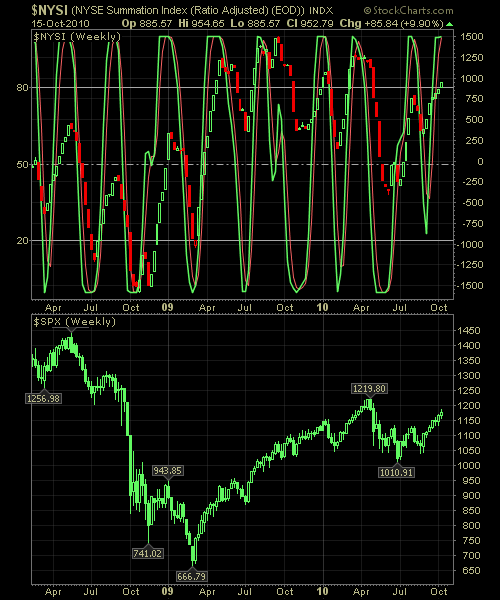

Very similar to the reading we got last week, the NYSE Reversal Indicator shows that a pullback is in the cards in the near future, but it is not quite ready to make it official. I personally look for the Green and Red lines (to keep it simple) to cross and start moving downward. However, that has yet to happen. Very good chance though we see that happen this week – especially if we see any further selling in the markets like we did yesterday. I am still unhedged in my portfolio, but nowhere near as committed as I was earlier last week (at one point I was about 116% long). Apple (AAPL) reports on Monday, and if they disappoint, I don’t doubt one bit that we’ll see sustained selling hit the markets.

I recommend, that you become very cautious about over committing to the long side, and instead start using any rally, to tighten stop-losses in order to preserve the majority of your profit, or to take profits all together.

For those of you who are not familiar with this chart, here’s quick tutorial…

Remember, the extremes are where you are wanting to pay the closest attention to, particularly where the %K & %D lines cross (i.e the red and green lines). This is typically where we begin to see changes in the behavior of the market – not always but quite often enough, to warrant our attention. What this tool is best for, in terms of what I use it for, is market timing and position building. When there is a crossover at one of the extremes that goes against the positions in my portfolio, I, often times, look to take profits in those positions or at least hedge against them

Here is the NYSE Reversal Indicator.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, at episode 500, I am diving into the lessons learned from trading over the last 100 episodes, because as traders we are evolving and always attempting to improve our skillset. So here is to episode 500, and to another 500 episodes of learning and developing as swing traders in the stock market!

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.