$ACAD Weekly Chart – Sitting above the 7.03 Fibonacci level at pre-market. As long as it holds above that level it is a nice long. An idea would be to see the open, wait for the gap left behind to be filled, and once it crosses the 7.03 Fib level, one can go long with stop at 6.80.

$BBRY Daily Chart – Held the 16 dollar mark yesterday. As long as it doesn’t pullback to the 15.52 which represents the 50% Fibonacci level, it should be good for a run up to 17.72.

$DELL Daily Chart – I am curious to see what happens to the stock when it reaches the 61.8% Fibonacci level. I think it pullsback.

$GILD 15 Min Chart – I think that above 44.77 it goes.

$LULU 15 Min Chart – Gaping crazy high above 2 Fibonacci levels at once. The 38.2% and the 50%. On pre-market it is at 64.80. The 50% Fibonacci level is at 64.70. I think that under this level it is a short with a target of 64.06.

$NUAN Hourly Chart – I had to be modest drawing the study on this chart. I think this is a great setup, eventhough the next Fibonacci Levele of 61.8% is so close. I actually think that if it crosses the 19.83 level, it will go much higher. This is a chart that you may see myself changing it during the day if it really works so it reflects it’s overall target. But for now this is what it looks like.

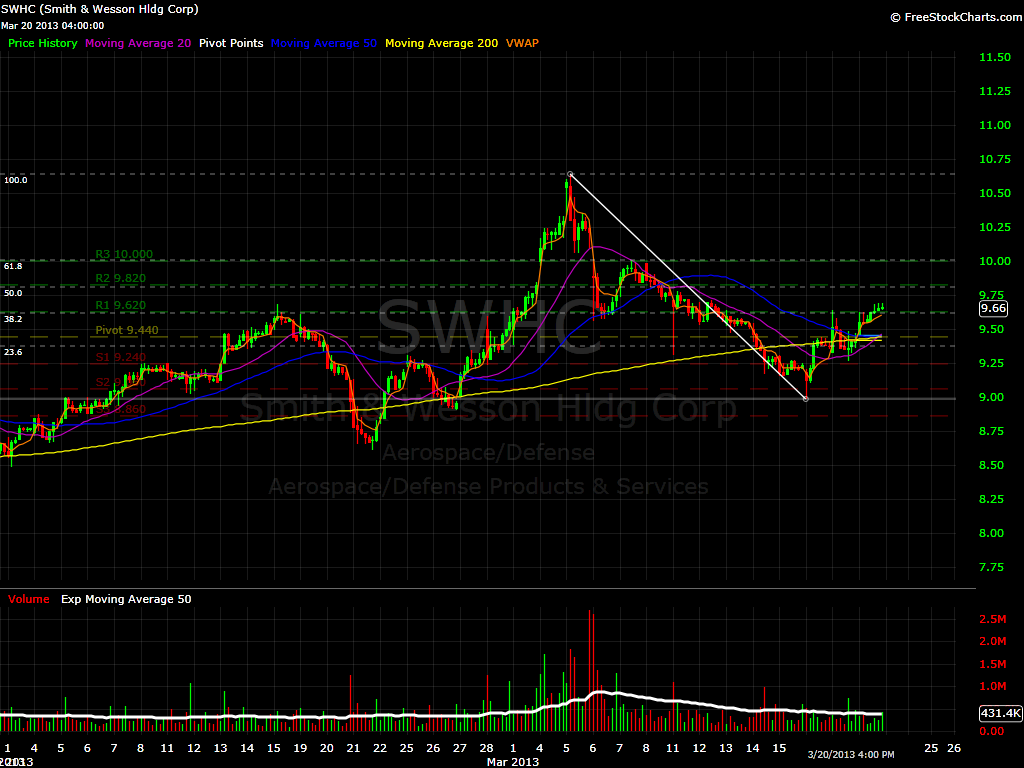

$SWHC Hourly Chart – Not my favorite kind of chart. I think that it will reach 9.81 and it will pull back. Smith and Wesson don’t just move higher without pull backs.

$TSLA 15 Min chart – 36 is the launch pad. Over that, and it goes.

$YHOO Daily chart. This stock is refusing to drop. The gap is not as strong. I think it will re-test that 21.50 level soon, and then it will be a nice short opportunity if it can’t hold that level.

$ZNGA Same thing as $YHOO, trying hard but will fail as usual. That 3.10 price which represents the 23.6% Fibonacci level is just around the corner. For this one to be a good long, from here it would have to cross the 3.73 price.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Passive investing can be a great source of funds for retirement and for building a nest egg. In this podcast episode, a husband and wife asks Ryan's thoughts on building a SPY position on just $2/day. While consistent building a nest egg, is great, the timing and strategy in doing so is just as important.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.