Let’s just say that the Russell index does not like to put forward a good challenge to the 50-week moving average and this week has been no different. After testing the 50-week moving average last week for the first time since early December of last year, the Russell index tested it this week too. And

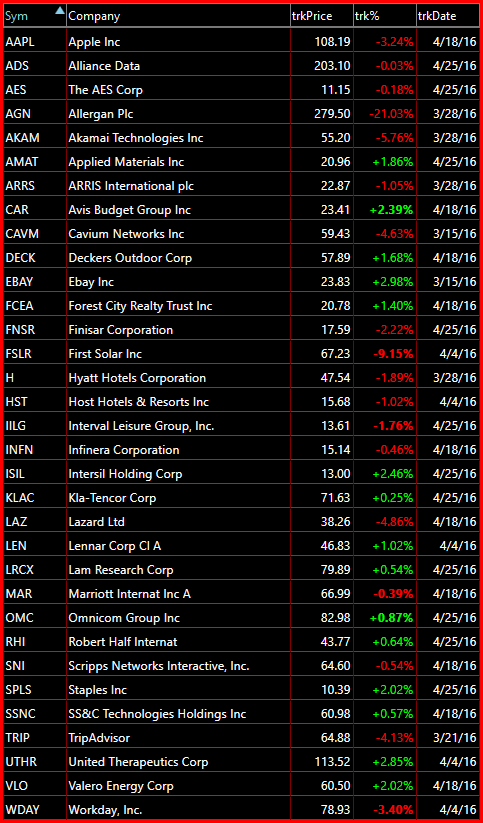

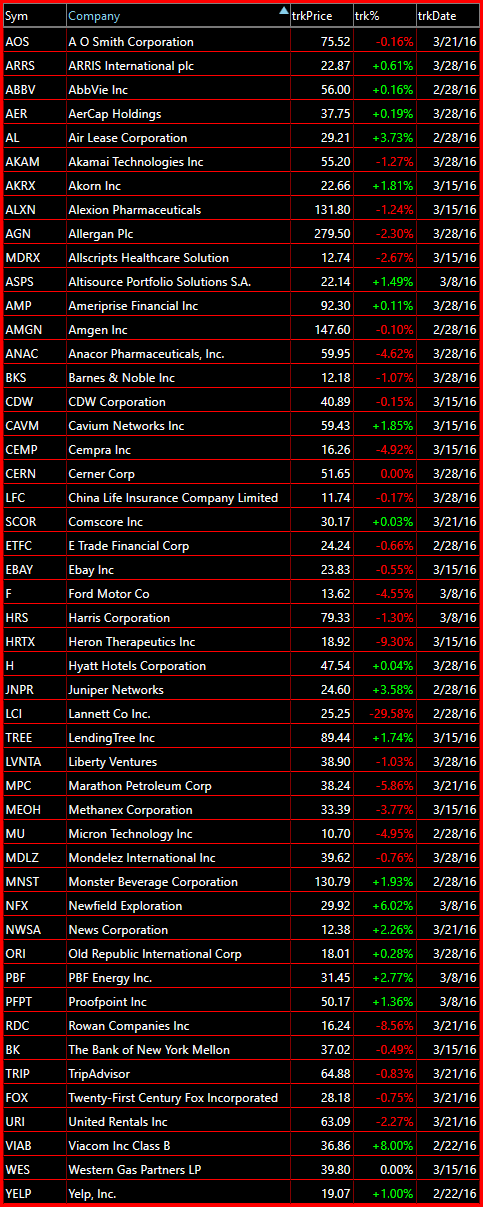

This list is dwindling by the day, down to just 33 names that are showing desirable short setups. That is because from even an intraday standpoint, you cannot get a sell-off to stick. That doesn’t mean the market is still rallying higher right now, it just means, that the bulls can not come off its

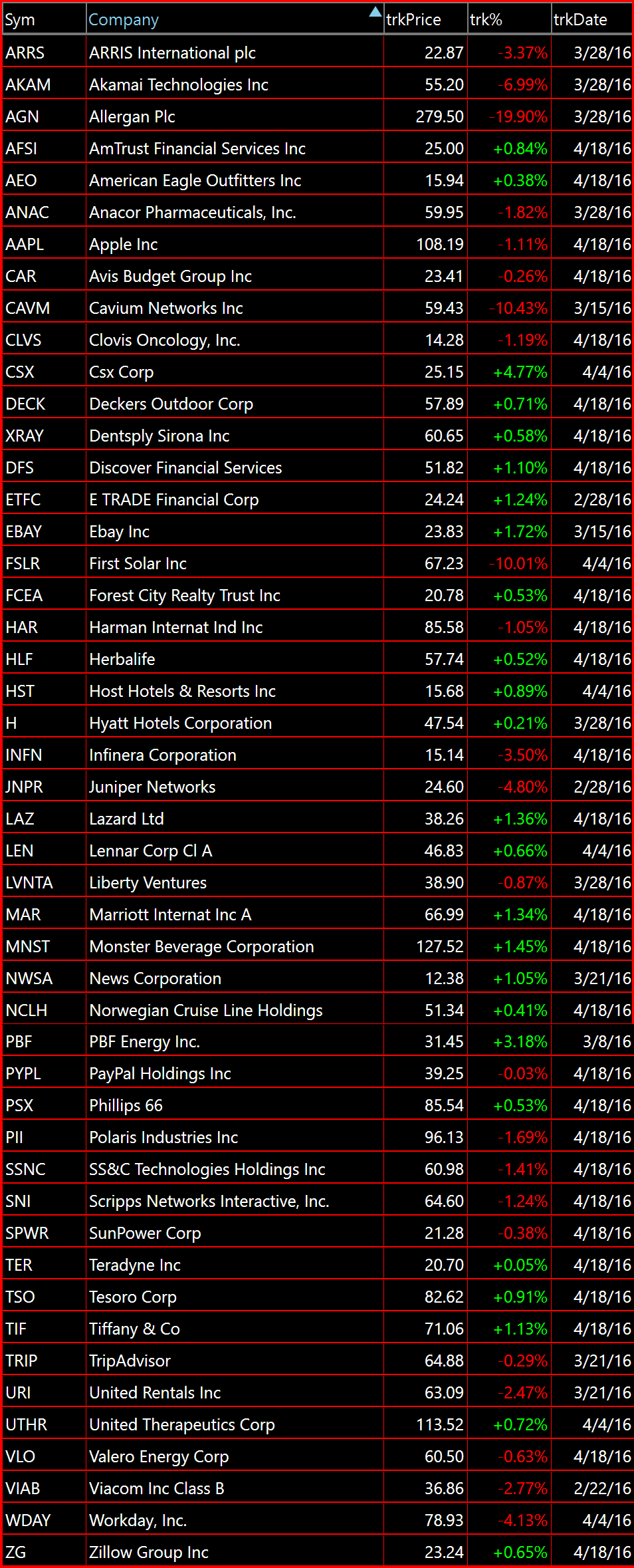

Careful with getting too heavy on the long side early on this week. There was some patches of selling late last week and it is bleeding into this week here to start things. Not to mention, oil is struggling at its rally highs here and looks ready for a pullback. Below is the long list

Just think… just a little over two months ago, SPX was down almost 12% year-to-date with what appeared to be no end in sight. Since then, the market has been on an unabated rally that has erased all of those losses that the market was experiencing.

It took a grand total of five minutes for the market to overcome a five percent drop in the price of oil and ultimately push the indices back into the green, erasing all the hopes and dreams that the bears came into the week with. So far today, the gains the market is experiencing looks

Two days in a row where the SPX is selling off, and today, if the weakness can hold, would be the biggest sell-off since March 8th. Some selling would definitely be in order here and continued selling today will be flashing sell signals across a lot of indicators. So saddle up, if we are putting

Yup, the sellers are showing early control of the market to start this week, but let’s be honest with ourselves, have they really showed any conviction to the downside? Any momentum worth mentioning? No. In fact, I wouldn’t be surprised if the bulls try to stage another rally in the last hour just to get

USO chart so far is really interesting to me. Yes, it has lost all of its short-term moving averages that include the 5-day, 10-day and 20-day, but overall, the pullback that has, until today, lasted six straight days and seven of the last eight days, has only given up 38.2% of its recent gains, which

The chart is beautiful, and there is little resistance overhead. I’ve already added one new swing trade to the portfolio today and I like my positions and long exposure where they current are. As a result, I don’t want to add any new long positions to my portfolio right now.

Let’s face it, the Central Bank Bubble is still on the up and up. Yes, it was off to a rocky start this year, and last year, well, last year was a total bore. But the the Fed, ECB, BOJ, and PBOC are clearly doubling down on their desire to keep the rally from 2009