$BVSN Hourly Chart – Looking to open above 11 which is Fibonacci Level. If we have any kind of stremgth, watch this pop fast to 11.84 where it should ultimately fail, and drop back to 11 or lower.

$CIEN Weekly Chart – Watch for this stock to open under 17.11. I think it is a monster short under that Fibonacci level.

$DELL Daily Chart – gaping a little bit, but until it crosses 14.67 it got nothing, so if it tests that level and it fails, just short it.

$ERIC Weekly Chart – Trying to reach 13.22 but until it does, just short it on any pop.

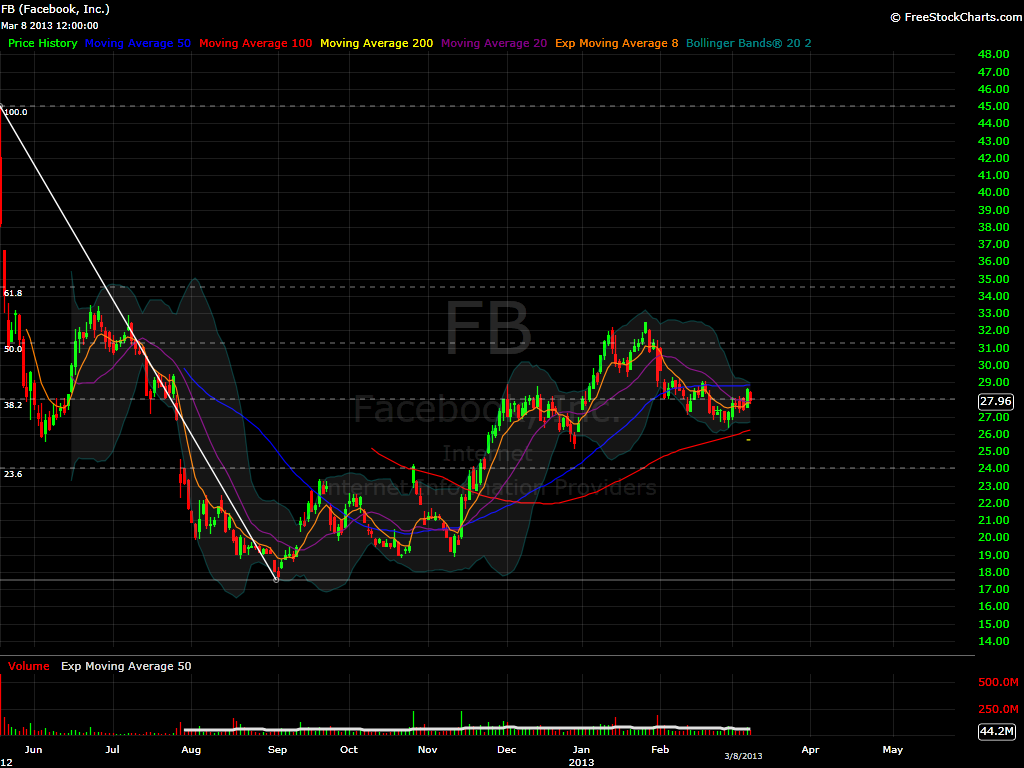

$FB Daily Chart – Any attemp it did to cross 28 the past week was a frustrating attempt of the bulls. This week I think the pattern will be the same. So under 28 just short it.

$HIMX Weekly Chart – Opening very strong, but until it breaks 5.05 this name got nothing.

$SQQQ 15 min Chart – this is a nice stock to scalp today. Probably going to do it’s best to break above the 33.98 Fibonacci Level, if it fails, it may be a good short opportunity where we can find new lows.

$VELT 15 Min ChartGood name to trade or scalp too. Above 3.34 is good entry with stop at 3.13. I suggest 1/3 to 1/2 position on this.

$ZNGA Daily Chart – I was not going to put this chart, but I do like it. Like $VELT if one can take a 1/3 to 1/2 position in it if it can cross 3.72 with a stop @ 3.45, then this has a good chance to surprise. Not as fast as a mover as it was before, but nice.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Passive investing can be a great source of funds for retirement and for building a nest egg. In this podcast episode, a husband and wife asks Ryan's thoughts on building a SPY position on just $2/day. While consistent building a nest egg, is great, the timing and strategy in doing so is just as important.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.