July 23, 2008

A couple of ways to look at the market today. Both a bullish and a bearish perspective. First, the bulls will argue that today’s rally is proof that we have finally hit bottom. Why? Each rally has been met with a solid follow-through, not to mention the rally yesterday, preceded by a weak opening from the Apple earnings report that saw Wall Street use the morning dip as a buying opportunity.

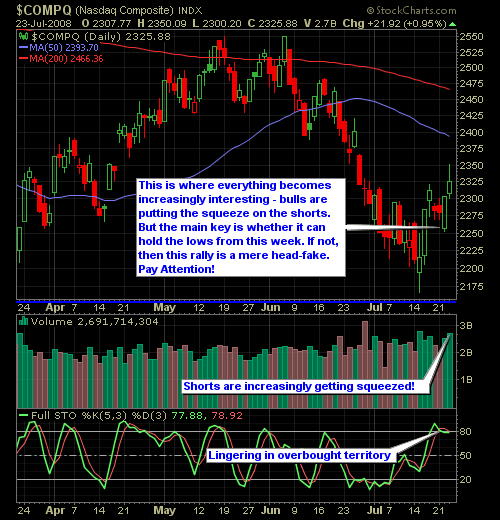

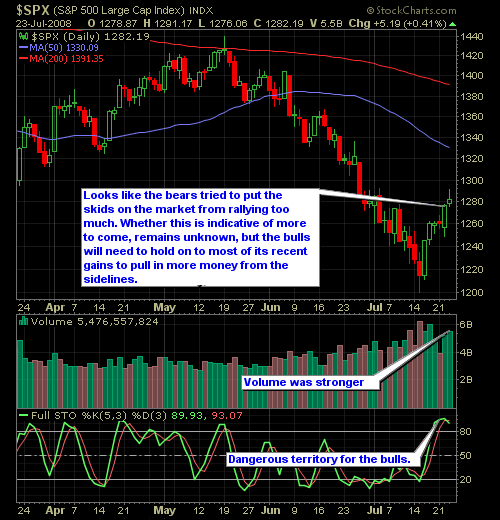

The bears can argue that we are not too far removed from the recent lows, and that it is entirely unknown as to whether we have priced in all the bad news. Furthermore, it only takes one more bank to default in order to see the same level of panic selling that we saw recently. We are also as overbought as we have been across the board in a very long time. And oil – well, this could be a mere correction that is near its end before rallying once again, and if it does, then the market will respond in kind with another nasty sell-off.

So there you have it – two arguments, each with its own merits. Only time will confirm who is right. Yours and my job is to make sure that we are ready to jump on board when it finally does start to move again.

Here’s the NASDAQ and S&P Charts…

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In this podcast episode Ryan talks about not allocating all of your capital to one single trade. He covers why it is dangerous to your trading and the sustainability of that strategy long-term. Also covered is how much should you dedicate to long-term vs short-term trading, and whether you should ditch one approach for the other.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

My Website: https://shareplanner.com

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.