Some divergence maybe starting to show up on the T2108. Not a bear flag as it is only an indicator between 0-100.

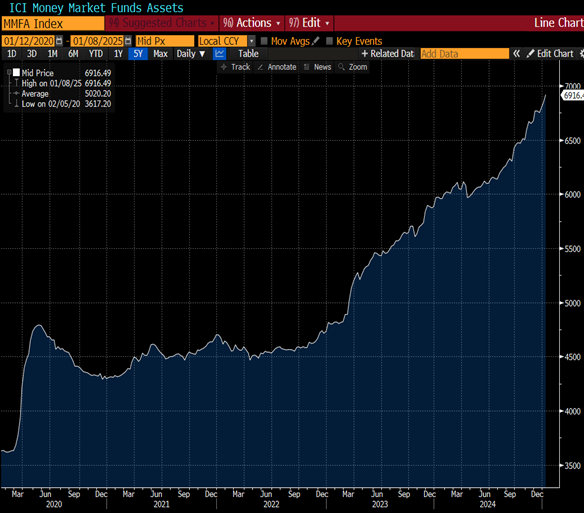

Investors showing they want little to do with stocks right now.

Despite a 100 basis points in cuts by the Fed, mortgage rates continue to push higher.

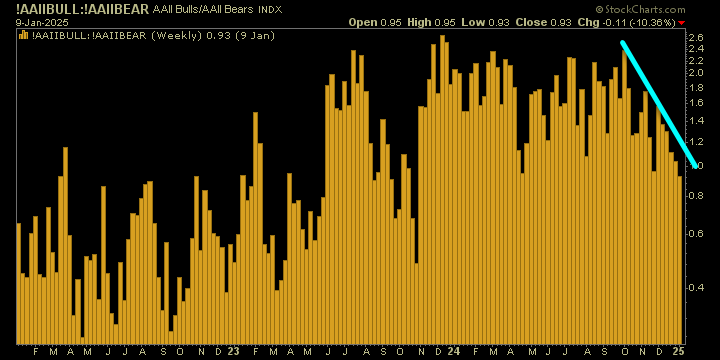

Bullishness among retail dropping for a fifth straight week.

T2108 still remains well overbought but indices yet to see a meaningful bounce.

The 5-month moving average on SPY is resilient.

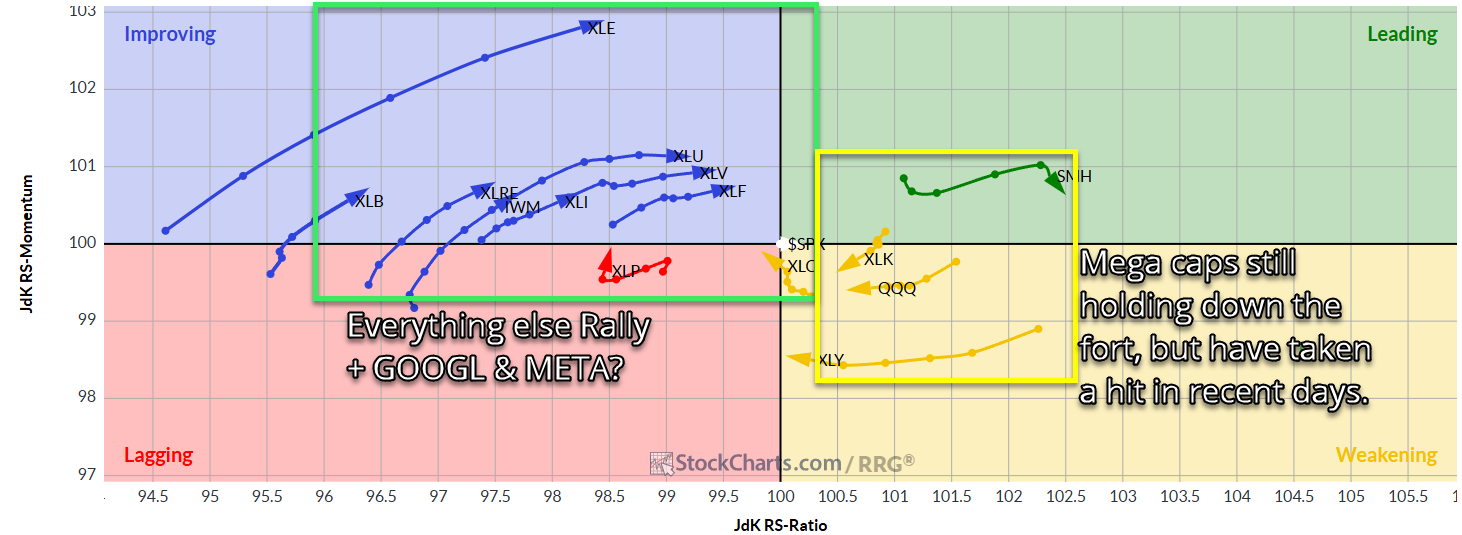

SPY continue to march in lockstep with the Mega caps.

Fed just won't let off the gas peddle!

Notable spread between SPY (market cap weighted) and RSP (equal weighting).