Current Long Positions (stop-losses in parentheses): GOOG (528.75), NFLX June 270 Calls, AAPL (342.25), NTAP (52.45), B (24.64), PEP (69.75), APH (55.20), HPQ (40.65), RSH (15.93), STZ (22.20), CHKP (54.19), SSO (53.35)

Current Short Positions (stop-losses in parentheses): None

BIAS: 60% Long

Economic Reports Due Out (Times are EST): Empire State Manufacturing Survey(8:30am), Treasury International Capital (9am), Housing Market Index (10am)

My Observations and What to Expect:

- Futures are down moderately ahead of the open.

- Asia, as a whole, was about down 1%, and Europe is worse trading with losses of about 1.2%.

- Currently there is some mixed sentiment surrounding commodities this morning with silver continuing its decline with oil, while gold is actually showing some strength.Dollar is showing a hint of strength as well.

- Some weekend news that may be weighing on the market – 1) fighting around the Israeli boarder. 2) Head of IMF arrested on rape accusations.

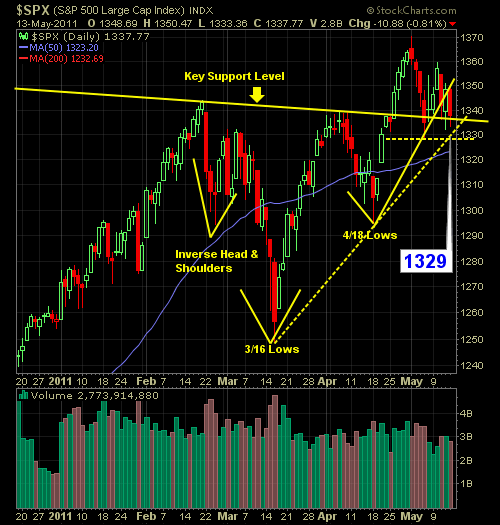

- The 1340 breakout level was broken on Friday. Now the big question is whether it can hold is previous higher-low at 1329. We are setting up for a challenge of it right at the open.

- There is also a rising, long-term trend-line to watch at 1319 on the S&P.

- Over the last two weeks, the market mentality has been to bend but not break and that is exactly what it did last week.

- We broke the 20-day moving average, which had provided a descent amount of support in previous sessions. The 50-day is at 1323, but for me I’ll be more concerned with the 1329 level.

- A break of 1329, will likely see 1290 in the near future.

- By breaking 1340 recently, we confirmed the inverse head and shoulders that had been in development since February ’11. Last time we confirmed a IH&S pattern was back in Sept ’10 and we rallied 220 points after the confirmation.

- My conclusion: I still remain cautiously bullish, and will be drawing a line in the sand at 1329. If we close below that level, I’ll be closing out my long positions and re-evaluating my trading strategy at that point.

Here Are The Actions I Will Be Taking:

- Added SSO off of an extreme TICK negative tick reading on Friday.

- Closed out GOOG at $529.75 for a 1% gain, AAPL at $340.61 for a 2.6% loss, B at $24.85 for a 0.2% loss, and NFLX June 270 Calls for a 68% return on the premium and 9.1% on the underlying asset.

- Will to add 1-2 new positions to the portfolio today, if we can show any type of market strength.

- I’ll likely close out my SSO position before the end of the day.

- Follow me in the SharePlanner Chat-Room today for all my live trades and ideas (as well as everyone else’s).

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Is it better to be lucky or skillful when it comes to being a good trader? I would argue you can have it both ways, but it requires that skill manages the luck, and at times when luck is simply against you too.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.