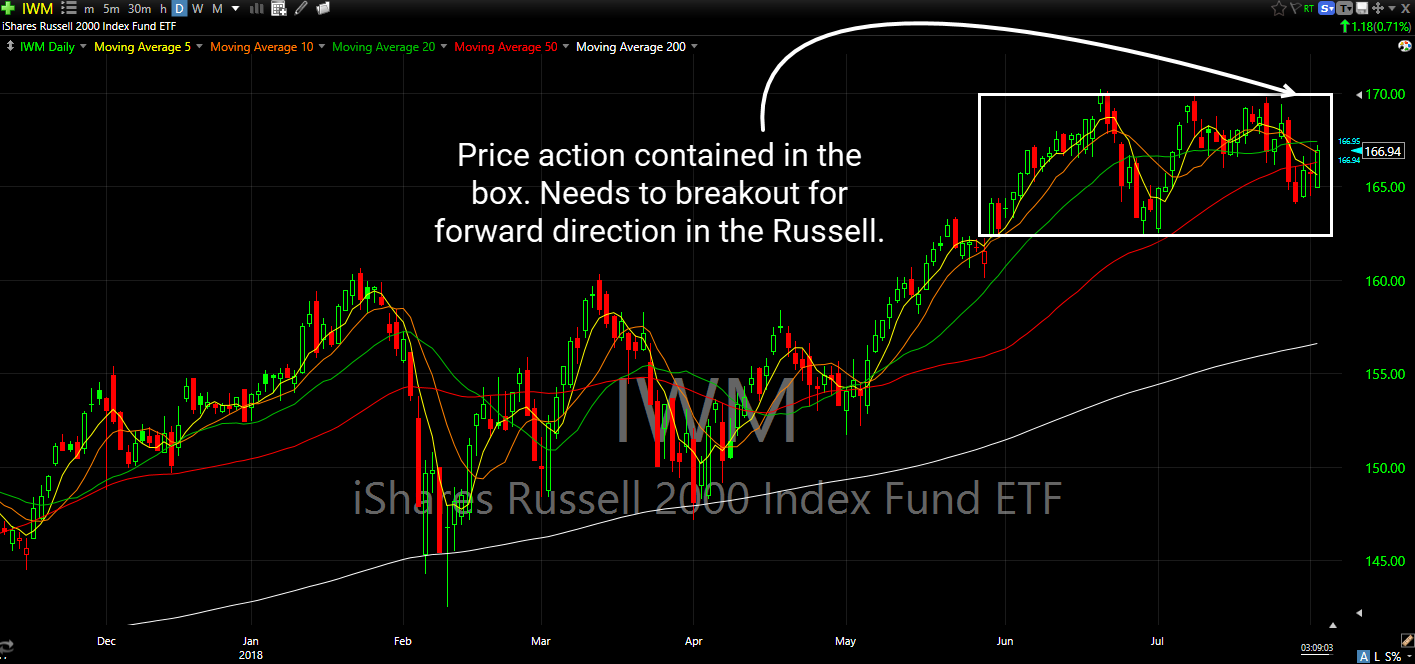

These market conditions continue to ugly themselves here. I don’t like it. Overall the NYSE Decliners holding a 16:13 edge so far today, which doesn’t bread confidence, and neither does the small caps trading 0.81% lower on the Russell.

Each of the indices are telling a different story, and they can shift quite regularly. But after the surprising, not-so-surprising bounce off the lows of the day, to rip the hearts right out of the bears, the markets are showing themselves to be willing to push higher – particularly the Nasdaq and S&P 500.

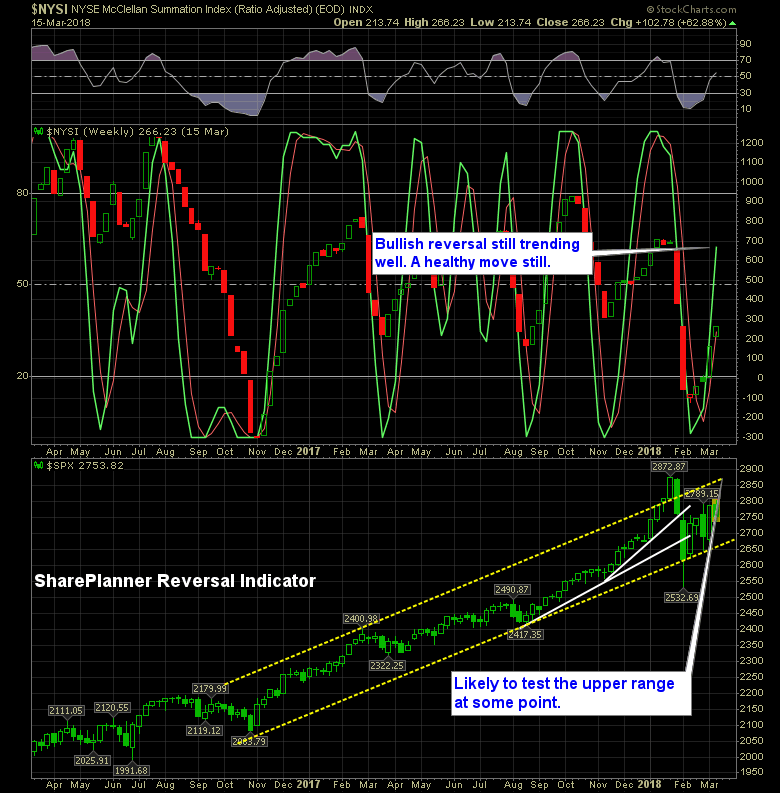

It has been a couple of weeks since we received the bullish reversal and it remains strong today. Price action this week has been less than desirable, to put it mildly, but that hasn’t affected the SharePlanner Reversal Indicator from trending bullish still.

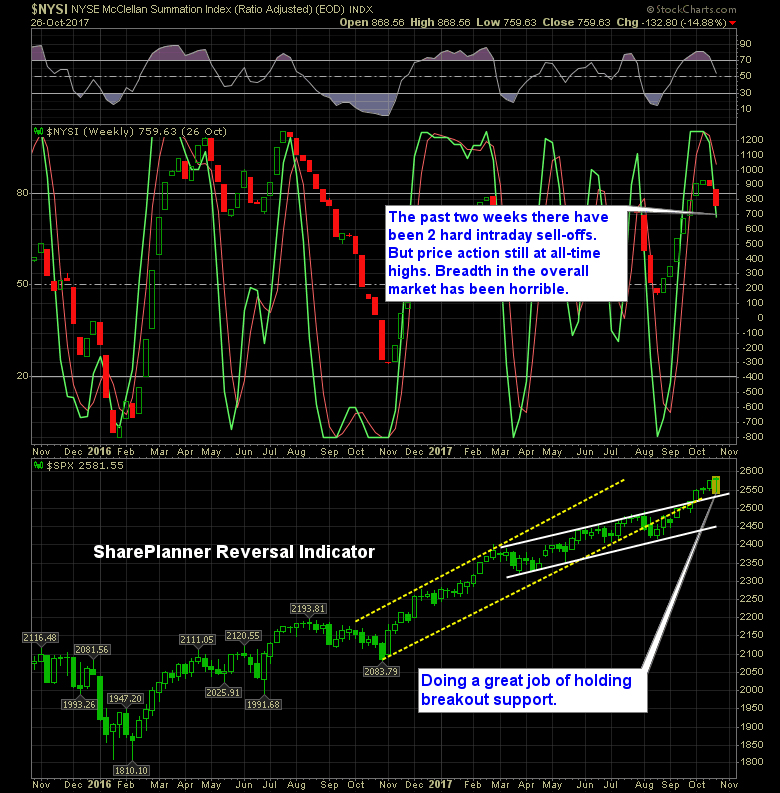

If you glance at the indices, you wouldn’t realize the market is actually fairing poorly today. Breadth is actually negative VIX is trading 3.5% higher The percentage of stocks trading above their 40-day moving average is declining. Technology is trading lower Small Caps are in the red

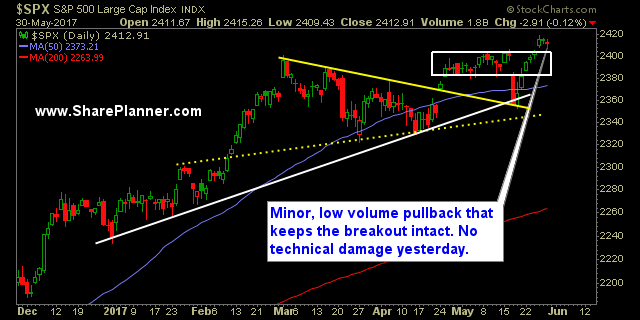

I barely remember the sell-off that ‘alledgedly’ happened yesterday. People say that there was one, but I can’t take their word for certain. The buy-the-dip crowd would never allow such a thing. Don’t believe me? Take a look at the charts below – nothing ever happened yesterday. S&P 500 (SPY) Dip Buy Nasdaq (QQQ) Dip Buy

Instead of “Sell in May”, it is “Snooze in May” But more to the extent that the market is simply lacking the participants for big moves. There has only been one move so far this month that was in excess of 1%. But really, this market has been extremely flat since March. Nonetheless though, we

One last thought about bitcoin Okay, I want to go this whole week without mentioning bitcoin, crap I just mentioned it and even titled this post after it, so lets go ahead and throw that idea out the window, because it was over before it ever got started.