Pre-market update:

- Asian markets traded 0.3% higher.

- European markets are trading 0.3% lower.

- US futures are trading 0.1% higher ahead of the market open.

Economic reports due out (all times are eastern): ICSC-Goldman Store Sales (7:45), International Trade (8:30), Redbook (8:55), JOLTS (10)

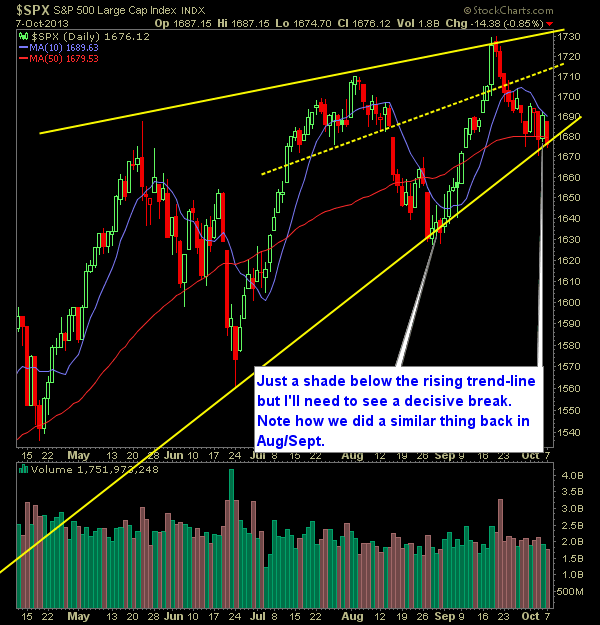

Technical Outlook (SPX):

- It is worth noting that we broke 3 points below the rising trend-line yesterday, but we need to see a more decisive move.

- Today’s action will be key for the bears to drive the price of stocks below the rising November 2012 trend-line.

- To reclaim the rising trend-line price will need to rise back above 1681.

- For the second time in the past three sessions we are just barely trading below the 50-day moving average.

- Volume on yesterday’s sell-off was incredibly weak.

- We are also back in oversold territory.

- 10-day moivng average has offered some short-term resistance for the bulls of late so be aware of it around 1686 about.

- Most concerning for the bulls is the huge rip in the VIX yesterday. Up a whoopin’ 16% to 19.4.

- Large Bearish wedge has formed as shown below.

- It’s a tough call in this market right now in determining where it wants to go. The SharePlanner Reversal Indicator is playing heavily into my trading strategy, and the signals it is giving off suggests that this market is heading lower in the near future.

- If a compromise is reached, expect a significant bounce back.

- Confirmed Head and shoulders pattern on the SPX 30-minute chart still in play.

- Markets don’t care about the economy nor earnings. That is not what is driving them. The markets only care about what the Fed is doing to keep equities propped up.

My Opinions & Trades:

- Added one new short position yesterday.

- Sold ITMN at 14.99 for a 2% loss.

- Sold DKS at 52.99 for a 1.6% loss.

- I’m more interested at this point in thinning out my longs rather than adding to them. May also add another short position today.

- Currently 60% long / 20% short / 20% cash.

- Current Longs: RDC at 37.17, UHS at 73.85, MPEL at 31.59, CSE at 11.86, GNW at 12.82, ACAS at 13.75.

- Current Shorts: STT at 65.83.

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Passive investing can be a great source of funds for retirement and for building a nest egg. In this podcast episode, a husband and wife asks Ryan's thoughts on building a SPY position on just $2/day. While consistent building a nest egg, is great, the timing and strategy in doing so is just as important.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.