Maybe the title is a bit of an exaggeration, but new presidencies always bring jitters to Wall Street regardless if the President is a Republican, Democrat, Whig, Federalist, or none of the above. Simply put, uncertainty creates profit taking, and profit-taking creates selling pressures, and as a result the markets usually take some time to adjust to the policies and agendas of incoming Presidents. President-Elect Obama is no exception to this either. His approach with Wall Street and his taxation policies for higher wage earners will likely have some effect on the mood of the overall market.

Historically, the 1st and 2nd year of an administration is usually the hardest on Wall Street, as those years have historically performed the worst. Years three and four typically are the best (except for this year of course!). So it will take some time for the markets to adjust to Obama, especially if his economic policies introduce major changes to Wall Street and the economy in general. But overtime, a President and Congress has very few tools in the arsenal to directly help the economy out (just look at what $2.2 Trillion in spending did to fix the financial crisis – absolutely nothing!).

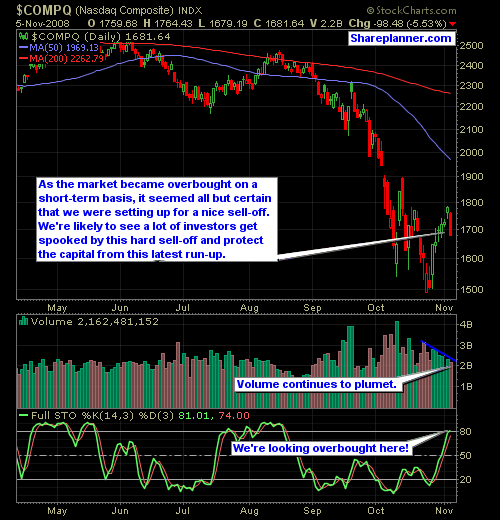

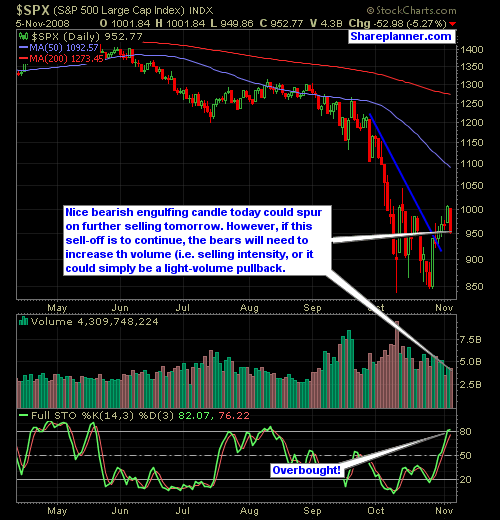

Now that I have given my salute to the fact that we had a new president elected last night, lets get on with what really matters – Stocks! The markets’ sell-off came on the heels of entering overbought territory, while the bears reloaded their short positions in an attempt to drive this market back down to its lows from October. To be honest, I believe that in order for the bulls to counter the selling pressures, there will need to be an inordinate amount of buying taking place. Thursday and Friday should undoubtedly be interesting for the markets and where we go from here.

Here’s the Nasdaq and S&P charts…

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

What do you do when the best trade setup that you can find is a stock that you already have a position in? Should you trade a stock that you already have a position in and exponentially increase the size of that position? In this podcast episode Ryan explains the circumstances that allows you to increase your position size in an already profitable trade and how to manage the risk in doing so.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.