SPY doing absolutely nothing today!

Only 13% of stocks trading 2 standard deviations above their 40-day moving average. For being so close to all-time highs, should see readings around closer to 25-30%

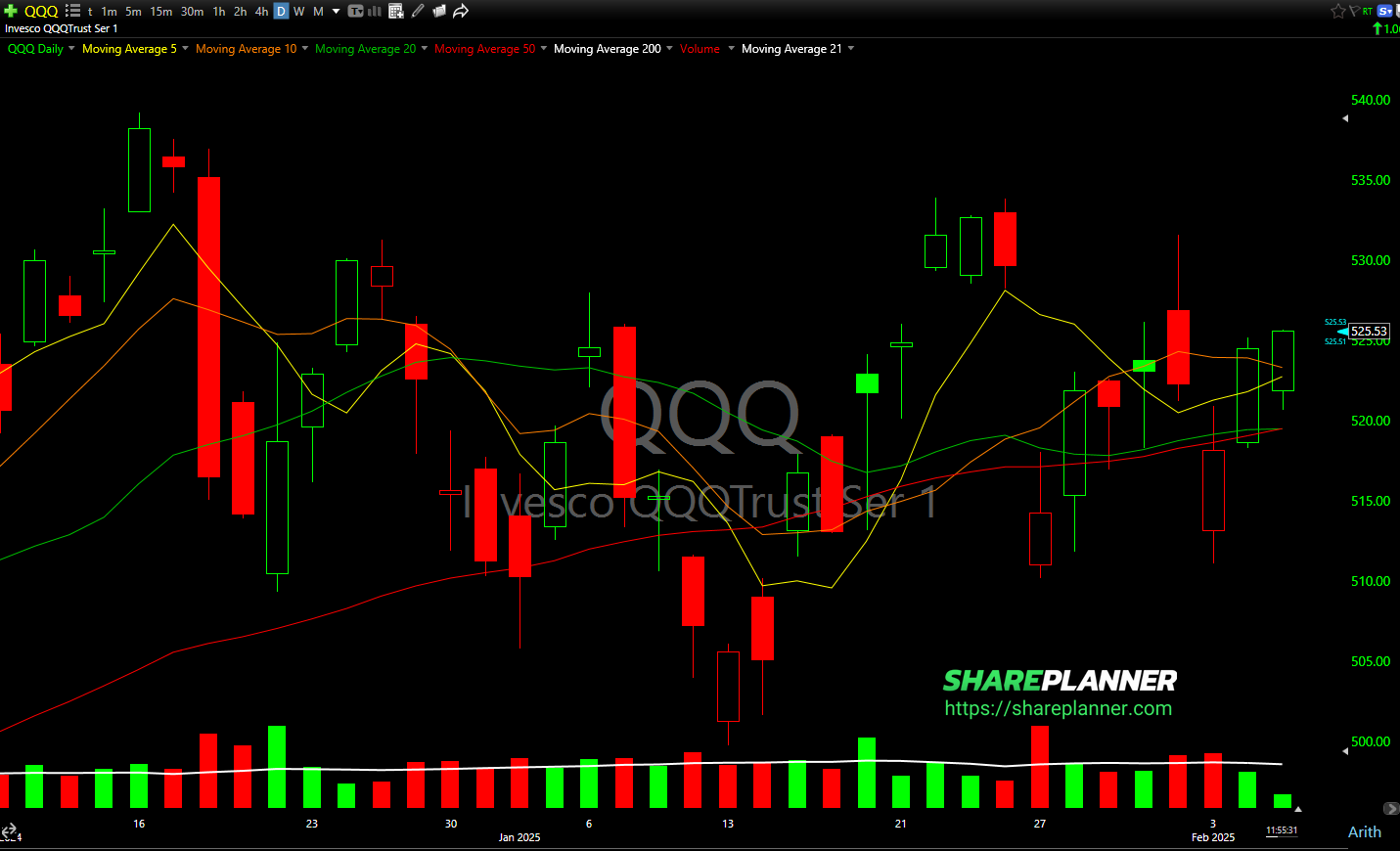

QQQ over the past 1.5 months is incredibly choppy. Day-to-day price action means very little until this chop fest (i.e. distribution) ends.

SPY Just won't stop chopping.

PLTR is up 530% over the last past and another 23% today alone! Tech bubble is getting more exaggerated.

Investors still bullish, but lower from the reading a couple of weeks ago.

Some bounce out of T2108 from its lows on the day. Still, only 40% of stocks trading above their 40 day moving average, after hitting 54% last Thursday.

The market chop over the last 2 months has really kept a lot of stocks from getting much separation from their MA's, despite trading at all-time highs earlier today. Only 10% are trading more than 2 standard deviations above their 40-day MA.

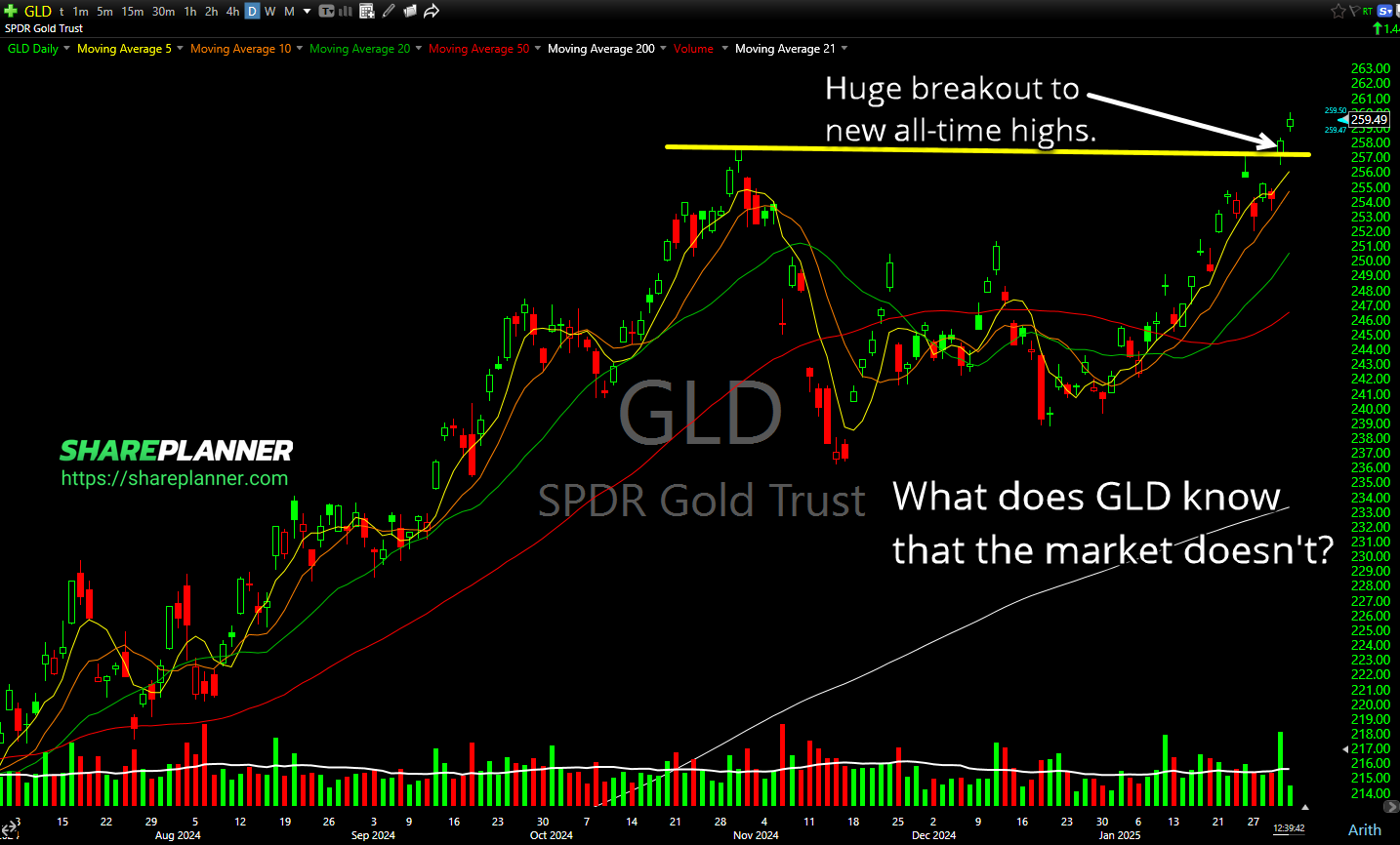

GLD breaking out to new all-time highs!

The % of stocks trading above their 40-day moving average.