$ARCP Interesting gap, I would like to see it hold the 13.91 fib level before it takes off to new highs.

$BBRY If it can reach 13.71, that is where I want to see it pushing through. If it can’t take that level, then it will be a short to 12.30. Enough is enough.

$CIEN showing an open on the 16.83 fib level. If it can’t break that this time, it will be a nice short all the way down to 12.34. If it can break then the next target is around 20.50.

$ERIC nice momentum, the big challenge will be at the 13.22 where I think it will fail, and start the process of filling all the lower gaps all the way down to 11.39 and beyond.

$HIMX That pullback almost touched the 3.55 Fibonacci Level, I mentioned on my twitter yesterday, that it was a nice long, and what else can I say, it is popping 25% in pre-market. I am also looking to see it fail around the 5.06 level, where I think there is a short opportunity.

$JDSU Huge gap for this name, just under the 15.46 level, where I think it will fail and give all the gains back and re-test the 13.81 level.

$MLNX This is a tough setup, but I wanted to show you all since it can be a nice opportunity to learn about Fibonacci levels. The pre-market is showing a pop to 53.09. That sits almost in the middle between the 54.60 and 52.13 Fibonacci Levels. I personally think it will pop, drop and test the 52.13 level, it will then hold, and if it can close above that level, then one can have a better chance of a nice follow through in the upcoming days to touch the 54.50 level.

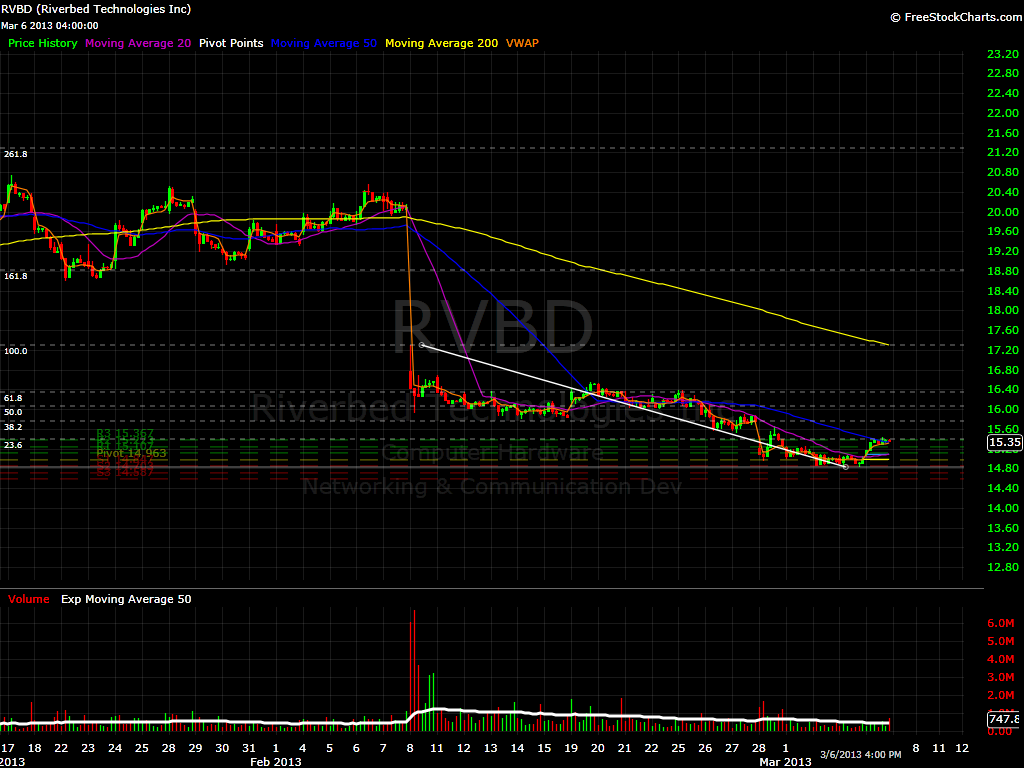

$RVBD I like this setup a lot. Th current launch pad is just above the 15.40 Fibonacci Level. So wait until it crosses, and maybe you will have a nice run to 15.77, may not sound like much now, but this one have enormous potential if one can apply some patience.

$SKUL is my favorite kind of setup, the one where I can scoop from the bottom up. Pre-market showing at 6.80, I would wait for it to pullback to 6.63, and then take it long if it can hold.

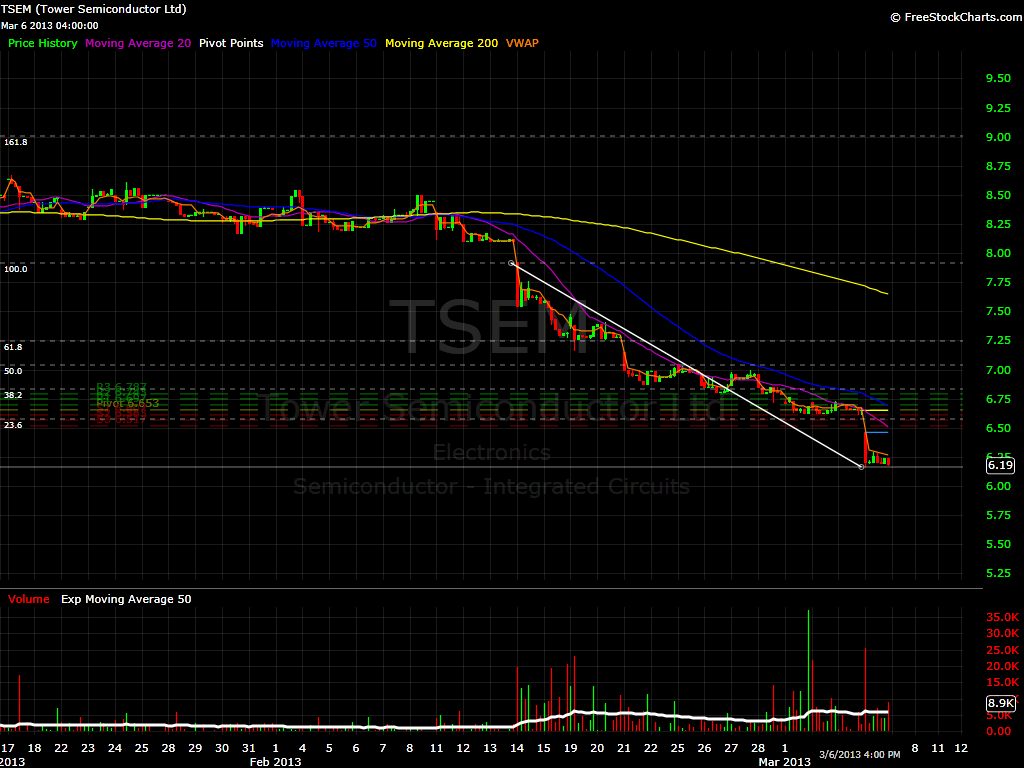

$TSEM very similar to $SKUL, but this one is a little bit more challenging. If one takes this kind of setup which will be great once it crosses the 6.58 fibonacci Level, I suggest a 1/3 to 1/2 position. Low volume and low priced stock, means that you have to be extra cautious.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Passive investing can be a great source of funds for retirement and for building a nest egg. In this podcast episode, a husband and wife asks Ryan's thoughts on building a SPY position on just $2/day. While consistent building a nest egg, is great, the timing and strategy in doing so is just as important.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.