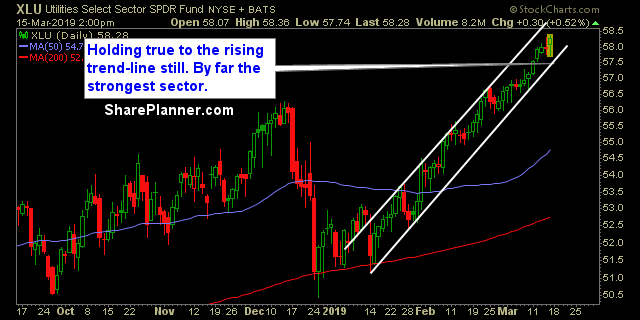

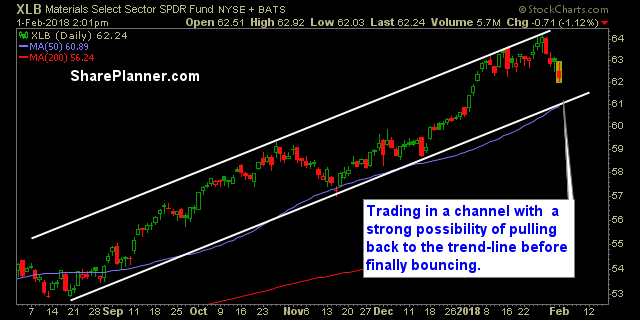

Resistance being tested in nearly every sector. Unless you are utilities, you have some resistance sitting just above your current price. Though overall, the market needs to break through it all at every level if it has any desire to keep this market rally going. The good thing is, that once it breaks, it should

Industrial sector continues to be one of the best sectors to trade in. That is namely because Boeing (BA) is soaring through the stratosphere and they are and remain the best stock in the industrial sector. The best time to be buying into it is on any test of the 10-day moving average as it has

My Swing Trading Approach I held off on adding any new positions yesterday in light of the upcoming Apple (AAPL) earnings. I’ll look to add 1-2 new positions today, should the market not fade the AAPL earnings. A break below 2801, will be reason to consider getting short on the market. Indicators

Beyond the technical analysis of the overall market, it is critically important to keep tabs on each sector, to know where the strength lies. For instance, had you invested in utilities over the past two months, you would be down royally, on your trade, while the rest of the market rallied. The same could be

My Swing Trading Approach For three days, the stock market has traded sideways. I have taken a more cautionary approach to the market during this time. I will look to add new long positions today, but only if the market cooperates. Indicators

My Swing Trading Approach I’ll be looking to add 1-2 new trade setups to the portfolio today. Right now, I am at 70% cash. I want to increase that some today. Indicators

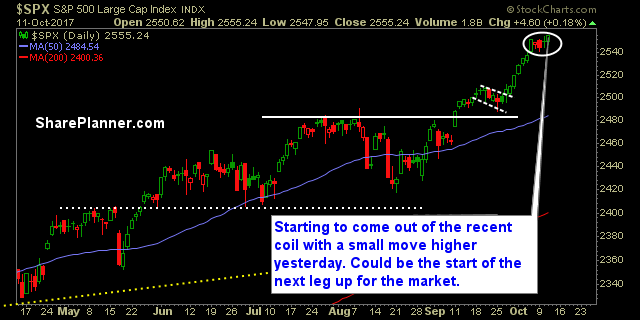

My Swing Trading Approach I’m nearing a point where I want to see price action move out of the recent price coil before getting any more aggressive on this market. As always, I’ll look for opportunities where appropriate, to book profits and move up stop-losses. Indicators

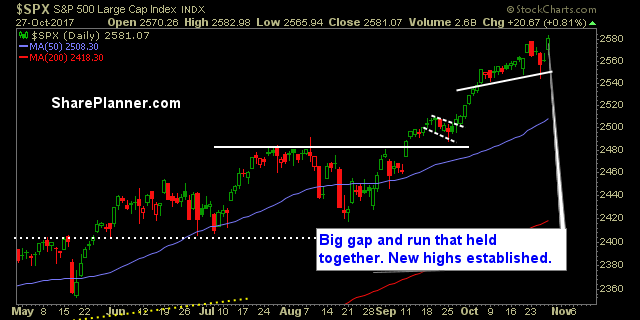

My Swing Trading Approach I won’t rule out adding additional position or two to the portfolio today, but I’m not looking to pile on in this market. Manage the trades that I have, trim the ones that don’t provide a solid reason to keep, and raise the stops on the rest. Indicators

My Swing Trading Approach Tighten the stop-loss on existing swing-trades, book gains on over-extended trades. Will limit how much additional long exposure I add to the portfolio today. Indicators

Technical Analysis: A sell-off yesterday that was hardly a sell-off for the S&P 500 (SPX). Price fell by 0.66 points or 0.03%. Essentially it was a day of sideways price action. SPX found support right at the 20-day moving average yesterday by forming an indecisive doji candle just above it. Volume fell off some yesterday