The SharePlanner Investment System continues to out perform the market with incredible gains across the board and my past performance has provided traders with solid gains.

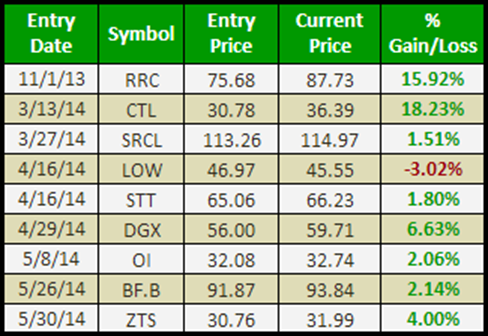

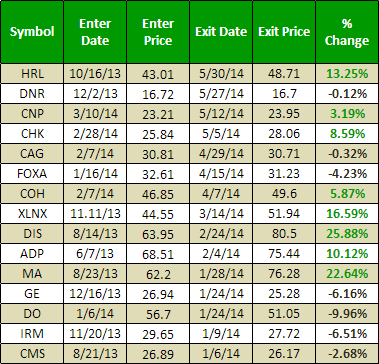

Here’s what the portfolios of members of my system currently looks like.

The system is as easy as it gets. You will receive an email every night with any new positions to add for the next day. If there is a new position, you simply place an order at the market open for that stock and attach a ‘good till cancelled’ stop-loss of 10%.

Simple as that!

And all the picks come from stocks listed in the S&P 500 so there is no worries of buying low-float stocks that can be easily manipulated nor is there any shorting of stocks.

My past performance is a hard one to match as we near the half way mark of the year and the kinds of gains that have been realized are outstanding:

Eight out of the fifteen investments have closed out as winners, and those winners easily out pace the losers, with the winner’s average return being 13.3% and the average loser being only -4.3%. That means the average winner out paces the average loser by 3-to-1!

It doesn’t matter whether you are a full-time trader or gainfully employed with a regular 9-5 job, you can easily take advantage of my Investment Systems with the least amount of effort. So don’t worry if you can’t watch the markets all the time, with the SharePlanner Investment System it is easy to manage your investments on your own or you can choose to auto-trade the Investment System, while you sit back and relax.

Start Investing with SharePlanner Today

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Is it better to be lucky or skillful when it comes to being a good trader? I would argue you can have it both ways, but it requires that skill manages the luck, and at times when luck is simply against you too.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.