We’ve made a nice recovery off of the lows of the – a very nice one actually as we bounced off of the 38.2% Fibonacci retracement level at 1342 on the S&P. Below are this week’s stocks that are gaining momentum. There are only four of them this time in my screen results due to

The stocks below are showing signs of, or already in the process of, breaking down as the smart money appears to be leaving them in a subtle manner. There are stocks trading at its peak and finally showing some vulnerability, while on the other extreme, there are stocks that have been in a channel near

Here is my list of top defensive plays going into April. If you’re looking for some nice defensive stocks to go along with the rest of your long positions in the portfolio, then take a look at the list of stocks below that are more defensive than growth oriented. They are stocks that shouldn’t see

It’s time for the weekly momentum gainers that you need to be keeping a close eye on. In particular, I would watch Microsoft (MSFT) which is putting in a nice double-bottom, and at current prices makes for an appealing trade with the opportunity to see it move as high as $28.00. I also like

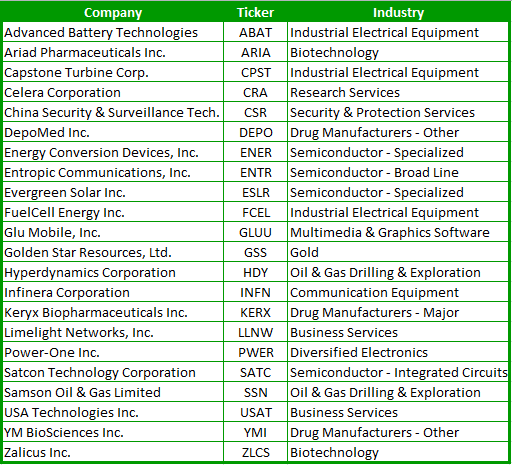

Below is a list of small-cap stocks that have been heavily shorted by the street, and should the market continue to rally, these stocks could see their share price launch into the stratosphere (if they haven’t begun so already) because of the bears being forced to cover their short positions in the stock. Based on

Unlike any of my other screens, this stock screen focuses on stocks trading under $10/share, and have a market cap of around $1 billion or less. As for the variables that I used in the screen, I focused on fundamentals, particularly companies that have a healthy balance sheet with little debt to speak of, with

The stocks below are showing signs of, or already in the process of, breaking down as the smart money appears to be leaving them in a subtle manner. There are stocks trading at its peak and finally showing some vulnerability, while on the other extreme, there are stocks that have been in a channel near

It’s time for the weekly momentum gainers that you need to be keeping a close eye on. This week, there are 15 stocks that have some intriguing appeal to them. Last week’s recommendation was JNJ which is up $2 from where I spoke of it at. This week, keep an eye on Manpower Inc.

Here’s one of your more traditional “Buffett-like” stock screens where I am essentially looking for companies selling well below their book value. The stocks below represent six companies that are trading at less than half its book value. CDC Corp (CHINA) has finally broken its one year downtrend, and is holding up very well against

The screen below are for those stocks that have primarily been on a solid uptrend of late, but are starting to show signs of breaking down along with a loss of interest by the street as a whole. So if you are looking to short this recent market rally, use the list below as bit