Couple of things to note here on the JPM chart: 1) HUGE head and shoulders pattern in place, but needs to clear $49.70 to confirm 2) Downward ascending trend-line is broken off of the July highs. Could negate the H&S pattern. Right now the head and shoulders pattern may be compromised, especially if price

As I have come accustomed to doing, I save the last day in the week for my “All-Short” Friday list of trade setups. That doesn’t mean I’m suddenly ubber-bear, its just a theme…. a theme folks! Short Tiffany (TIF):

It's time for another SharePlanner Giveaway - This time around I am raffling off my SharePlanner DVD course on Swing Trading ($100 Value). To enter is easy and free. you simply LIKE the SharePlanner Page on Facebook, follow us on Twitter, or retweet the contest. Better yet you can do all three. So enter, and

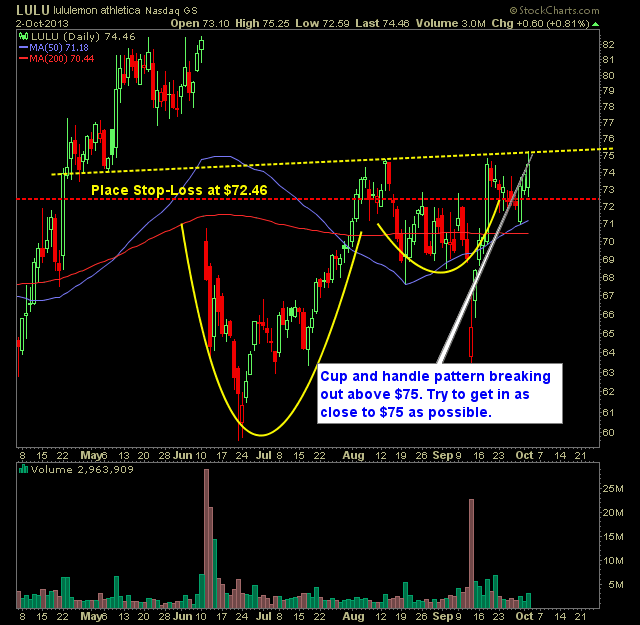

Cup and handle pattern breaking out above $75. Try to get in as close to $75 as possible. I’d place my stop-loss at $72.46. Here’s the trade setup:

Here’s today’s players: 3 long setups and 2 short setups Long Molycorp (MCP):

Here’s today’s plays: 3 longs and 2 short setups: Long Louisiana Pacific (LPX):

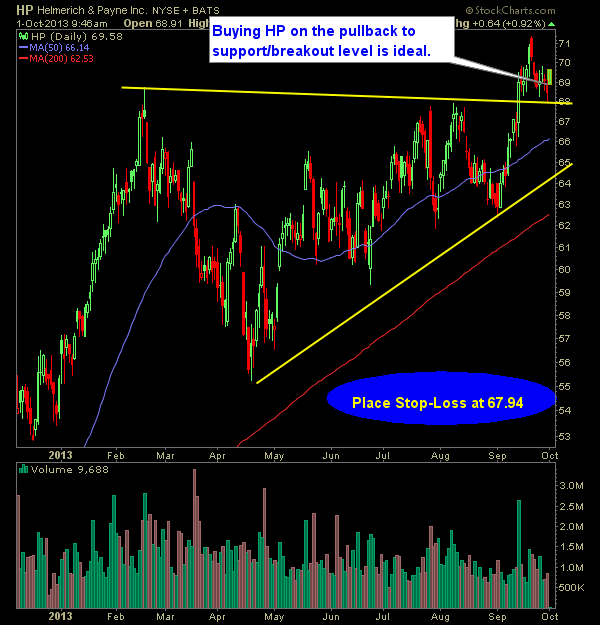

Finally a bounce in this market – lets see whether it can 1) be sustained and 2) can be significant enough to call it a “bounce” Here’s today’s swing-trade hit list, I’ll focus some more on short setups as well starting tomorrow. Long Helmerich and Payne (HP):

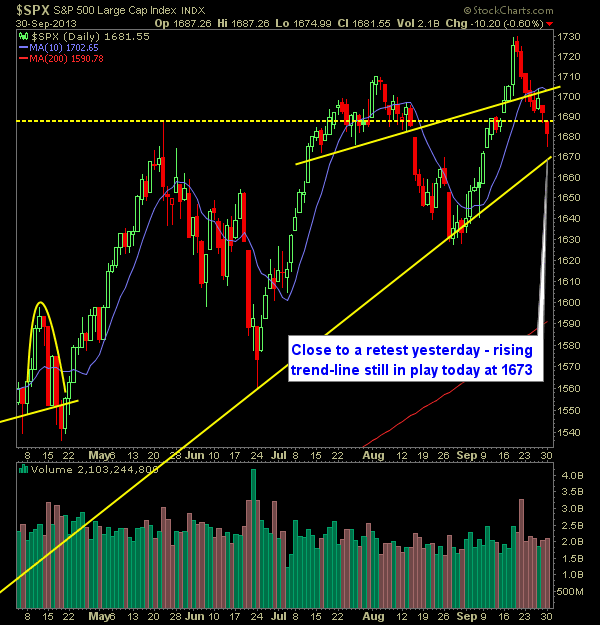

Pre-market update: Asian markets traded -0.5% lower. European markets are trading 0.2% higher. US futures are trading 0.3% higher ahead of the market open. Economic reports due out (all times are eastern): ICSC-Goldman Store Sales (7:45), Redbook (8:55), PMI Manufacturing Index (8:58), ISM Manufacturing Index (10), Construction spending (10) Technical Outlook (SPX): Yesterday’s sell-off

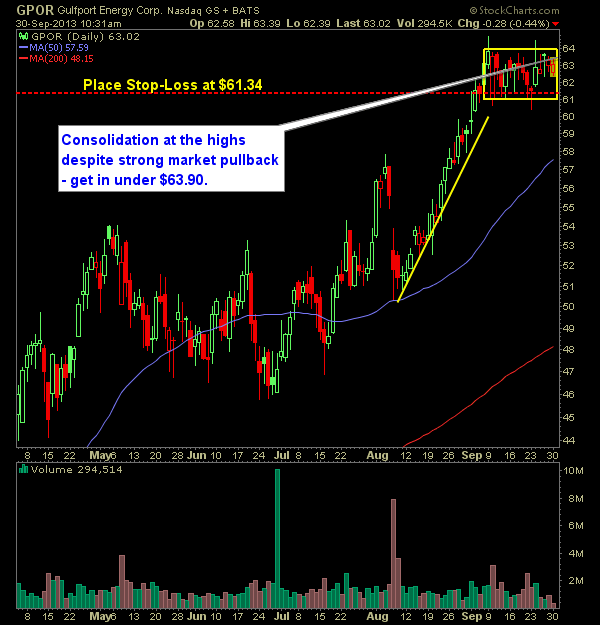

Let’s start this week – I’m expecting a bounce at some point here – might as well have some longs handy for when that time comes: Long Gulfport Energy (GPOP):

Its been a while since I have focused solely on the shorts for my daily setups. So here we go: Short Advanced Micro Devices (AMD):