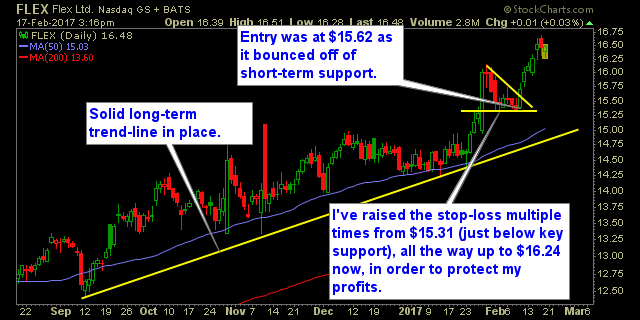

Good example of using stop-loss orders for protecting profits on my current trade of Flex Ltd (FLEX)

Which happens to be a Contract Manufacturer in the technology sector, with a market cap of $8.8B

I was really drawn to this stock when it pulled back following the sharp spike higher in January. Not to mention the volume has been tremendious of late, and buyers are seriously interested in this play. With extreme bullish market conditions, this stock has simply climbed higher the entire way. With this kind of strategy it is unnecessary to dive into the world of options and start using protective put or call strategies.

However, markets don’t go up forever and neither do individual stocks, so I have to manage the downside risk on this trade as if it could turn on me at any second. Originally, I placed the stop-loss just below the lows from 2/2 at $15.31 and have continuously raised the stop-loss since then including the latest yesterday putting it at $16.24. Previous stop-loss increases were at the stock price intrevals of $15.58, $15.74, $15.94. All along, I am doing what is the absolutely most important thing you can do with a trade, and that is to manage the risk.

Sure I could get stopped out of it at any moment, but if I do…

I am walking away with some solid profits and I’ll move on to the next trade.

Or…

The stock could just keep climbing like it currently is doing, and I’ll keep raising the stop-loss as it affords me to do.

So check it out, see for yourself how well orchrestrated the risk management aspect of this trade was, and how it always goes back to the saying of mine, “Manage the risk and the profits will take care of themselves!”

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Passive investing can be a great source of funds for retirement and for building a nest egg. In this podcast episode, a husband and wife asks Ryan's thoughts on building a SPY position on just $2/day. While consistent building a nest egg, is great, the timing and strategy in doing so is just as important.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.