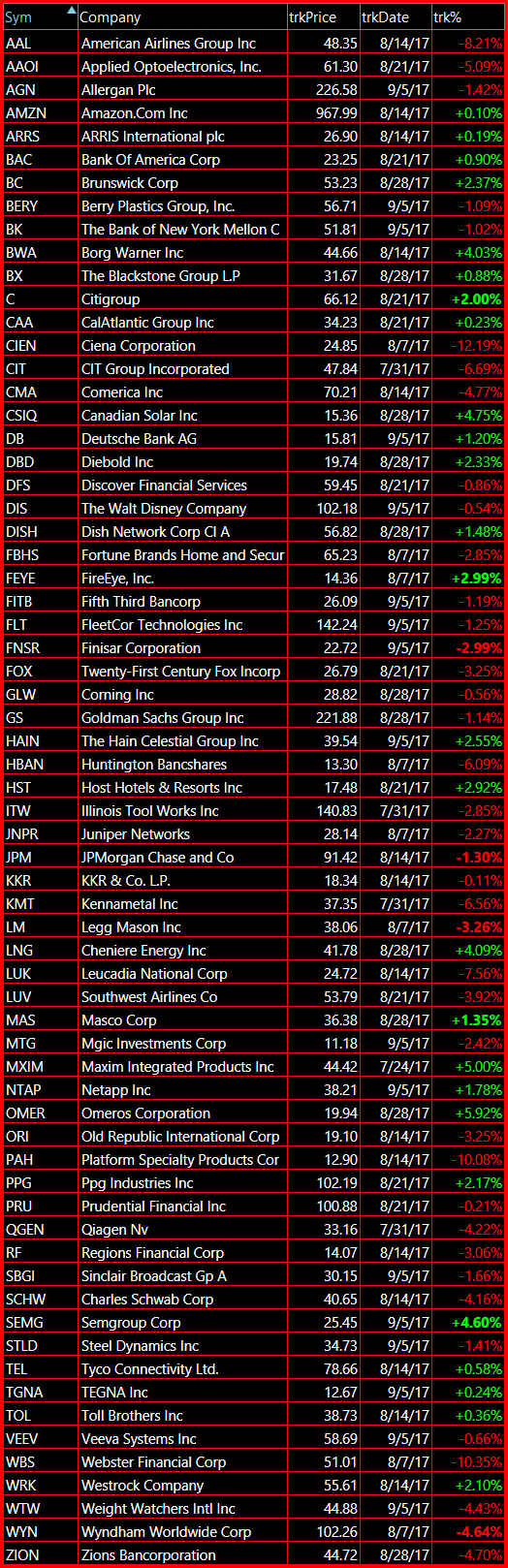

Here are the bullish setups to follow this week:

I’m not shorting any of these right now, but if the market does sell-off again, a lot of these stocks, especially the financials, will be nice candidates to short.

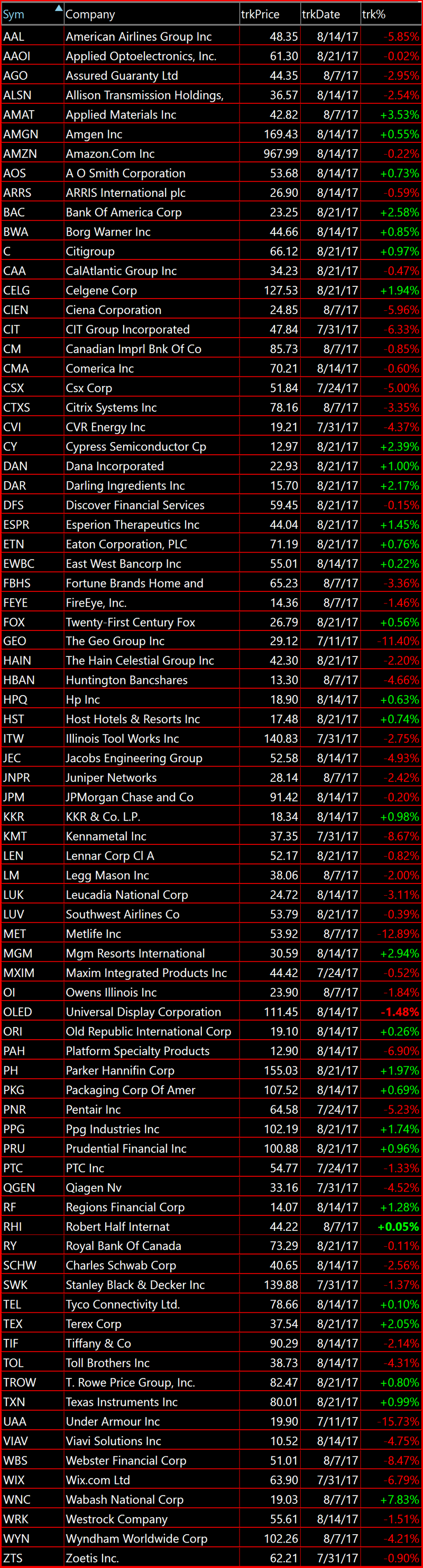

Here are the trade setups to follow this week:

I am seriously trying to tempt this market to prove me wrong. For years now I have been providing you with a bearish list of stocks to watch for shorting purposes. Rarely has it ever been useful, simply because the bulls keep buying every stinking dip.

Such a dull market. If you are losing your mind watching the ticks, go outside, take a walk, and come back in. You probably won’t miss anything.

My gosh, are the bears the biggest putzes in the known universe? For Pete's sake, its been 200 days since we've had a pullback of any kind! I'm fine trading long, I can make my money just as easily to the long side as I can to the long side, but there is a part

Bulls as they always do, have a chance to bounce this market today. The attempt so far has simply kept the market form having a meltdown, but not necessarily erasing the losses from the past two weeks.

Obviously the bears had a fairly difficult time keeping the bulls down from last Thursday’s sell-off. In fact, pretty much all the losses the market incurred by that sell-off has been wiped away already.

The bears had their chance, and as they always do they blew it. The S&P 500 has nearly wiped away all the losses on the month so far, and the bears are just getting squeezed all day long.

The bulls had everything going for them, and then they pulled a rabbit out of their hat and sank this market. I didn't even know that was still a thing! For so long now the bears have been the incompetent ones and now all of a sudden the bulls are the ones that completely head-fake