Even Fear/Greed Index hovering around extreme readings.

The last four times we've come out of an inverted yield curve and start to steepen, the US economy went into a recession.

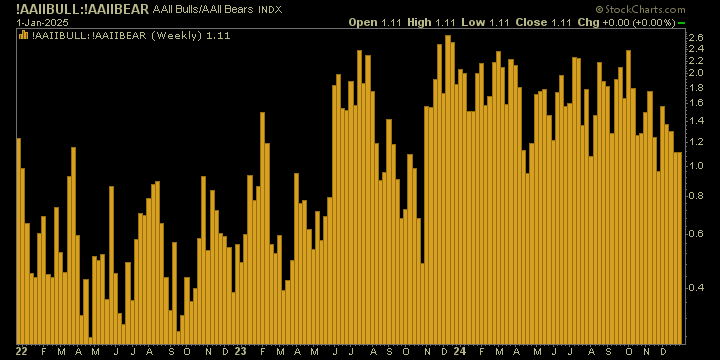

Retail Bulls at their lowest levels since early November.

There might be some truth to this wacky long-term support level for Bitcoin - because so far it has yet to break.

Doesn't get much worse than these readings. Getting short here is a high risk setup.

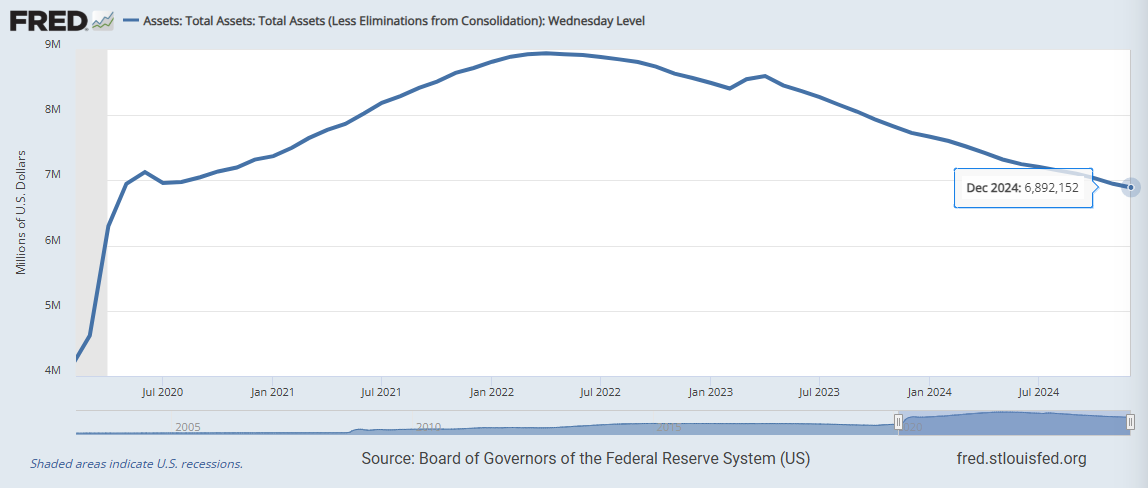

Fed Balance sheet dropped another 55 billion in the month of December. For the year, they reduced the balance sheet by 838B. Still a long way to go to get to pre-Covid levels.

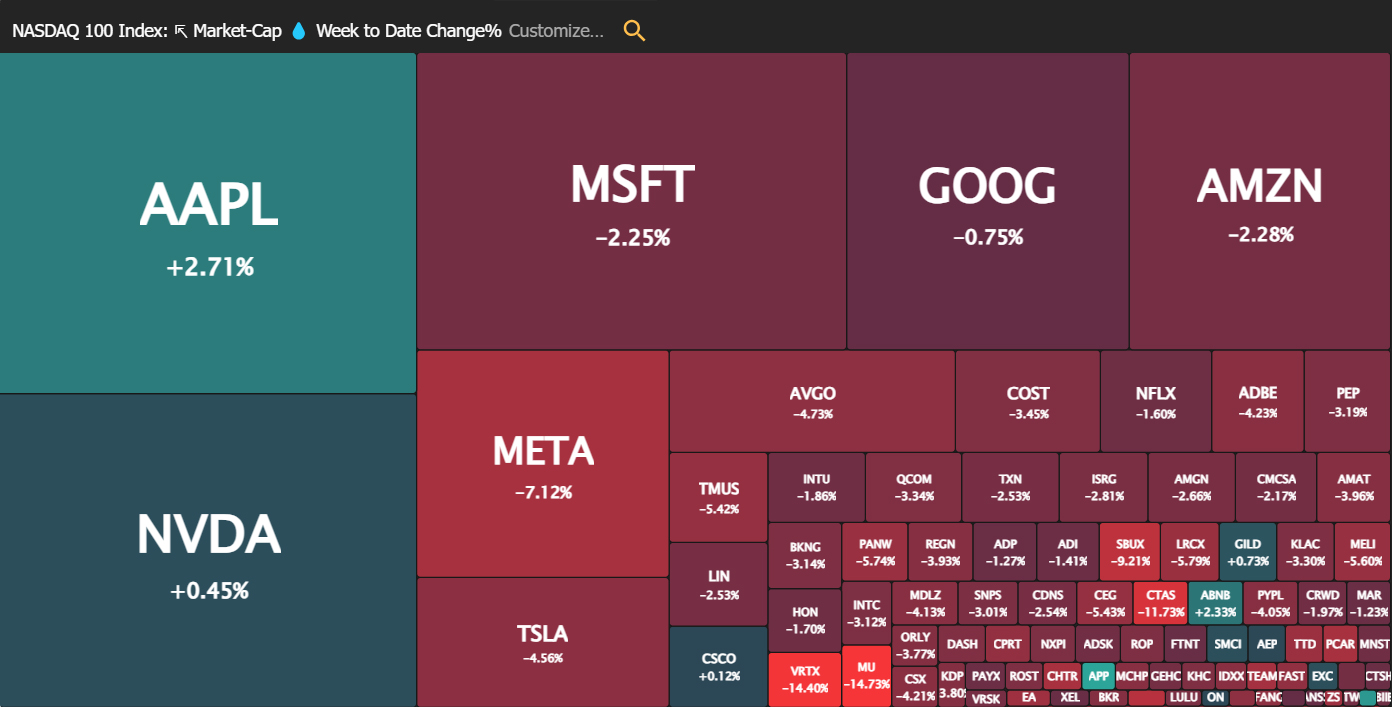

This market really had no choice but to bounce. It was way over done on the "everything else stocks".

Nasdaq heat map went scorch earth!