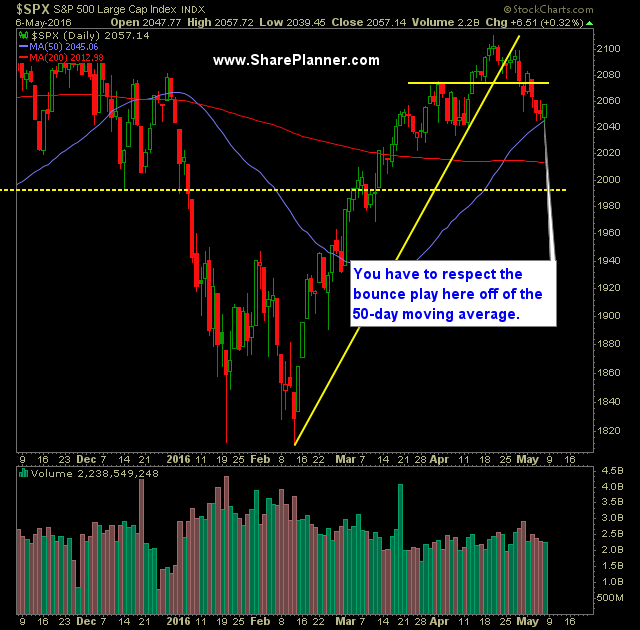

Technical Outlook:

- SPX experienced a hard reversal on Friday where price found buyers at and around the 50-day moving average and ultimately ended up resulting in an 18 point reversal off the lows of the day.

- Despite all the days of selling that was to be had last week, SPX finished just eight points lower on the week.

- Similar bounces were seen on Friday, off of the 50-day moving average, on the Russell 2000 and Dow Jones Industrial Average.

- Tech (Nasdaq) continues to perform the weakest among all the indices, but QQQ saw a strong bullish engulfing candle pattern on Friday.

- Uptick in volume on Friday from what was seen the day prior on SPY, but still slightly below recent averages.

- Despite the rally on Friday, SPX still hasn’t made a higher-high on the 30 minute chart. Needs a close above 2060 level.

- Very concerning was the hard sell-off at key resistance on Friday that resulted in a 7.5% decline down to 14.72. Rejection in the 16.40’s continues to be a huge problem for a sixth straight day.

- SPX at this point looks ready to bounce following the mild weakness of late.

- Historically the May through October time frame is much weaker than the rest of the year.

My Trades:

- Covered ORCL on Friday at $39.21 for a 1.3% profit.

- Sold SDS on Friday at $18.90 for a 1.1% profit.

- Added two new long positions on Friday.

- Currently 30% Long / 20% Short / 50% Cash

- Remain Long: JNJ at $112.65.

- Remain Short two positions.

- Will look to add 1-2 new short positions today if the market seeks to push lower. Will be aware for the potential of a bounce as well.

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Passive investing can be a great source of funds for retirement and for building a nest egg. In this podcast episode, a husband and wife asks Ryan's thoughts on building a SPY position on just $2/day. While consistent building a nest egg, is great, the timing and strategy in doing so is just as important.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.