Swing Trading Strategy:

The Fed just can’t seem to help matters…

Yesterday’s Swing-Trading Outlook, I mentioned about the Fed’s actions that “It may help the stock market today, but my biggest concern is how we’ve seen some pretty bold moves made by the Fed of late, and the price bump ultimately all fall apart before the market can even close the day out.” The market couldn’t even hold today’s pre-market gains into the open, and instead gave up another 2.6% today.

Look, I don’t know how low this market wants to go, and nobody does. If they say they do, they are an absolute fool. There is no point even engaging in such things. There are price levels that I am watching, but whether they will actually get hit or even hold for that matter, remains to be seen .

For me, if we eventually bounce here, I will only trade it with a few small positions at best, while remaining the majority in cash. If the market continues to improve, or even manage to build on any rally with a multi-day rally, I will slowing increase my long exposure. But I’m not going to force any new trades and you shouldn’t either. Just manage the risk – and that means not trading at all sometimes.

Indicators

- Volatility Index (VIX) – This gives me a little bit of hope here because as SPX has dropped two straight days, VIX has done the same. The fear index is coming down some, and that could lead to investors eventually wanting to rally this market a bit. Currently at 61.59.

- T2108 (% of stocks trading above their 40-day moving average): Breadth, while still weak, is improving some. We aren’t seeing the more than 20:1 negative breadth that had previously been seen. Again, a divergence from recent market behaviors.

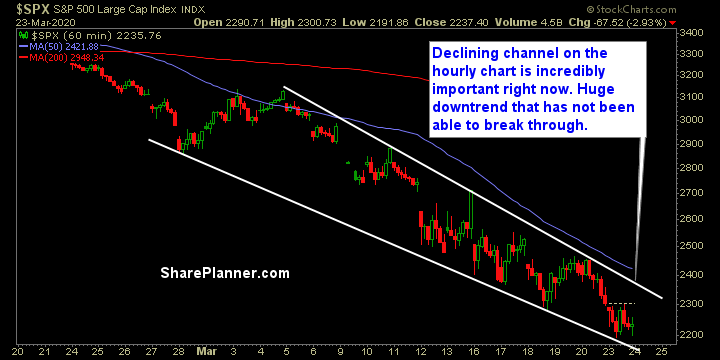

- Moving averages (SPX): Currently trading below all the major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Technology was the sole sector to finish higher today. Traders are starting to take inventory of some of the massive sell-offs in this sector and scaling into some long positions. Good sign for the market if that can continue into tomorrow. Utilities continued the slaughter, selling off almost 20% in the last four trading sessions. Financials weakened today due to the Fed’s announcements in the pre-market. Industrials showing no willingness to consolidate.

My Market Sentiment

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

How should one go from their regular 9-5 job into full-time trading? As a swing trader, we don't have to necessarily be full-time, and instead we can combine our trading into a lifestyle that allows us to maximize our time and earning ability.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.