The bulls started off strong on the week, but the bears quickly faded the gap – nonetheless, there are trading opportunities out there and plenty of them at that. With this week being window dressing for the funds and considering how strong the first half of the year has been, I’ll be surprised if the

No longer smart money, it is the fast money that is dip buying. It is impossible to get a sell-off to last more than just one day. Though today might be a bit different as far as that is concerned.

Similar price action to yesterday. I think there is a good chance that we see more of the same kind of sideways to slightly bearish trading action. Of course on Thursday you have the James Comey testimony, and I’ll refrain from calling it a big “nothingburger” because I refuse to say something just because that

Russia Week for the Stock Market + Trade Setups The bulls are not starting the week off with a bang, but then again neither are the bears. The market is trading sideways, which isn’t all that surprising, and could see that continuing into Thursday when Comey testifies. Unless James Comey drops a massive bombshell (which

Can the bears make something of this market… finally? I have been very quiet on the trading front today. I didn’t buy the dip, and so far it looks like that was the right play to make.

If you haven’t noticed today, the volume on Wall Street is quite weak. I suspect that will continue throughout the week. It doesn’t mean that there can’t be a significant move that is made. Trust me, headline risk can really get things going especially in low volume markets where the big players might not

How many times have I wrote a post that includes the phrase “The bears blew another opportunity”? Except for a handful of occasions, over the past 8 years and more specifically, over the past year, sell-offs tend to be nothing more than a blip on the radar. You have to take them serious, but it

Risk On Attitude has Created a No-Fear Market Trading Atmosphere Intraday sell-offs aren’t even being taken serious by traders any more. Before the market can drop five points on SPX, mentions of BTFD and “Buy the ‘you-know-what’ dip” begins to permeate throughout financial social media. You want to know why the VIX is

The bulls are trying to make a solid rally of it today. With a move back over 2400 in the wake of more saber-rattling out of North Korea and one of the biggest cyber attacks ever, the market, nonetheless is holding its own and looking at a move yet again at the all-time highs. This

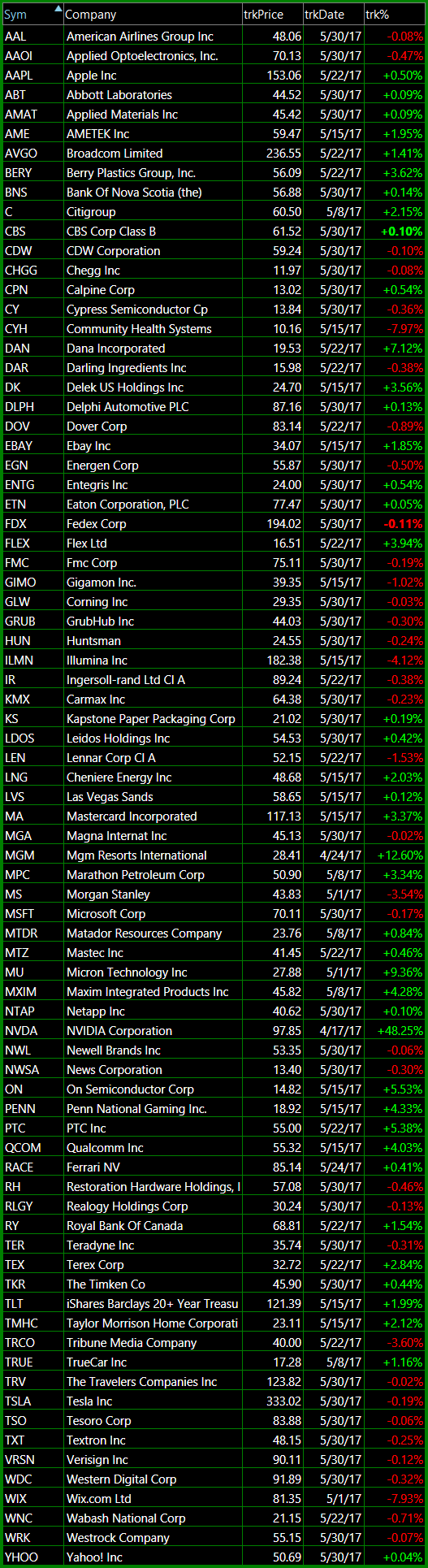

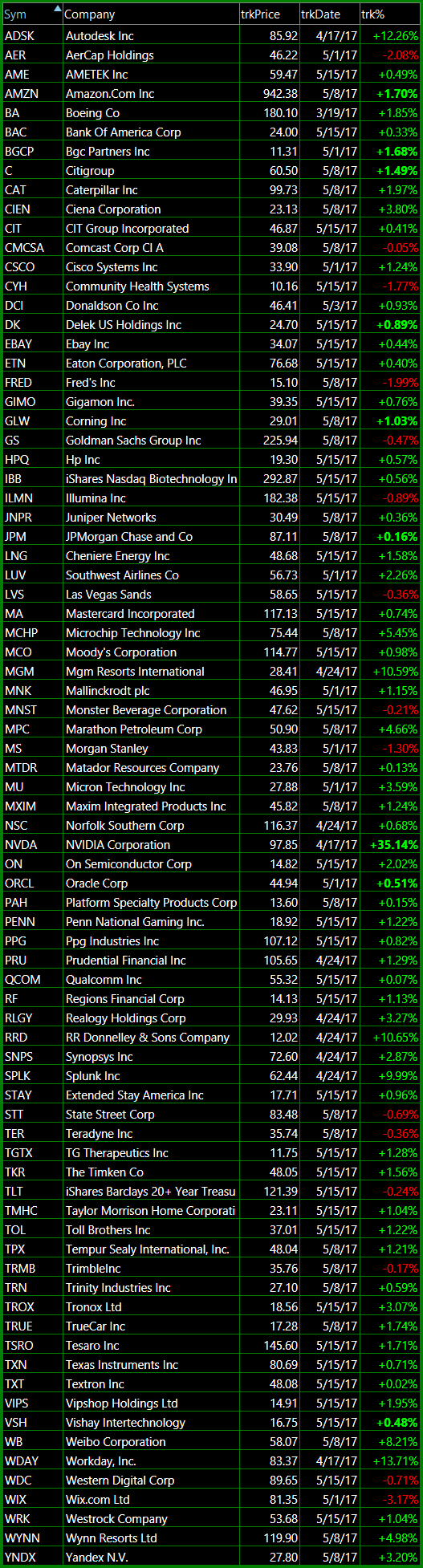

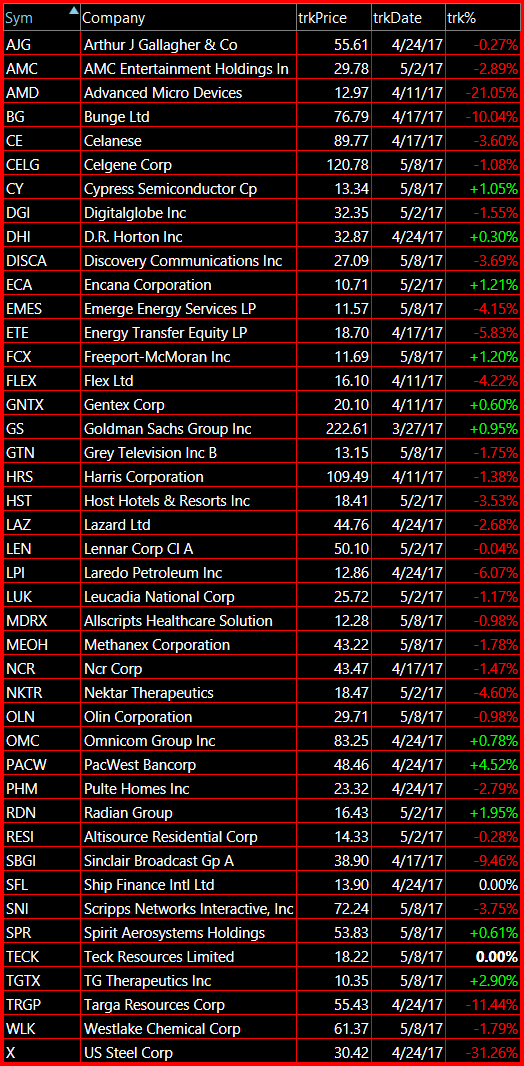

Bearish Trade setups – to watch, for now. The bears, or what’s left of them, are really struggling to make sense of this market. I do too, at times, but that doesn’t mean I go shorting it. There will be a time for that, and when that time is, nobody knows. For now, you have