Choppy trading session as the bulls nor the bears are holding on to any king trading edge here. This is in large part due to the suspense that the Brexit vote has the market in. Odds seem to point at them staying, however polls today show the “leave” vote evening up the score. Where do

Retail is dead if you aren’t Walmart (WMT) or Amazon (AMZN) but a chart pattern is a chart pattern and what you have on Tiffany (TIF) is a gorgeous triple bottom with just the right amount of sparkle to it. The $60 level seems to have insane amounts of support there, because every

Rare do you find such an unenthusiastic rally, but that is what we have here today. The bulls goosed the markets overnight to ungodly pre-market highs, but since the initial burst at the open, it has done nothing but put in lower-highs and lower-lows on the five minute chart. There is a part of me

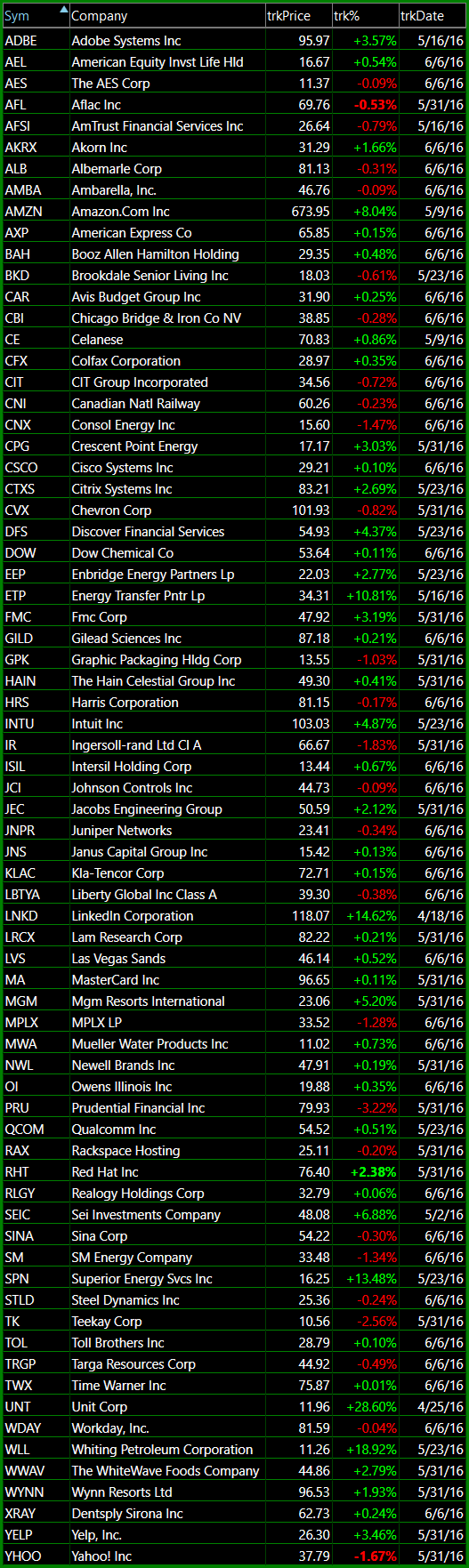

I’m not short anything yet. Instead, what I am waiting for is the market to give us a bounce that alleviates some of the selling pressures seen over the last four days of trading and set up the stocks listed below, in the most minted kind of way. I say that, but of course the

Early on this morning, the market acted like it may want to bounce off of support in the 2087-2102 range on SPX. That is in doubt at this point as the market quickly erased the morning bounce off of the lows from this morning. It is hard to say where this market truly wants

The S&P 500 has hardly had a down day, and its cousin Russell wouldn’t know one if you slapped him across the face with it. But take its tech-savvy brother, Nasdaq, and you have someone lost in his ways. While the market keeps scorching higher (okay, “scorching” may be an exaggeration), the Nasdaq has

Retail sucks, Nike blows, and if you aren’t Amazon (AMZN) you don’t have a leg to stand on. Except for lululemon (LULU).

At this point, the bearish case doesn’t have many proponents supporting it. For me, I just go where the price takes me and right now, it isn’t taking me lower, as a result, I am trading long. Today is fairly significant for the bullsA if it can hold the current price gains into the close

Here’s four dead cat bounces that I am watching closely if this market rally ends up failing. That doesn’t mean I am saying it will fail, that is me saying “IF” it fails. I have none of these as shorts, and am only looking to add them if the market conditions start showing signs

So far today, I am not adding any new positions to the portfolio. I am at a point here with this market, where I’m not willing to add any additional exposure to the portfolio (currently 30% long and 70% cash) from a long standpoint, until this 2111 on SPX is cleared. It is simply