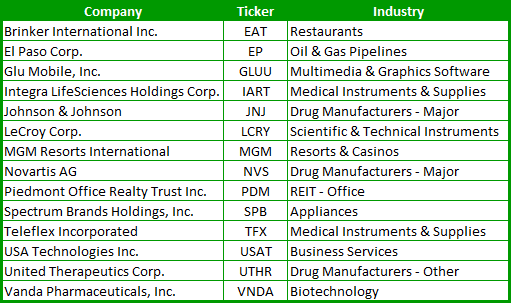

Its time for the weekly momentum gainers that you need to be keeping a close eye on. This week, there are about 14 stocks that have some intriguing appeal to them. One that is setting up nicely is Johnson & Johnson (JNJ), which bounced nicely off of its March lows, and looks to breakout

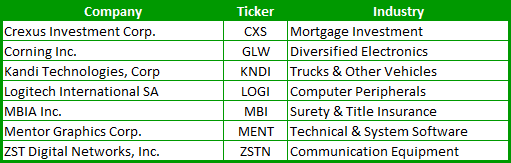

Here’s a new screen that I’m rolling out today, and it involves a mixture of high-risk knife catching setups with out-sized reward setups, should the stock bounce as their internal indicators are starting to suggest. These stocks have taken a royal beaten of late, and while the trend could very well continue down in the

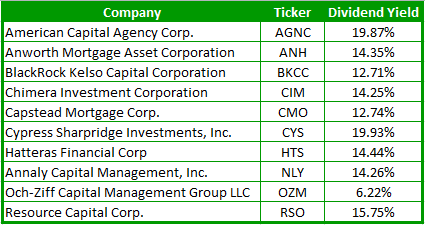

You’ll find that the stocks below are sporting some pretty nice dividends, but don’t just dive into one of the stocks listed below without doing first the necessary due diligence required. With the huge jump in prices across the market since last September, a lot of dividends have been diluted due to price appreciation, so

This is by far, one of my favorite stock screens that I run. I have probably found more winning stocks (and big % ones at that) off of this screen, than any other one that I run. These stocks make it a habit to trade on their own merits and not that of the market itself.

The stocks below are showing signs of, or already in the process of, breaking down as the smart money appears to be leaving them in a subtle manner. There are stocks trading at its peak and finally showing some vulnerability, while on the other extreme, there are stocks that have been in a channel near

Its time for the weekly momentum gainers that you need to be keeping a close eye on. This week, there are about 25 stocks that some intriguing appeal to them. The one I like best is probably Hecla Mining (HL). If it can breat $9.53, we could see a very nice move out of this

The screen below are for those stocks that have primarily been on a solid uptrend of late, but are starting to show signs of breaking down along with a loss of interest by the street as a whole. So if you are looking to short this recent market rally, use the list below as bit

Here is my list of top defensive plays going into April. If you’re looking for some nice defensive stocks to go along with the rest of your long positions in the portfolio, then take a look at the list of stocks below that are more defensive than growth oriented. They are stocks that shouldn’t see

The stocks below are showing signs of, or already in the process of, breaking down as the smart money appears to be leaving them in a subtle manner. There are stocks trading at its peak and finally showing some vulnerability, while on the other extreme, there are stocks that have been in a channel near

It’s just another day where the market appears impervious to weakness, and with that said, the market seems to have all but forgotten what is going on in Libya as well as Japan and looks ready to challenge recent highs the market put in back in February. This is similar to its sister-screen that I