July 30, 2008

Another solid effort by the bulls today as they managed an impressive follow through from yesterday’s 2% bounce. But here’s the breakdown: the status quo that we have mentioned in previous articles (namely financial crisis, housing meltdown, and oil exuberance) hasn’t changed. There is no confirmation that another major bank won’t go belly-up though it seems like the banking industry is starting to come clean with some of their bad loans. Oil has pulled back significantly, but we are still seeing $100+ oil and it saw a spike in prices today also (largely ignored by the broader markets). And as for housing, well, there is no relief in sight despite Congress and the White House’s attempt to help out those in or nearing foreclosure.

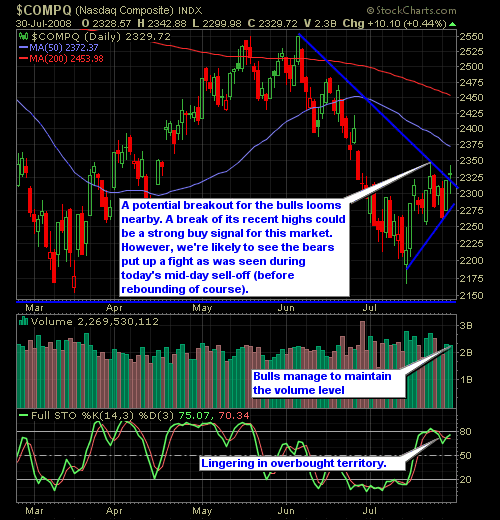

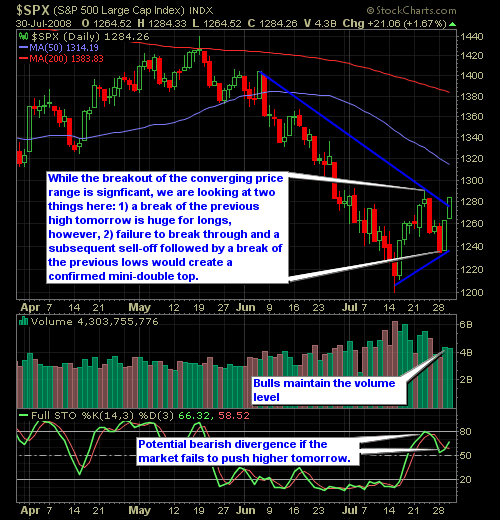

Nonetheless, recent action in the markets can not go ignored. There are some solid technical improvements, even if the fundamental picture doesn’t validate it, with what can be considered a breakout to the upside. However, we would warn readers to show caution on this early upside-breakout, namely because, the bulls need to break the previous high that it is eye-to-eye with as defined in both the NASDAQ and S&P charts below. Failure to break these highs leading to further selling would demoralize the bulls and a break of support at the previous lows established from this month would create a mini-double top that the bulls would prefer avoiding. While in our own portfolio we are skewed to the downside, we are not afraid to begin aggressively adding new positions to our portfolio if we can get that breakout to the upside. We have some setups that we want to throw out there, but until we have the confirmation technically we won’t do it.

Here’s the NASDAQ and S&P Charts…

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

As swing traders, we have to accept that losing will be a regular part of trading and one that we must accept. In this podcast episode, Ryan explains how a trader who isn't comfortable with losing is a losing trader. If you're not comfortable with losing in the stock market, you'll never find real success as a trader either.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.