July 15, 2008

Today’s action and volatile swing in the indices can be attributed to the “Fearsome Threesome”. The market got a dose of all the powers at bay, with commentary from the Uncle Ben (Fed), my Cousin Paulson (Treasury Secatary), and the Grandpa Cox (Head of the SEC). The tone of the stock market improved dramatically at mid-session as the price of oil plunged more than $7 per barrel on their commentary. The Dow rebounded from an earlier loss of 228 points and Nasdaq turned positive after erasing a loss of 45, but some last hour weakness caused the indices to close in the red.

Ben Bernanke’s gloomy assessment of the economy and a cut in the demand forecast by OPEC were factors behind the huge price drop in crude. The Fed Chairman told Congress he sees risks to economic growth and a danger of heightened inflation. Paulson said the treasury would support the biggest U.S. mortgage-finance companies despite the Moody financial strength downgrades and Mr. Cox decided he would let the short sellers know that the SEC will now start to enforce their laws against naked shorting.

Like we indicated before, the “Fearsome Threesome” are pulling out all the stops to try and give this market some confidence. Although most of it is just commentary, and not a shift in fundamentals, this market doesn’t need much rally and the short sellers will eventually have to cover. Either to close a trade, take profits, or be forced to by law. Although the real effect of Cox’s statement will be probably be minimal, it may prevent the big funds from leaning on the battered financials and help stop the bleeding.

We are not suggesting to get long just yet, but it seems as though all the reasons to sell, and believe me there are a million, are starting to lose a little steam, and that may be all we need for 5%-7% rally that is long overdue. Over the past few day the markets have tended to rally off their lows, as if some of the cash on the sidelines is starting to do some bottom fishing and value hunting. Heck, even our buddies at Goldman “Craps” came out this week and gave the S&P a fair value around 1300. Be careful not to read into this action too much, and if you do decided to take on some long positions, I suggest you keep your stops tight, because there are many financial institutions still walking the tight rope.

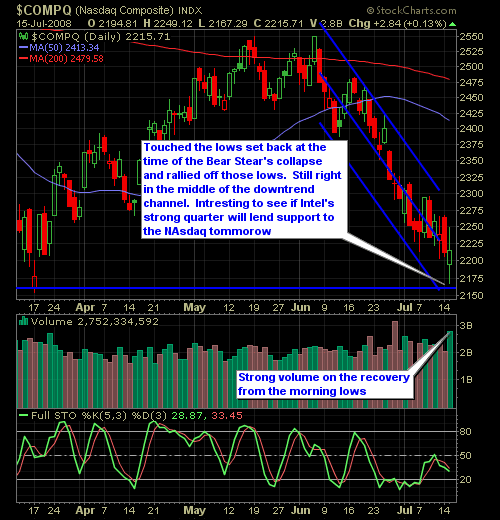

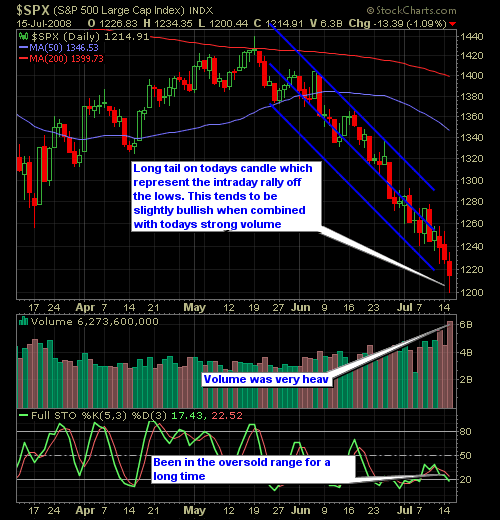

Here’s the NASDAQ and S&P Charts…

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Is it better to be lucky or skillful when it comes to being a good trader? I would argue you can have it both ways, but it requires that skill manages the luck, and at times when luck is simply against you too.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.