Everyone is trying to position themselves for the long-term financially and in the process finding out what the best options are for achieving their goals for retirement.

If this is the case for you, let me direct your attention to the SharePlanner Investment System – a service for those who need help with their 401(k)’s, IRA’s and other investment vehicles.

I have been offering this service since 2003, and it has increased the original investment over that time by more than 21x. That means means a $10,000 portfolio in 2003 is now worth more than $210,000.

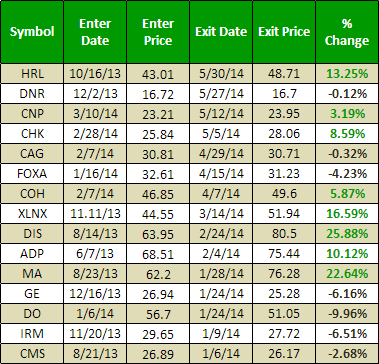

Just check out how well it has performed so far this year:

That is over 76% in net cumulative gains.

Combined with the stock in the portfolio like RRC that is up 23.3%, CTL 23.6% and DGX over 8.8% (just to name a few) there are more than 141% in total gains across all the positions traded this year. For a net gain on the year so far that comes out to 14.1%.

Considering that the S&P 500 is only up 4% on the year, that means the SharePlanner Investment System is outperforming the market by more than three times in returns.

To make things even better, my investment system is so easy that anyone can do it and succeed at it. Each night I send out an email outlining new trades for the next day. I only choose those that are listed on the S&P 500, so liquidity is never an issue. All you have to do is buy the stock as soon as the market opens and put a 10% trailing stop-loss on it.

And that’s it! It is literally that easy.

So sign up today and if you’d like to have your trades automated, then sign up sign up with one of our partner brokerages at no additional charge.

Discover the Best Investment System on the Web!

Start Investing with SharePlanner Today

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Is it better to be lucky or skillful when it comes to being a good trader? I would argue you can have it both ways, but it requires that skill manages the luck, and at times when luck is simply against you too.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.