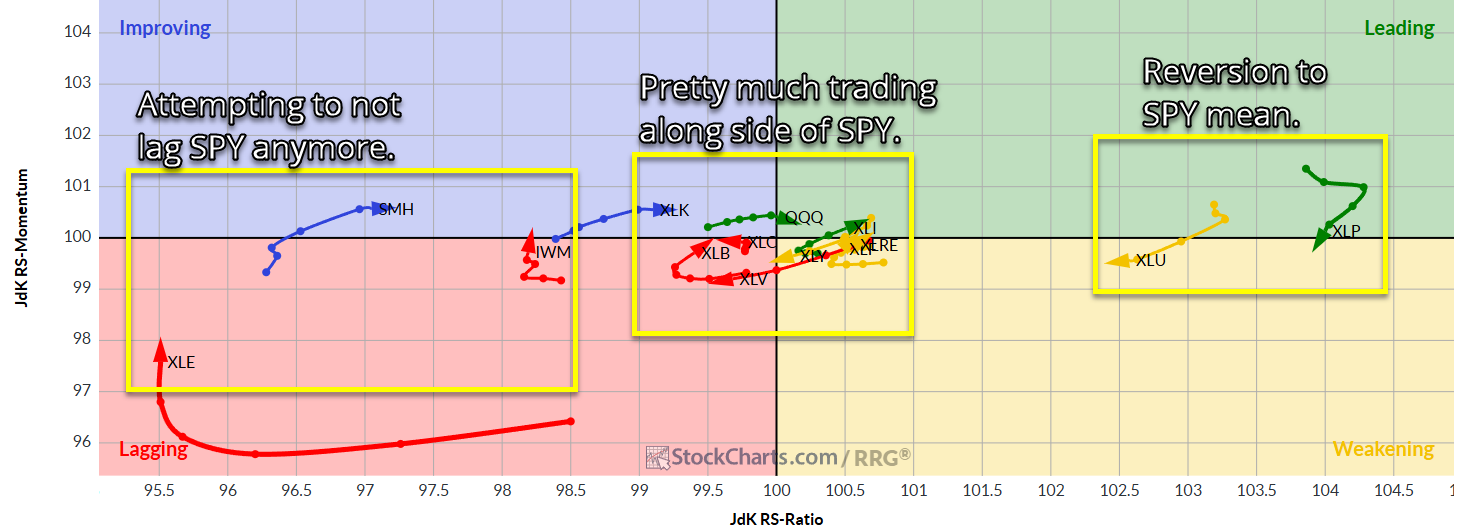

FOMO starting to bring back semis and tech into market leadership.

For 2.5 years now, the market simply can't get mortgage rates to go down. Big pop last week.

Retail sentiment is deteriorating as the mood has fallen in 3 of the last 4 weeks, while equities are trending higher.

Energy showing some life, perhaps new leadership from Real Estate?

Heaviest short interest, by a long shot, in the last six years.

Hardly any negative ticks, which is very unusual. Look at the other days - much broader range.

Bear Flag setting up well here intraday for further downside off the highs of the day.

Huge bounce today on this indicator, though it has given up about 2/3's of those gains.

Everything moving towards SPY's day-to-day movements.

There's zero reason to be lowering interest rates here. It'll only spike inflation again.