The election for incumbents and stock market outcomes

If you are like me, and live in a swing-state for this 2012 election, you are absolutely sick and tired of the ads, smears, lies, and just everything politics. I give more thought to moving to North Dakota every time an election cycle rolls around just to avoid the onslaught of ads, mailings, and phone calls.![]()

But my question to you is, how does the market fare when it comes to a President seeking re-election? What is the norm and how does the market tend to react. As a result, I looked at every successful and unsuccessful re-election bid, dating back 32 years to to the Carter Vs. Reagan election to see if there was anything worth noting particularly from August through November (Elections occur on the second Tuesday of the month).

Jimmy Carter vs. Ronald Reagan: 1980

Despite the 70’s being pretty miserable for the economy, from August to November things seemed ‘suddenly favorable’ when Carter’s re-election came up. In particular the early part of August. What this chart should show you though (and later with Bush Sr.) is that despite a market rally into the election, it is no guarantee that a President will be re-elected.

Ronald Reagan vs. Walter Mondale: 1984

I’m pretty sure Reagan could have won against Mondale, even with a market like 2008 was for McCain. His gains were incredible in August, but muted the rest of the time. Overall, still solid.

George H.W. Bush vs. Bill Clinton: 1992

“No new taxes” was the theme, and Clinton’s “it’s the economy, stupid” rang true with voters. Still another rally into the election.

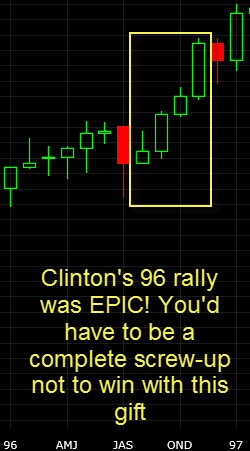

Bill Clinton vs. Bob Dole

Sort of like 1984, Bill Clinton would’ve won with any economy, but this was a monster rally, that made losing as unlikely as him scoring with an intern…no wait, that did happen. Never mind!

George W. Bush vs. John Kerry

This market rally may have saved the day for Bush as this significant rally, helped put aside the growing dissatisfaction with the Iraq war.

So then, what’s the take away from all of this? Careful, be very careful about getting heavily short as the November election nears and Obama seeks to extend his Hope and Change Presidency into a second term. This time of the year, has seen some monster rallies – even in some rancid economies – and based on what we’ve seen in the past, I wouldn’t bet against it happening again.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Is it better to be lucky or skillful when it comes to being a good trader? I would argue you can have it both ways, but it requires that skill manages the luck, and at times when luck is simply against you too.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.