We warned this morning when the market futures were showing solid gains that the lift of the short sell ban would create some major selling today due to the flood of supply that would hit the markets – and that’s exactly what we got. Which sector you ask that led the way? FINANCIALS! Who do you have to thank? The SEC and Chairman Christopher Cox!

We said all along that banning financial short sells would be absolutely moronic in every shape and form, and it turned out to be true. There was never any short covering when the market saw huge declines to bring us off of our lows. And today, the markets were hit with an influx of supply. Since the ban on short selling of financials, the S&P has declined over 27%. If the government would just leave things alone, there could possibly be a turnaround. But as long as the Fed continues to artificially pump up the prices only to see them fall even further, we are going to see a slow motion crash that takes us down this dreadful path much farther than expected.

So where do we stand heading into Friday? Futures at 9:30pm are already showing -1% losses heading into the market open. However, because financials declined over 10% today, we wouldn’t be surprised to see some short covering tomorrow, which could provide the market with a boost. But we’re not confident enough to try and make that trade. Instead we will continue to look for new short positions to add to our portfolio. Speaking of which we closed out UFI today for a nice 14% gain (shorted at 4.32, covered at 3.71).

My phone has been ringing off the hook lately from family and friends asking whether to get out of this market, and some just letting me know they just did get out all together. Often times when you see everyone running for the exits, good chance we are closer to a bottom then we think. At this point in the decline, I believe the market is moving more on emotion and fear then on fundamentals, which is a good sign, because the ‘weak-hands’ needs to be shaken out of this market before it can truly put in a bottom and finally recover its losses.

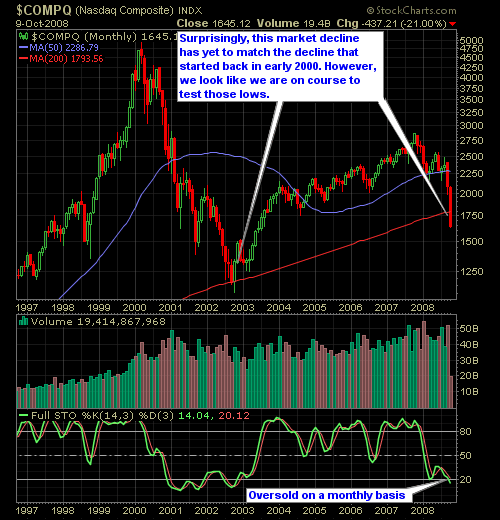

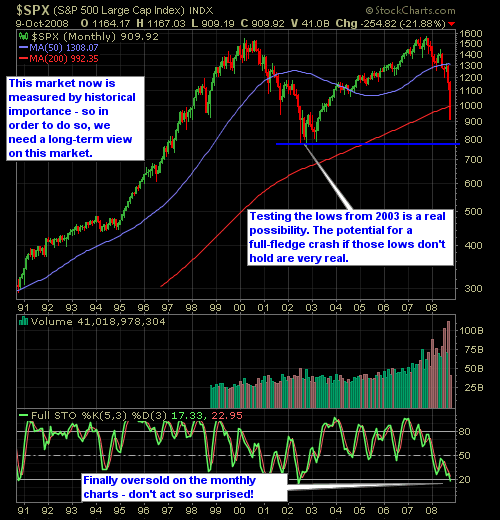

Here’s the Nasdaq and S&P Monthly charts….(If you dare!)

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, at episode 500, I am diving into the lessons learned from trading over the last 100 episodes, because as traders we are evolving and always attempting to improve our skillset. So here is to episode 500, and to another 500 episodes of learning and developing as swing traders in the stock market!

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.