Pre-market update (updated 9:00am eastern):

- Europe is trading 1.5% higher.

- Asian markets traded 1.0% higher.

- US futures are up strong ahead of the bell – nearly 1%

Economic reports due out (all times are eastern): Existing Home Sales (10am), Housing Market Index (10am)

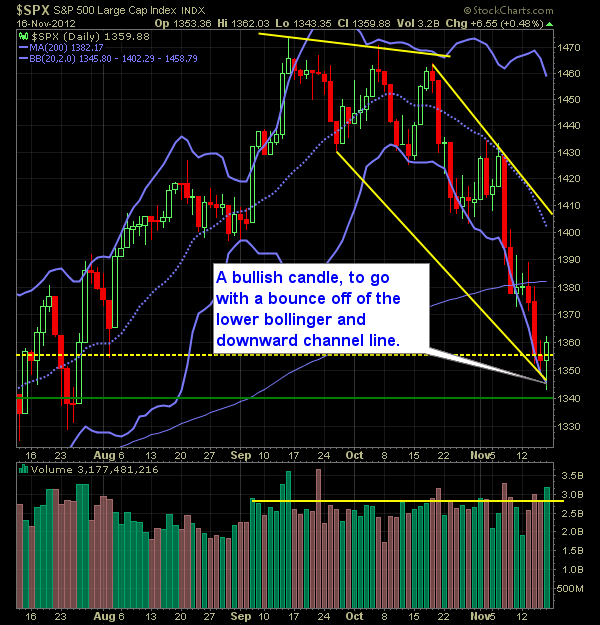

Technical Outlook (SPX):

- As noted last week, this market is well oversold on both the daily and weekly time frames and as a result is setting up for a multi-day bounce into the historically bullish and shortened Thanksgiving holiday week.

- If you still are short heading into today, I’d avoid being short longer than you have to be. The likelihood of the market pushing lower throughout the week, is possible but not likely.

- On Friday, the SPX bounced off of the lower line of the downward channel it has been trading in.

- As an initial target, I would expect that this market could go as high as 1404 before encountering any significant push back from the bears.

- SPX is badly in need of a new lower-high, which is something we haven’t seen since dropping 75+ points from the previous lower-high.

- Volume tends to be light holiday weeks, and will get lighter as the week carries on.

- Thursday the market is closed, and Friday it is only open until 1pm.

- Also worth noting, is that this bounce will come off of the bollinger band on the weekly chart, as previously noted, and similar to what we saw on 6/1.

- 30-min chart shows a disfigured inverse head and shoulders pattern.

- VIX dropped hard below 17.

My Opinions & Trades:

- Covered CLNE at $12.05 from $12.88 for a 6.44% gain.

- Went long MWE at $48.00

- Went long CMCSA at $35.32

- Went long ITW at $59.04

- Went long AET at 40.80.

- May add an additional 1-2 new long positions on intraday dips.

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Passive investing can be a great source of funds for retirement and for building a nest egg. In this podcast episode, a husband and wife asks Ryan's thoughts on building a SPY position on just $2/day. While consistent building a nest egg, is great, the timing and strategy in doing so is just as important.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.